- United States

- /

- Biotech

- /

- NasdaqCM:VKTX

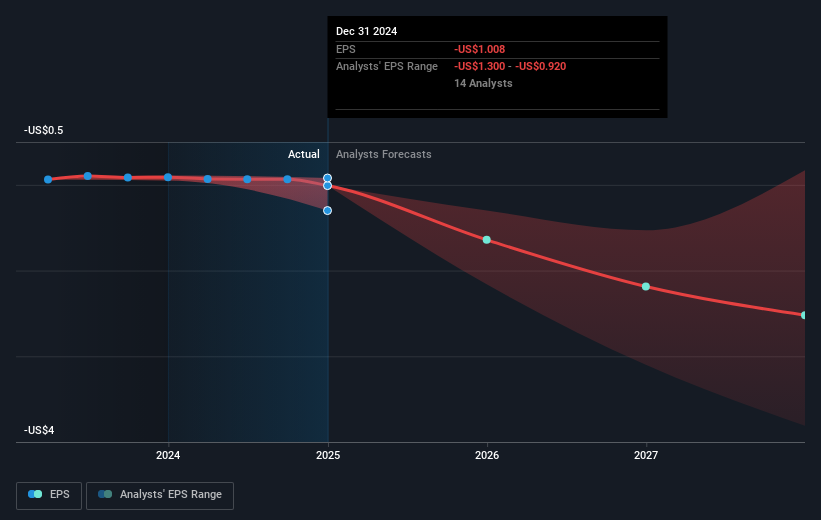

Viking Therapeutics (NasdaqCM:VKTX) Sees 14% Drop After US$35 Million Quarterly Loss

Reviewed by Simply Wall St

Viking Therapeutics (NasdaqCM:VKTX) announced its financial results for Q4 2024 and the full year, revealing a significant increase in net losses, with a quarterly loss of $35 million compared to the previous year's $25 million. This financial deterioration may have influenced the company's share price decrease of 13.84% over the last week, amid a broader market environment where the U.S. stock indexes also saw mixed performance. The Dow Jones rose moderately while the S&P 500 and Nasdaq showed declines, driven by investor reactions to key earnings reports and new tariff announcements by President Trump. As such, despite the advanced growth predictions in the broader market, equity challenges, and earnings pressures seem to have impacted VKTX more markedly. Investors should remain attentive to upcoming financial disclosures and macroeconomic factors that might further influence market sentiment.

Click to explore a detailed breakdown of our findings on Viking Therapeutics.

Despite recent setbacks, Viking Therapeutics' shares have achieved very large total returns of 740.48% over the last three years, showcasing significant long-term growth. This period has been marked by key developments that have likely influenced this performance. Positive results from the Phase 2b trial of VK2809 in November 2024, demonstrated efficacy in reducing liver fat and resolving NASH, possibly driving investor interest. Additionally, the initiation of the VK2735 Phase 2 trial in January 2025 for obesity treatment could have bolstered sentiment towards the company's innovative treatments.

Looking over the past year, Viking Therapeutics underperformed both the U.S. market and the biotech industry. Despite positive product-related announcements, increased insider selling in recent months may have contributed to market concerns. Furthermore, while the company remains unprofitable, the substantial equity offer in February 2024, raising US$550.04 million, might have impacted the liquidity and valuation sentiments surrounding Viking Therapeutics' shares.

- Unlock the insights behind Viking Therapeutics' valuation and discover its true investment potential

- Analyze the downside risks for Viking Therapeutics and understand their potential impact—click to learn more.

- Is Viking Therapeutics part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VKTX

Viking Therapeutics

A clinical-stage biopharmaceutical company, focuses on the development of novel therapies for metabolic and endocrine disorders.

Excellent balance sheet moderate.

Market Insights

Community Narratives