- United States

- /

- Biotech

- /

- NasdaqGM:VCYT

Veracyte (VCYT) Valuation in Focus as Groundbreaking Prostate Cancer Study Drives Clinical Adoption and Pipeline Progress

Reviewed by Simply Wall St

If you’ve been tracking Veracyte (VCYT), the past week probably has you leaning in. Two major updates just dropped: a landmark study published in Cell shows Veracyte’s Decipher Prostate Genomic Classifier can pinpoint which metastatic prostate cancer patients will actually benefit from chemotherapy, allowing more tailored, less toxic treatment plans. Not only is this a scientific first for gene expression tests in this advanced cancer setting, but it's also a meaningful stride as Veracyte just made this test widely available to clinicians across the U.S. Meanwhile, in its lung cancer pipeline, Veracyte has completed patient enrollment for its nightINGALE trial, advancing its Percepta Nasal Swab test toward broader clinical use.

Investors have certainly noticed. After some ups and downs in recent years, Veracyte’s share price has gained 19% over the past month, building clear momentum after mostly lagging earlier in the year. These new milestones in prostate and lung cancer are drawing fresh attention to the company’s growth prospects, especially as it looks to translate scientific breakthroughs into commercial gains. The market’s response suggests a shifting perception of risk and reward around the stock’s potential.

The big question, then, is whether Veracyte’s latest moves are laying the foundation for further gains or if the market has already factored in its future growth.

Most Popular Narrative: 18% Undervalued

According to the most popular narrative, Veracyte is viewed as significantly undervalued, with its current price estimated to be about 18% below fair value. This perspective is built on strong future expectations around growth, profitability, and market expansion.

"Pipeline momentum, with five major product launches and a pivotal clinical study (OPTIMA) completing in the next 18 months, positions Veracyte to further diversify revenue, drive cross-selling, penetrate new markets (e.g., MRD in bladder cancer, Prosigna for breast cancer), and significantly expand addressable markets, supporting long-term topline acceleration."

Curious why analysts are predicting such a sharp upside for Veracyte? There is one surprising quantitative assumption driving this bold fair value, but it’s not what most investors expect. Want to see which bullish trend the narrative claims will transform Veracyte’s financial profile over the next few years?

Result: Fair Value of $39.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on just a few core products and unpredictable payer coverage remain significant risks. These factors could undermine even the brightest outlook.

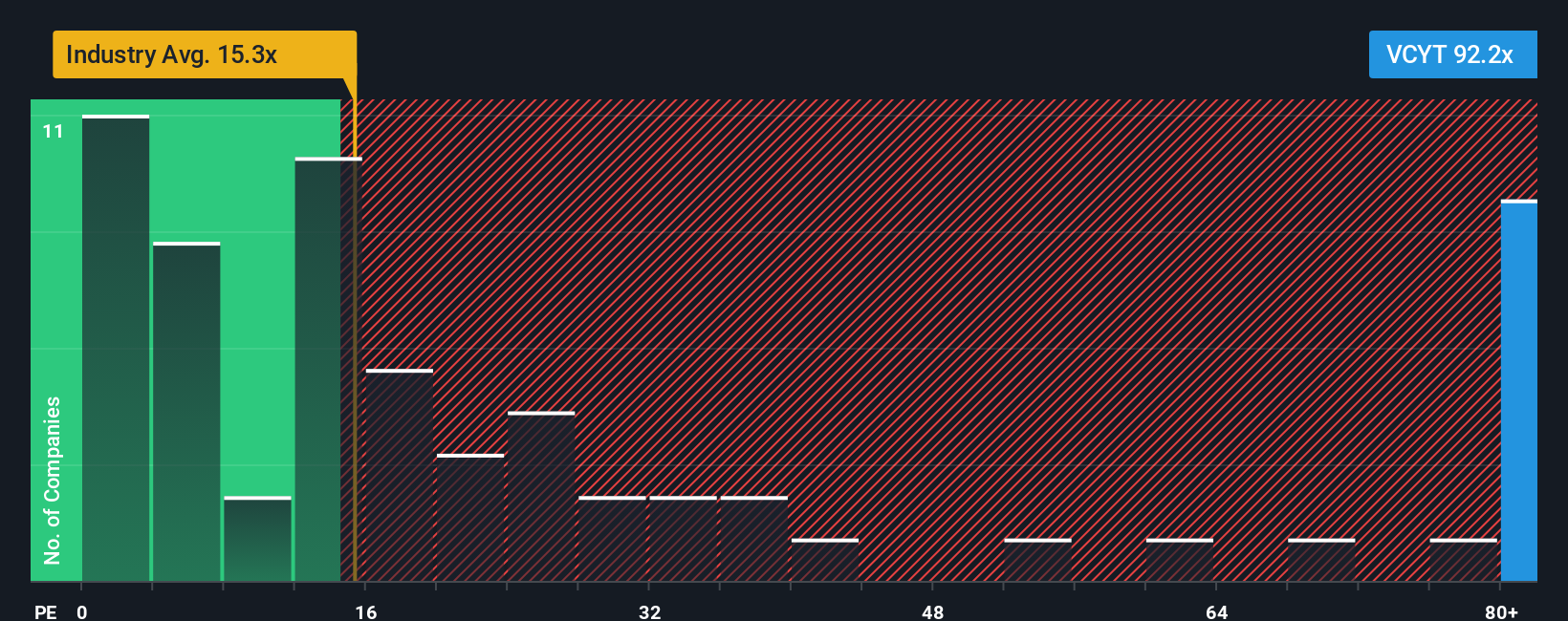

Find out about the key risks to this Veracyte narrative.Another View: Industry Comparison Says Price Is Steep

Looking at things from a different angle, a quick industry comparison suggests Veracyte’s shares are more expensive than most biotech stocks. This challenges the idea that the company is a hidden bargain. Which outlook will prove right?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Veracyte to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Veracyte Narrative

If you’d rather draw your own conclusions or trust your personal research, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Veracyte research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep a few promising stocks on their radar. Don't let incredible opportunities slip by while you focus on just one company. Unlock new possibilities now:

- Supercharge your portfolio by targeting penny stocks with strong financials. You'll spot growth-stage companies making waves in their industries through penny stocks with strong financials.

- Get ahead of the curve as AI shapes tomorrow’s winners. See which innovative businesses are harnessing artificial intelligence for real-world breakthroughs with AI penny stocks.

- Seize the potential for real value by pinpointing undervalued stocks based on cash flows and back your investments with hard financial data through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGM:VCYT

Veracyte

Operates as a diagnostics company in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives