- United States

- /

- Biotech

- /

- NasdaqGM:XENE

Is Analyst Excitement Over Xenon's (XENE) Neuroscience Pipeline Justified After Q3 Losses?

Reviewed by Sasha Jovanovic

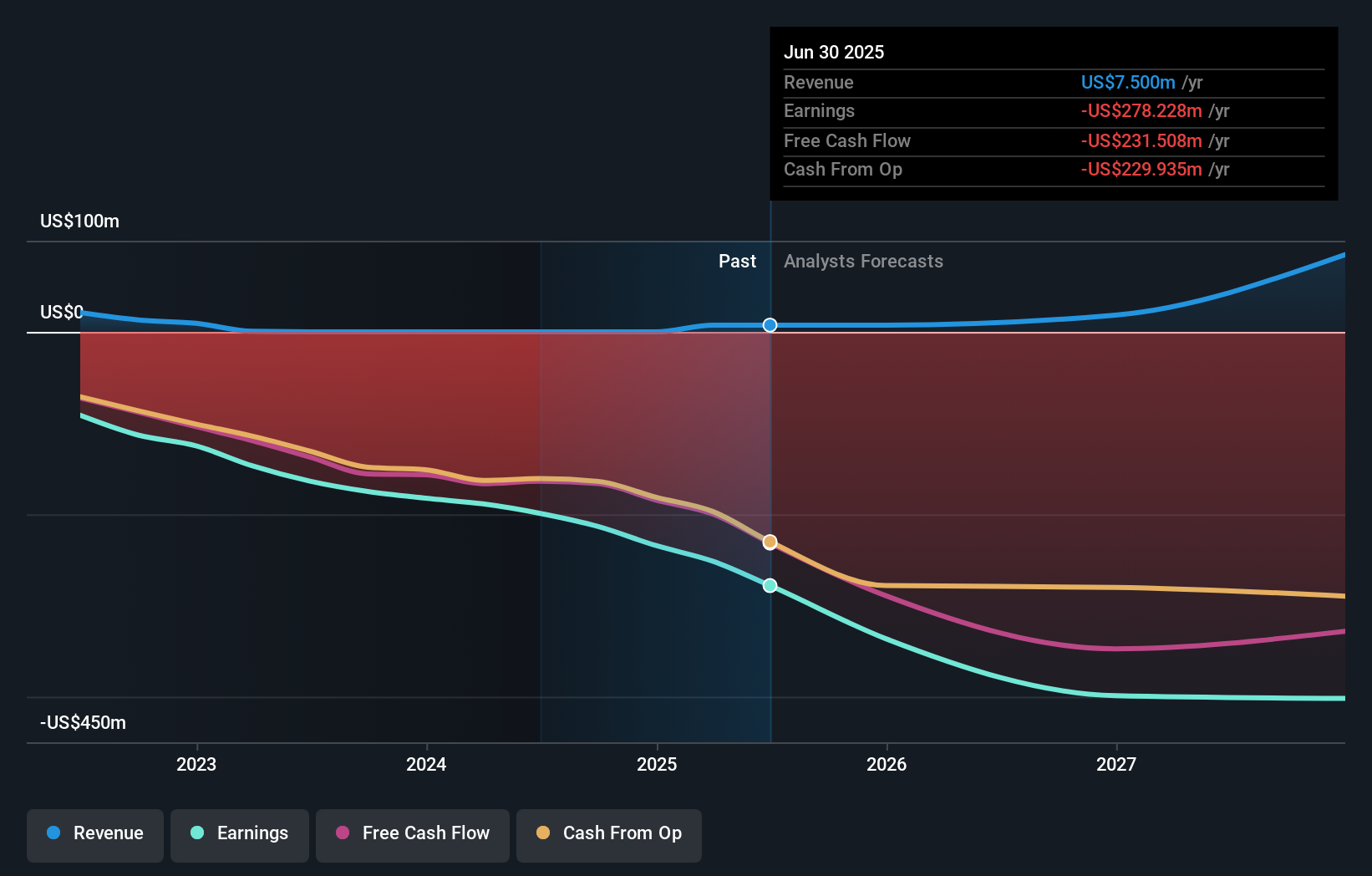

- Xenon Pharmaceuticals recently reported its third quarter and nine-month 2025 financial results, sharing increased net losses compared to the prior year, and participated at the Stifel 2025 Healthcare Conference in New York.

- The company's focus on neurological therapeutics and ongoing advances in neuroscience research have attracted heightened analyst and investor interest in its development pipeline.

- We'll explore how growing enthusiasm for Xenon's neuroscience pipeline is shaping the company's investment narrative following these latest updates.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Xenon Pharmaceuticals' Investment Narrative?

For those considering Xenon Pharmaceuticals, the core story remains unchanged: confidence in the company's neuroscience pipeline and its ability to convert research breakthroughs into approved, revenue-generating therapies. Recent third quarter results, showing higher net losses (US$90.9 million) than last year, do not materially shift the key short-term catalysts, which continue to center on late-stage trial outcomes for azetukalner and updates on commercialization plans. The upcoming results from pivotal trials and further clarity on regulatory timelines still matter most to the investment case. However, as development expenses continue to rise and losses widen, balancing the enthusiasm for the science with the company’s ability to manage cash burn and avoid future dilution becomes even more important. Participation at the Stifel Healthcare Conference reinforces ongoing investor interest, but doesn’t fundamentally change the biggest risks ahead. On the other hand, the challenge of sustained losses should not be underestimated.

Xenon Pharmaceuticals' shares have been on the rise but are still potentially undervalued by 41%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Xenon Pharmaceuticals - why the stock might be worth as much as 35% more than the current price!

Build Your Own Xenon Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Xenon Pharmaceuticals research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Xenon Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Xenon Pharmaceuticals' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:XENE

Xenon Pharmaceuticals

A neuroscience-focused biopharmaceutical company, engages in the discovery, development, and delivery of therapeutics to treat patients with neurological and psychiatric disorders in Canada.

Flawless balance sheet and fair value.

Market Insights

Community Narratives