- United States

- /

- Biotech

- /

- NasdaqGM:VNDA

3 Penny Stocks Under $300M Market Cap To Consider

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 2.2%, and in the past year, it has climbed 8.2%, with earnings expected to grow by 14% per annum in the coming years. For investors willing to explore beyond well-known companies, penny stocks—often representing smaller or newer firms—can present intriguing possibilities. Although "penny stock" might seem like an outdated term, these investments remain relevant today as they offer opportunities for growth when backed by strong financial health and resilience.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.50 | $361.71M | ✅ 3 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.34 | $1.44B | ✅ 3 ⚠️ 3 View Analysis > |

| Smith Micro Software (NasdaqCM:SMSI) | $1.03 | $18.66M | ✅ 4 ⚠️ 4 View Analysis > |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.2627 | $9.95M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $3.6784 | $46.16M | ✅ 4 ⚠️ 2 View Analysis > |

| Waterdrop (NYSE:WDH) | $1.31 | $477.39M | ✅ 4 ⚠️ 0 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.66 | $77.65M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (OTCPK:BABB) | $0.8184 | $6.02M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.46 | $80.24M | ✅ 3 ⚠️ 2 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8069 | $71.73M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 756 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Adverum Biotechnologies (NasdaqCM:ADVM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Adverum Biotechnologies, Inc. is a clinical-stage company focused on developing gene therapy product candidates for treating ocular diseases, with a market cap of $72.91 million.

Operations: Adverum Biotechnologies generates revenue primarily from developing and commercializing gene therapeutics, amounting to $1 million.

Market Cap: $72.91M

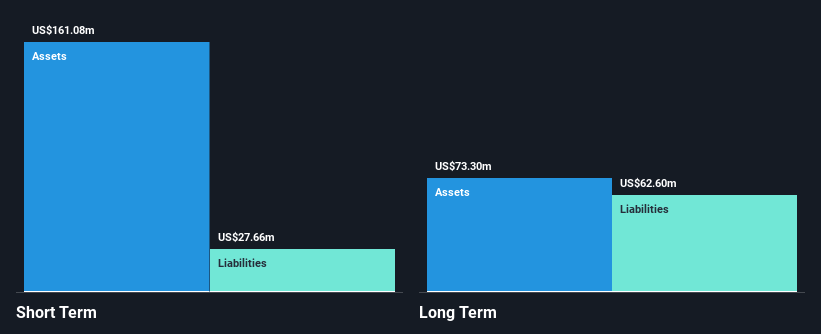

Adverum Biotechnologies, with a market cap of US$72.91 million, is a pre-revenue biotech firm focused on gene therapy for ocular diseases. Despite having short-term assets of US$131.3 million exceeding both short and long-term liabilities, the company faces challenges such as high volatility and unprofitability with a negative return on equity. Recent developments include an auditor's going concern doubts and delayed SEC filings, which could impact investor confidence. However, the initiation of the ARTEMIS Phase 3 study marks a significant step in its product pipeline aimed at treating neovascular age-related macular degeneration.

- Jump into the full analysis health report here for a deeper understanding of Adverum Biotechnologies.

- Learn about Adverum Biotechnologies' future growth trajectory here.

PLAYSTUDIOS (NasdaqGM:MYPS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PLAYSTUDIOS, Inc. develops and publishes free-to-play casual games for mobile and social platforms both in the United States and internationally, with a market cap of approximately $180.18 million.

