- United States

- /

- Biotech

- /

- NasdaqGM:XENE

We're Hopeful That Xenon Pharmaceuticals (NASDAQ:XENE) Will Use Its Cash Wisely

Just because a business does not make any money, does not mean that the stock will go down. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So should Xenon Pharmaceuticals (NASDAQ:XENE) shareholders be worried about its cash burn? In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for Xenon Pharmaceuticals

How Long Is Xenon Pharmaceuticals' Cash Runway?

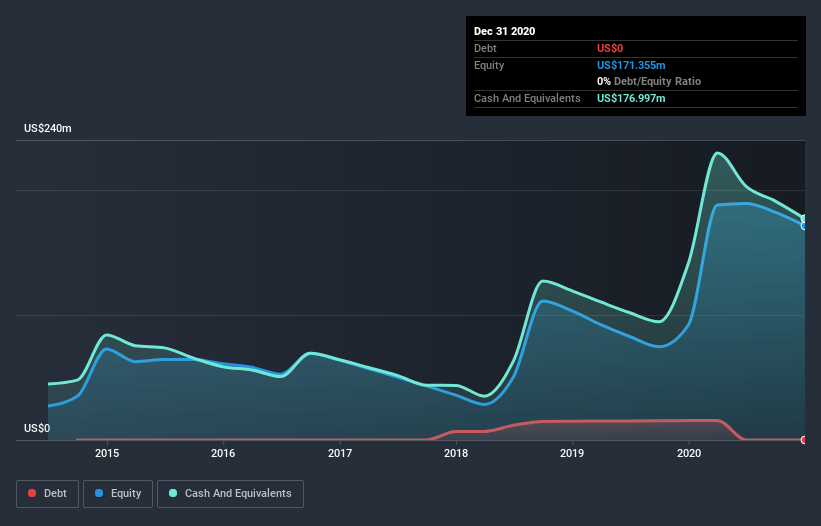

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. In December 2020, Xenon Pharmaceuticals had US$177m in cash, and was debt-free. Importantly, its cash burn was US$51m over the trailing twelve months. Therefore, from December 2020 it had 3.5 years of cash runway. Notably, analysts forecast that Xenon Pharmaceuticals will break even (at a free cash flow level) in about 4 years. So there's a very good chance it won't need more cash, when you consider the burn rate will be reducing in that period. You can see how its cash balance has changed over time in the image below.

How Well Is Xenon Pharmaceuticals Growing?

It was quite stunning to see that Xenon Pharmaceuticals increased its cash burn by 745% over the last year. But shareholders are no doubt taking some confidence from the rockstar revenue growth of 371% during that same year. Considering both these factors, we're not particularly excited by its growth profile. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Can Xenon Pharmaceuticals Raise More Cash Easily?

We are certainly impressed with the progress Xenon Pharmaceuticals has made over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Xenon Pharmaceuticals' cash burn of US$51m is about 7.0% of its US$722m market capitalisation. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

So, Should We Worry About Xenon Pharmaceuticals' Cash Burn?

As you can probably tell by now, we're not too worried about Xenon Pharmaceuticals' cash burn. In particular, we think its revenue growth stands out as evidence that the company is well on top of its spending. While we must concede that its increasing cash burn is a bit worrying, the other factors mentioned in this article provide great comfort when it comes to the cash burn. Shareholders can take heart from the fact that analysts are forecasting it will reach breakeven. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. Taking a deeper dive, we've spotted 3 warning signs for Xenon Pharmaceuticals you should be aware of, and 1 of them is a bit unpleasant.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

When trading Xenon Pharmaceuticals or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Xenon Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:XENE

Xenon Pharmaceuticals

A neuroscience-focused biopharmaceutical company, engages in the discovery, development, and delivery of therapeutics to treat patients with neurological and psychiatric disorders in Canada.

Flawless balance sheet and fair value.

Market Insights

Community Narratives