- United States

- /

- Pharma

- /

- NasdaqGM:VRCA

High Insider Ownership Growth Stocks On US Exchange For June 2024

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations, with recent slips in major indices like the Dow Jones, S&P 500, and Nasdaq from record highs, investors are keenly observing market dynamics and economic indicators such as inflation rates and interest rate expectations. In this context, examining growth companies with high insider ownership might offer valuable insights, as these firms often demonstrate a strong alignment between management's interests and shareholder returns.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

| Duolingo (NasdaqGS:DUOL) | 15% | 48% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

Let's review some notable picks from our screened stocks.

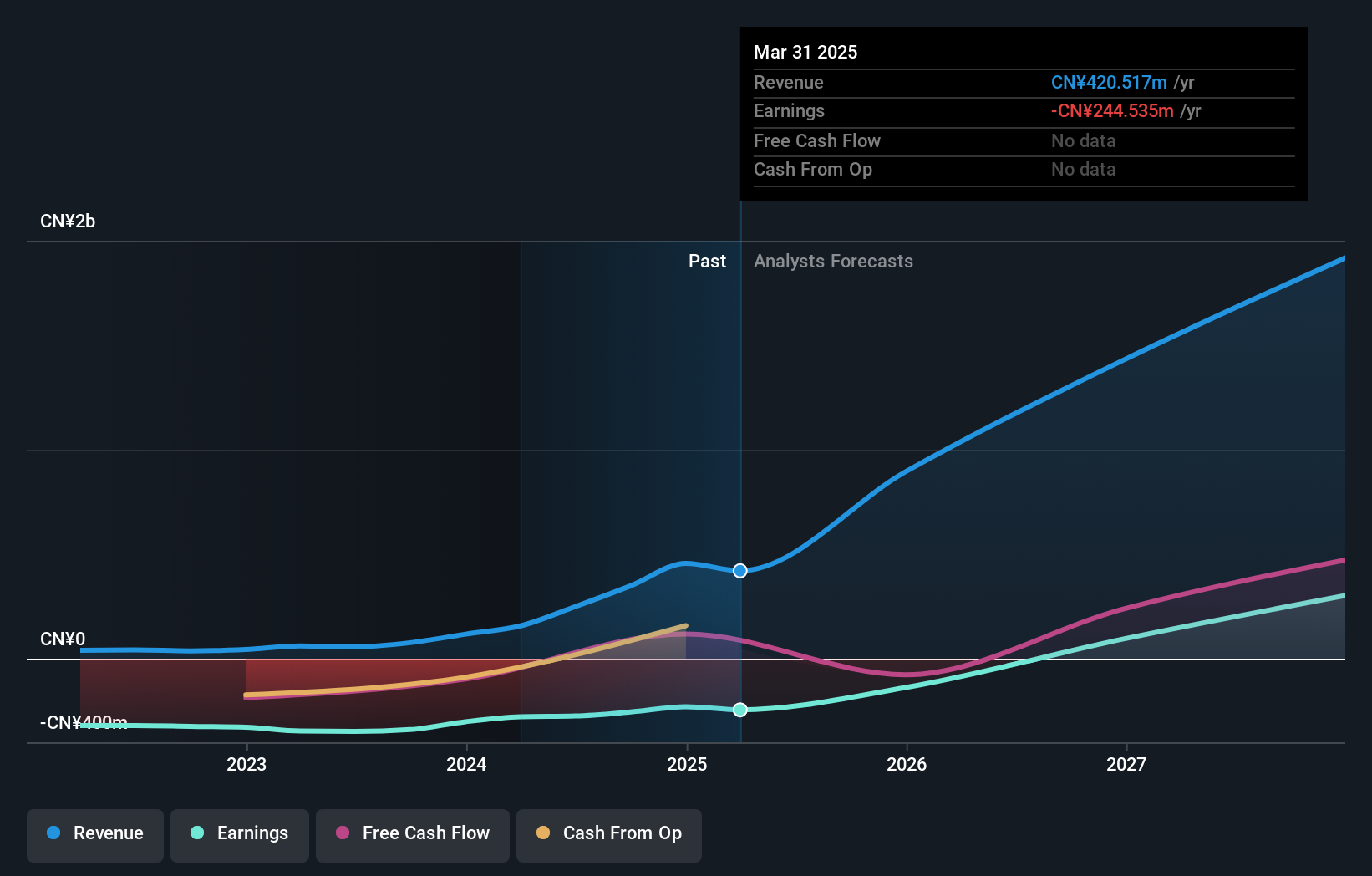

EHang Holdings (NasdaqGM:EH)

Simply Wall St Growth Rating: ★★★★★★

Overview: EHang Holdings Limited is an autonomous aerial vehicle technology platform company operating in the People’s Republic of China, East Asia, West Asia, and Europe with a market cap of approximately $863.22 million.