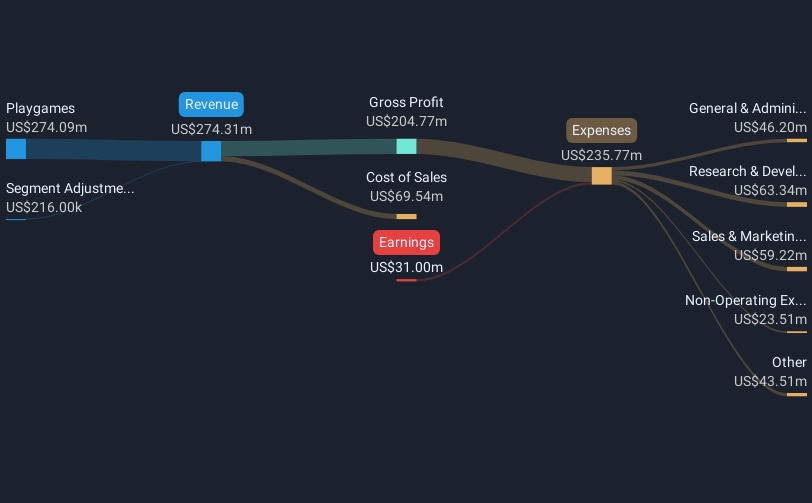

Operations: The company's revenue is primarily derived from its Playgames segment, which generated $289.37 million, while the Playawards segment contributed $0.06 million.

Market Cap: $180.18M

PLAYSTUDIOS, Inc., with a market cap of US$180.18 million, faces challenges typical of penny stocks, including unprofitability and negative return on equity (-11.72%). Despite this, the company has a strong cash position with short-term assets of US$147.1 million exceeding its liabilities and no debt burden. Recent earnings showed a decline in sales to US$62.71 million for Q1 2025 from US$77.83 million the previous year, alongside an increased net loss of US$2.88 million. The company's positive free cash flow provides a runway exceeding three years, offering some financial stability amidst its operational challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of PLAYSTUDIOS.

- Gain insights into PLAYSTUDIOS' future direction by reviewing our growth report.

Vanda Pharmaceuticals (NasdaqGM:VNDA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vanda Pharmaceuticals Inc. is a biopharmaceutical company dedicated to developing and commercializing therapies for high unmet medical needs globally, with a market cap of $269.33 million.

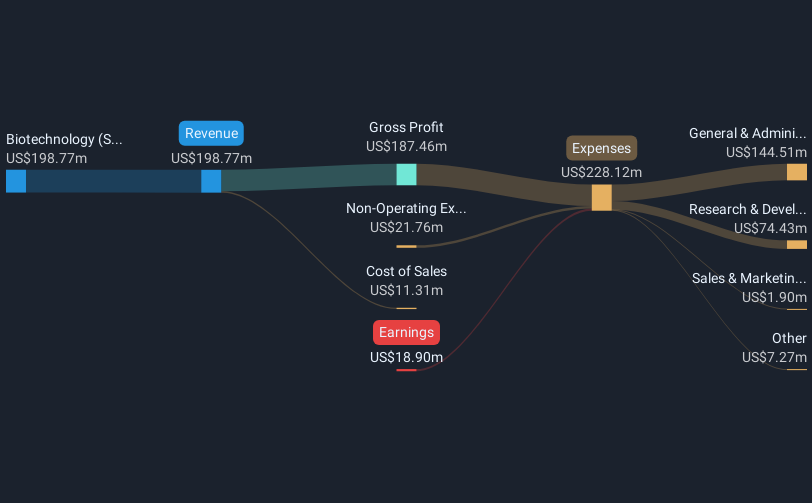

Operations: Vanda Pharmaceuticals generates revenue primarily from its Biotechnology (Startups) segment, amounting to $198.77 million.

Market Cap: $269.33M

Vanda Pharmaceuticals, with a market cap of US$269.33 million, is navigating the challenges of penny stocks while focusing on its pipeline development. The recent FDA filing for Bysanti (milsaperidone) marks a significant step towards potential revenue growth, with a decision expected in early 2026. Although currently unprofitable and experiencing increased losses over the past five years, Vanda's robust cash position—with short-term assets of US$438.9 million surpassing both short- and long-term liabilities—provides financial resilience. The company remains debt-free and benefits from an experienced management team guiding its strategic direction amidst ongoing clinical developments.

- Take a closer look at Vanda Pharmaceuticals' potential here in our financial health report.

- Review our growth performance report to gain insights into Vanda Pharmaceuticals' future.

Next Steps

- Dive into all 756 of the US Penny Stocks we have identified here.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VNDA

Vanda Pharmaceuticals

A biopharmaceutical company, focuses on the development and commercialization of therapies to address high unmet medical needs worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives