- United States

- /

- Biotech

- /

- OTCPK:VXRT

Shareholders Are Thrilled That The Vaxart (NASDAQ:VXRT) Share Price Increased 231%

It certainly might concern Vaxart, Inc. (NASDAQ:VXRT) shareholders to see the share price down 40% in just 30 days. But that doesn't detract from the splendid returns of the last year. Like an eagle, the share price soared 231% in that time. So some might not be surprised to see the price retrace some. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

See our latest analysis for Vaxart

Because Vaxart made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Vaxart saw its revenue shrink by 59%. We're a little surprised to see the share price pop 231% in the last year. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. It's quite likely the revenue fall was already priced in, anyway.

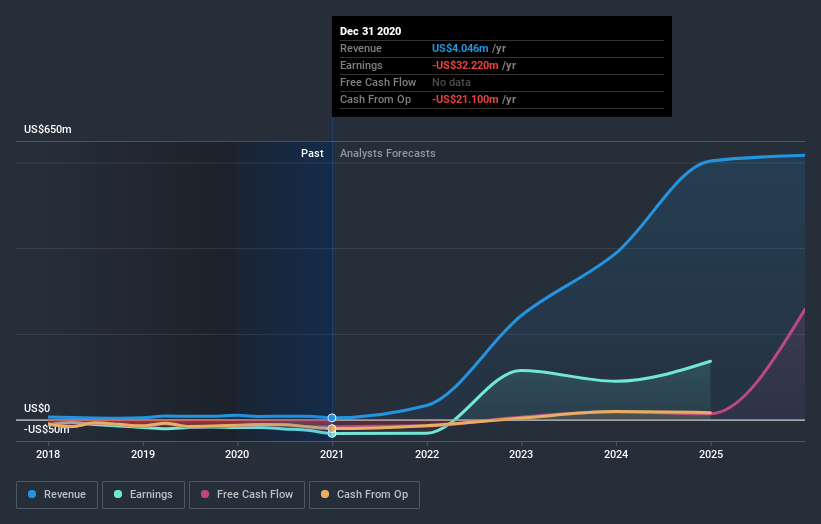

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Vaxart's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Vaxart shareholders have gained 231% (in total) over the last year. That's better than the annualized TSR of 7% over the last three years. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Vaxart you should be aware of, and 1 of them is a bit unpleasant.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Vaxart or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:VXRT

Vaxart

A clinical-stage biotechnology company, discovers and develops oral recombinant protein vaccines based on its vector-adjuvant-antigen standardized technology proprietary oral vaccine platform in the United States.

Moderate risk with mediocre balance sheet.

Market Insights

Community Narratives