Operations: The company generates revenue primarily from its Aerospace & Defense segment, which reported CN¥156.95 million in sales.

Insider Ownership: 32.8%

Earnings Growth Forecast: 74.3% p.a.

EHang Holdings is poised for significant growth with expected profitability within three years and forecasted annual earnings growth of 74.31%. Its revenue is anticipated to increase by 37.5% annually, outpacing the US market average. Despite high insider ownership, recent shareholder dilution raises concerns. The company recently enhanced its market presence through strategic agreements in Wencheng for its EH216-S pilotless aircraft, marking a pivotal development in low-altitude economy sectors like tourism and transportation.

- Unlock comprehensive insights into our analysis of EHang Holdings stock in this growth report.

- The analysis detailed in our EHang Holdings valuation report hints at an inflated share price compared to its estimated value.

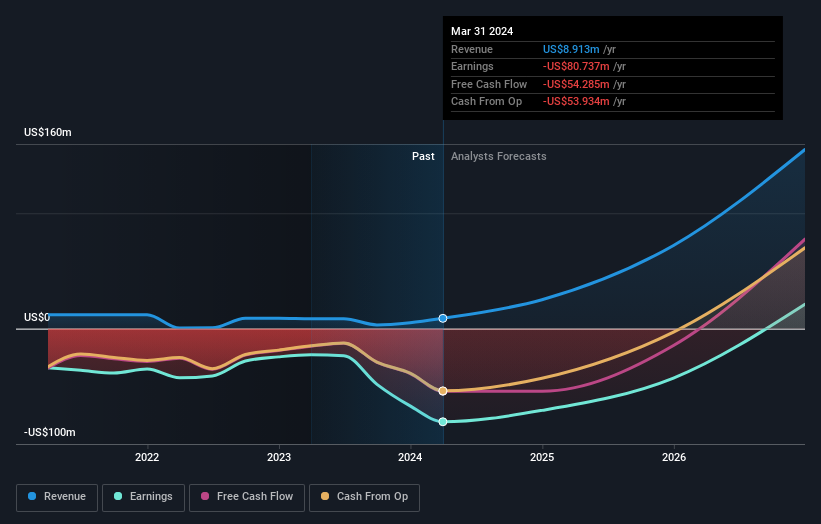

Verrica Pharmaceuticals (NasdaqGM:VRCA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Verrica Pharmaceuticals Inc. is a clinical-stage dermatology therapeutics company focused on developing medications for skin diseases in the United States, with a market capitalization of approximately $299.06 million.

Operations: The company's revenue from its pharmaceuticals segment is approximately $8.91 million.

Insider Ownership: 38.3%

Earnings Growth Forecast: 63.6% p.a.

Verrica Pharmaceuticals, despite a significant net loss of US$20.33 million in Q1 2024, is actively expanding its pipeline with strategic amendments to licensing agreements for global clinical trials. The company's collaboration with Torii Pharmaceutical aims to address the large unmet need in dermatology for common warts—a potential multibillion-dollar market. With insider ownership fostering aligned interests and a revenue growth forecast at 49.8% per year, Verrica is positioning itself strategically amidst financial challenges.

- Click to explore a detailed breakdown of our findings in Verrica Pharmaceuticals' earnings growth report.

- The valuation report we've compiled suggests that Verrica Pharmaceuticals' current price could be inflated.

