- United States

- /

- Biotech

- /

- NasdaqGS:VYGR

There's No Escaping Voyager Therapeutics, Inc.'s (NASDAQ:VYGR) Muted Revenues Despite A 28% Share Price Rise

Voyager Therapeutics, Inc. (NASDAQ:VYGR) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 11% is also fairly reasonable.

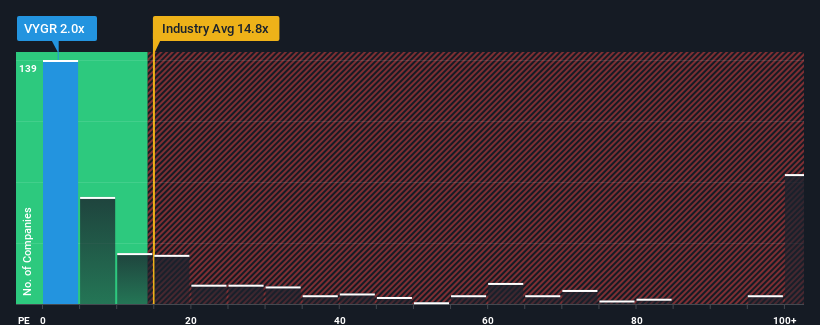

Even after such a large jump in price, Voyager Therapeutics' price-to-sales (or "P/S") ratio of 2x might still make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 14.8x and even P/S above 69x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Voyager Therapeutics

What Does Voyager Therapeutics' Recent Performance Look Like?

Recent times have been advantageous for Voyager Therapeutics as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Voyager Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Voyager Therapeutics?

The only time you'd be truly comfortable seeing a P/S as depressed as Voyager Therapeutics' is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. The latest three year period has also seen an excellent 46% overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 41% per annum as estimated by the eight analysts watching the company. Meanwhile, the broader industry is forecast to expand by 195% per year, which paints a poor picture.

In light of this, it's understandable that Voyager Therapeutics' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Voyager Therapeutics' P/S?

Shares in Voyager Therapeutics have risen appreciably however, its P/S is still subdued. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Voyager Therapeutics' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Voyager Therapeutics' poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Voyager Therapeutics (at least 1 which is potentially serious), and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Voyager Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VYGR

Voyager Therapeutics

A biotechnology company, focuses on the human genetics for the cure of neurological diseases.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives