- United States

- /

- Biotech

- /

- NasdaqGM:XENE

We Think The Compensation For Xenon Pharmaceuticals Inc.'s (NASDAQ:XENE) CEO Looks About Right

Key Insights

- Xenon Pharmaceuticals to hold its Annual General Meeting on 4th of June

- Salary of US$666.0k is part of CEO Ian Mortimer's total remuneration

- The overall pay is comparable to the industry average

- Xenon Pharmaceuticals' total shareholder return over the past three years was 109% while its EPS was down 28% over the past three years

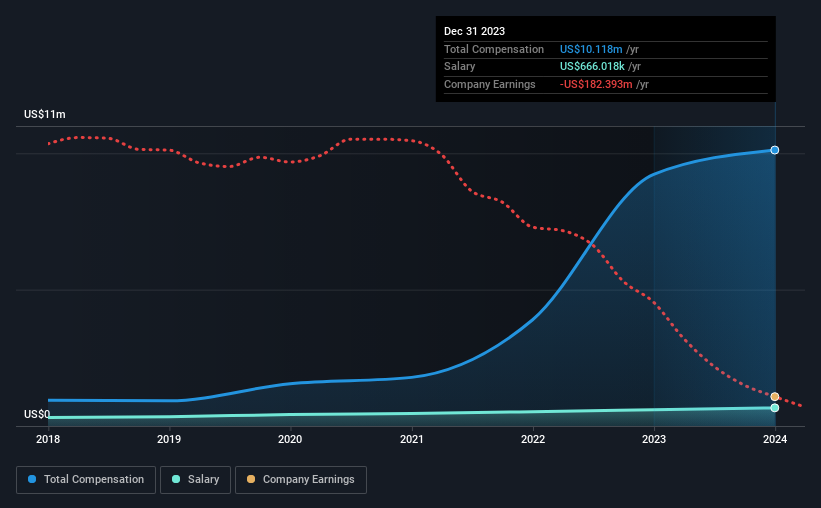

Despite strong share price growth of 109% for Xenon Pharmaceuticals Inc. (NASDAQ:XENE) over the last few years, earnings growth has been disappointing, which suggests something is amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 4th of June. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

Check out our latest analysis for Xenon Pharmaceuticals

Comparing Xenon Pharmaceuticals Inc.'s CEO Compensation With The Industry

At the time of writing, our data shows that Xenon Pharmaceuticals Inc. has a market capitalization of US$2.9b, and reported total annual CEO compensation of US$10m for the year to December 2023. Notably, that's an increase of 9.6% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at US$666k.

On examining similar-sized companies in the American Biotechs industry with market capitalizations between US$2.0b and US$6.4b, we discovered that the median CEO total compensation of that group was US$8.6m. So it looks like Xenon Pharmaceuticals compensates Ian Mortimer in line with the median for the industry. Moreover, Ian Mortimer also holds US$1.8m worth of Xenon Pharmaceuticals stock directly under their own name.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$666k | US$595k | 7% |

| Other | US$9.5m | US$8.6m | 93% |

| Total Compensation | US$10m | US$9.2m | 100% |

Talking in terms of the industry, salary represented approximately 23% of total compensation out of all the companies we analyzed, while other remuneration made up 77% of the pie. It's interesting to note that Xenon Pharmaceuticals allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Xenon Pharmaceuticals Inc.'s Growth

Xenon Pharmaceuticals Inc. has reduced its earnings per share by 28% a year over the last three years. In the last year, its revenue has collapsed effectively to zero.

The decline in EPS is a bit concerning. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Xenon Pharmaceuticals Inc. Been A Good Investment?

Most shareholders would probably be pleased with Xenon Pharmaceuticals Inc. for providing a total return of 109% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean returns may be hard to keep up. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 4 warning signs (and 1 which is a bit concerning) in Xenon Pharmaceuticals we think you should know about.

Important note: Xenon Pharmaceuticals is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:XENE

Xenon Pharmaceuticals

A neuroscience-focused biopharmaceutical company, engages in the discovery, development, and delivery of therapeutics to treat patients with neurological and psychiatric disorders in Canada.

Flawless balance sheet and fair value.

Market Insights

Community Narratives