- United States

- /

- Biotech

- /

- NasdaqGM:XENE

A Look at Xenon Pharmaceuticals (XENE) Valuation Following CFO Appointment Ahead of Potential Azetukalner Launch

Reviewed by Kshitija Bhandaru

Xenon Pharmaceuticals (XENE) has brought in Tucker Kelly as its new Chief Financial Officer to help steer the company through a crucial period. With azetukalner approaching potential commercialization, the leadership change is an intriguing signal for investors.

See our latest analysis for Xenon Pharmaceuticals.

Xenon’s 12.7% share price return over the past month and a 32.9% gain across the last 90 days reflect renewed optimism as anticipation builds for key milestones, even though the one-year total shareholder return is still slightly negative. The momentum suggests investors are watching closely, especially after executive changes and continued clinical trial progress.

If this turning point in leadership has you thinking about what’s next in biotech, take the opportunity to discover other healthcare stocks through our curated list: See the full list for free.

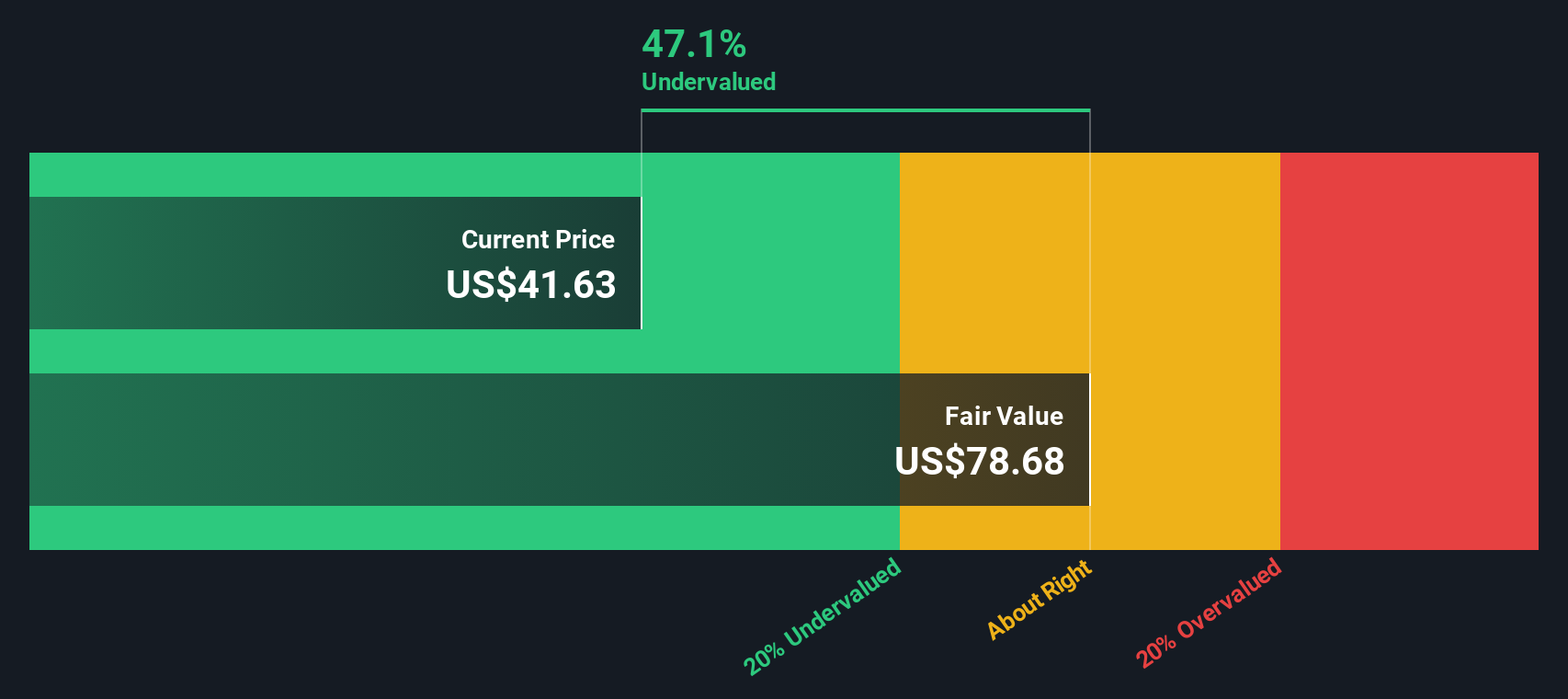

With shares trading well below most analyst price targets, but recent momentum fueling optimism, the real question is whether Xenon remains undervalued at current levels or if the market has already priced in the company’s next phase of growth.

Price-to-Book of 5.1: Is it justified?

Xenon Pharmaceuticals is currently trading at a price-to-book ratio of 5.1, which sets it apart from both the industry and its peers. With a last close of $41.63, this multiple suggests investors may be paying a premium compared to similar biotechs.

The price-to-book ratio reflects what the market is willing to pay for each dollar of net assets. In the biotech sector, this multiple often signals expectations for future growth or significant value creation, particularly when profits are still elusive.

Here, Xenon's 5.1x price-to-book is notably higher than both the US Biotechs industry average of 2.5x and the peer average of 4.1x. This stark gap highlights a market consensus that Xenon's assets or its prospects justify a meaningful premium, even with ongoing unprofitability.

However, while this premium may point to optimism about pipeline progress or leadership, it is important to remember that valuation multiples can quickly adjust if expectations are not met. Xenon's price-to-book stands well above its sector and peer group, indicating a material disconnect between market hopes and fundamentals.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 5.1 (OVERVALUED)

However, continued unprofitability and the possibility of slower than expected revenue growth could quickly temper the current optimism around Xenon Pharmaceuticals.

Find out about the key risks to this Xenon Pharmaceuticals narrative.

Another View: Discounted Cash Flow Analysis

While the current market price suggests Xenon Pharmaceuticals is expensive compared to assets, our SWS DCF model tells a different story. This approach estimates the company is trading 47.3% below its intrinsic value. Could this deep discount signal overlooked long-term upside, or is the risk already reflected?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Xenon Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Xenon Pharmaceuticals Narrative

If you want to dig into the numbers and develop your own perspective, you can create a personalized narrative in just a few minutes. Do it your way.

A great starting point for your Xenon Pharmaceuticals research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let a great opportunity slip by. The market is full of stocks breaking ground, and you deserve to know where the action is happening right now.

- Catch rapid movers by scanning these 3596 penny stocks with strong financials, which demonstrate strong financial performance and impressive resilience in turbulent markets.

- Grow your portfolio with reliable income by checking out these 18 dividend stocks with yields > 3%, which boasts yields over 3% for steady cash flow.

- Capitalize on tomorrow’s breakthroughs by targeting these 24 AI penny stocks, a group fueling innovation in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:XENE

Xenon Pharmaceuticals

A neuroscience-focused biopharmaceutical company, engages in the discovery, development, and delivery of therapeutics to treat patients with neurological and psychiatric disorders in Canada.

Flawless balance sheet and fair value.

Market Insights

Community Narratives