- United States

- /

- Pharma

- /

- NasdaqGS:XERS

Is Xeris Biopharma (XERS) Using XP-8121 Patents to Quietly Redefine Its Long-Term Growth Story?

Reviewed by Sasha Jovanovic

- Xeris Biopharma Holdings recently received a Notice of Allowance from the USPTO for a patent application covering XP-8121, its investigational once-weekly levothyroxine formulation, and earlier this month presented at the Piper Sandler 37th Annual Healthcare Conference in New York.

- The XP-8121 formulation patent progress strengthens Xeris’s intellectual property position in levothyroxine delivery, potentially reinforcing its efforts to address well-known limitations of oral thyroid hormone therapy.

- We’ll now examine how securing patent allowance for XP-8121 could influence Xeris’s investment narrative around pipeline-driven growth and future earnings.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Xeris Biopharma Holdings Investment Narrative Recap

To own Xeris, you need to believe its core endocrine portfolio can support the business while pipeline assets like XP-8121 add new, higher-value revenue streams over time. The XP-8121 patent allowance strengthens that pipeline story but does not change the near term dependence on Recorlev, Gvoke and Keveyis, nor the key risk that rising R&D and SG&A spend could outpace revenue growth.

The new XP-8121 patent allowance is the most relevant recent announcement here, because it reinforces Xeris’s efforts to build a defensible position in once-weekly levothyroxine using its XeriSol technology. This matters for the existing catalyst around XP-8121’s potential commercial launch, as stronger intellectual property can support longer duration of exclusivity if the asset successfully progresses through later stage trials and regulatory review.

However, investors should also be aware that while XP-8121 strengthens the story, it does not remove the risk that...

Read the full narrative on Xeris Biopharma Holdings (it's free!)

Xeris Biopharma Holdings' narrative projects $440.9 million revenue and $84.8 million earnings by 2028.

Uncover how Xeris Biopharma Holdings' forecasts yield a $11.50 fair value, a 71% upside to its current price.

Exploring Other Perspectives

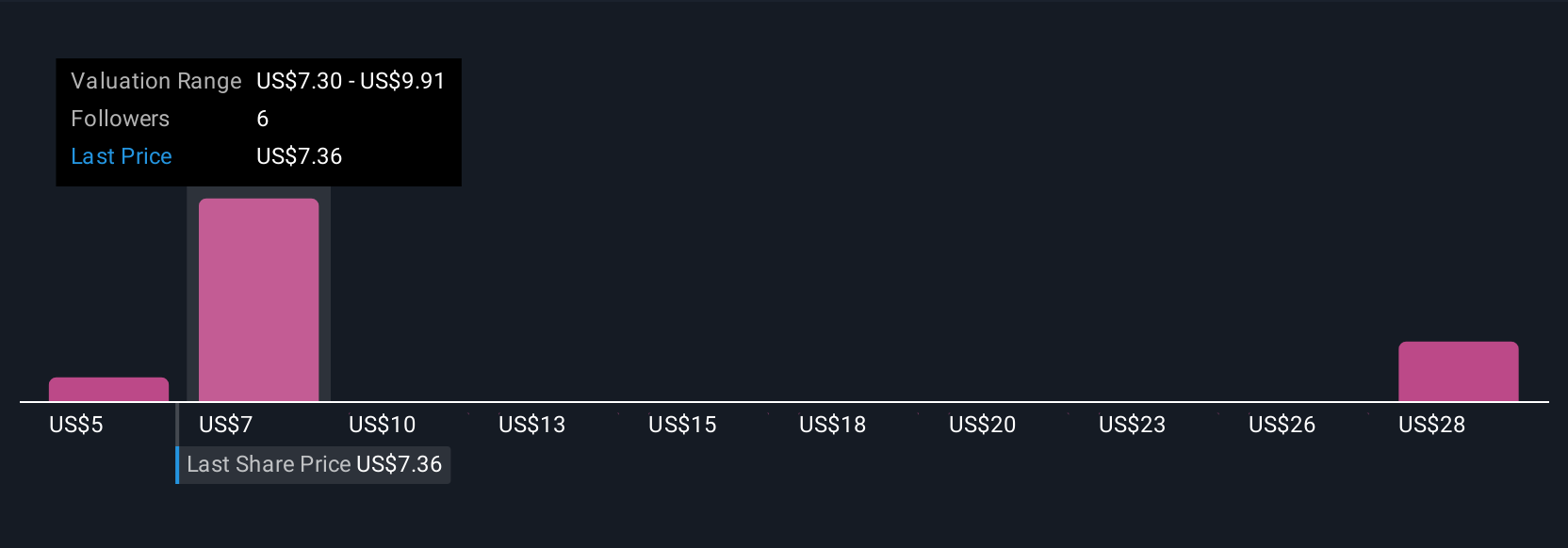

Four fair value estimates from the Simply Wall St Community span roughly US$4.70 to US$35.24 per share, underlining how far apart individual views can be. As you weigh those opinions, remember that Xeris’s ability to convert XP-8121 and other pipeline assets into approved, profitable products could be a key swing factor for long term performance, so it is worth exploring several contrasting viewpoints before deciding how this fits in your portfolio.

Explore 4 other fair value estimates on Xeris Biopharma Holdings - why the stock might be worth 30% less than the current price!

Build Your Own Xeris Biopharma Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Xeris Biopharma Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Xeris Biopharma Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Xeris Biopharma Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:XERS

Xeris Biopharma Holdings

A commercial-stage biopharmaceutical company, engages in developing and commercializing therapies for chronic endocrine and neurological diseases in Illinois.

Good value with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026