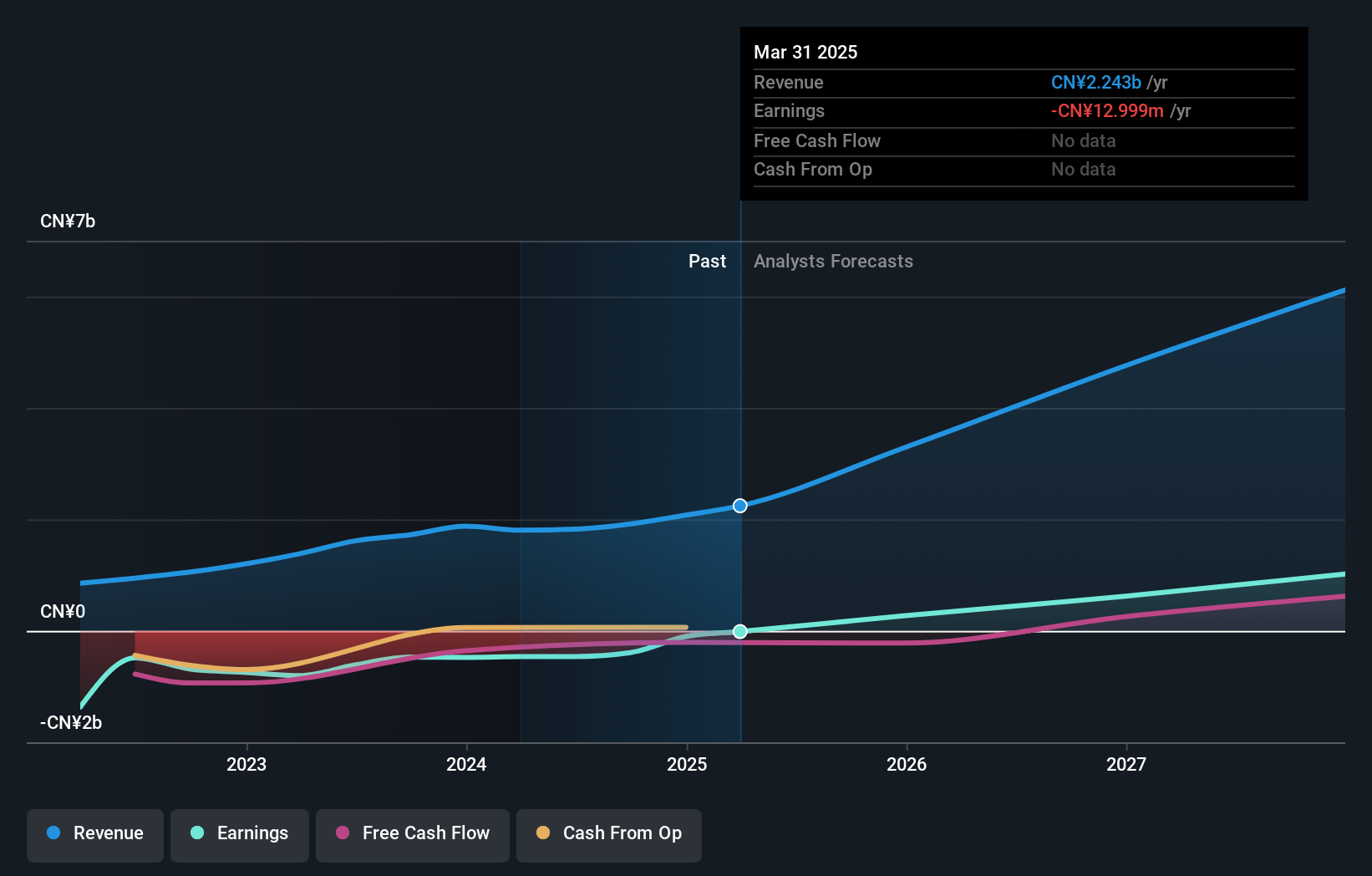

Hesai Group (NasdaqGS:HSAI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hesai Group operates globally, developing, manufacturing, and selling three-dimensional LiDAR solutions, with a market capitalization of approximately $554.53 million.

Operations: The company generates revenue from the development, manufacture, and sale of LiDAR solutions across Mainland China, Europe, and North America.

Insider Ownership: 24.4%

Earnings Growth Forecast: 71% p.a.

Hesai Group, a company with high insider ownership, is expected to become profitable within the next three years, outpacing average market growth. With earnings having increased by 15.6% annually over the past five years and revenue projected to grow at 26.4% per year—significantly above the US market rate of 8.7%—the firm shows promising growth potential. However, it faces challenges such as a highly volatile share price and recent executive changes that could impact stability.

- Navigate through the intricacies of Hesai Group with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Hesai Group's shares may be trading at a discount.

Where To Now?

- Unlock our comprehensive list of 180 Fast Growing US Companies With High Insider Ownership by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VRCA

Verrica Pharmaceuticals

A clinical-stage dermatology therapeutics company, develops medications for the treatment of skin diseases in the United States.

Undervalued with high growth potential.