- United States

- /

- Biotech

- /

- NasdaqGM:VCYT

Veracyte (VCYT) Valuation Check After Strong Q3 Beat and Upgraded 2024 Revenue, Margin Guidance

Reviewed by Simply Wall St

Veracyte (VCYT) just delivered a stronger than expected third quarter, topping earnings and revenue forecasts and lifting its full year revenue and adjusted EBITDA margin guidance, a combination that tends to reset investor expectations fast.

See our latest analysis for Veracyte.

That upbeat guidance lands after a strong run, with the share price up around 37 percent on a 90 day basis and supported by a 67 percent three year total shareholder return. This suggests momentum is building even after the latest pullback to about $44.61.

If Veracyte’s move has you rethinking your healthcare exposure, this could be a good moment to scout other ideas across healthcare stocks for potential next candidates.

With the stock now hovering just shy of analyst targets but still trading at a meaningful discount to some intrinsic estimates, should investors view Veracyte as underappreciated value, or has the market already priced in its next leg of growth?

Most Popular Narrative: 3.7% Undervalued

With Veracyte closing at $44.61 against a narrative fair value of $46.30, the current setup implies only a modest upside, but one built on detailed operational and clinical assumptions.

Pipeline momentum with five major product launches and a pivotal clinical study (OPTIMA) completing in the next 18 months positions Veracyte to further diversify revenue, drive cross-selling, penetrate new markets (e.g., MRD in bladder cancer, Prosigna for breast cancer), and significantly expand addressable markets, supporting long-term topline acceleration.

Want to see what kind of revenue climb, margin expansion, and future earnings multiple are baked into that seemingly small discount? The narrative leans on steady top line growth, sharply higher profitability, and a valuation multiple that rivals fast growing innovators. Curious how those moving parts add up to a higher fair value than today’s price? Read on to unpack the full playbook behind this projection.

Result: Fair Value of $46.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained success is not guaranteed, as Veracyte remains heavily reliant on Decipher and Afirma and continues to face reimbursement and pricing pressure.

Find out about the key risks to this Veracyte narrative.

Another Lens on Value

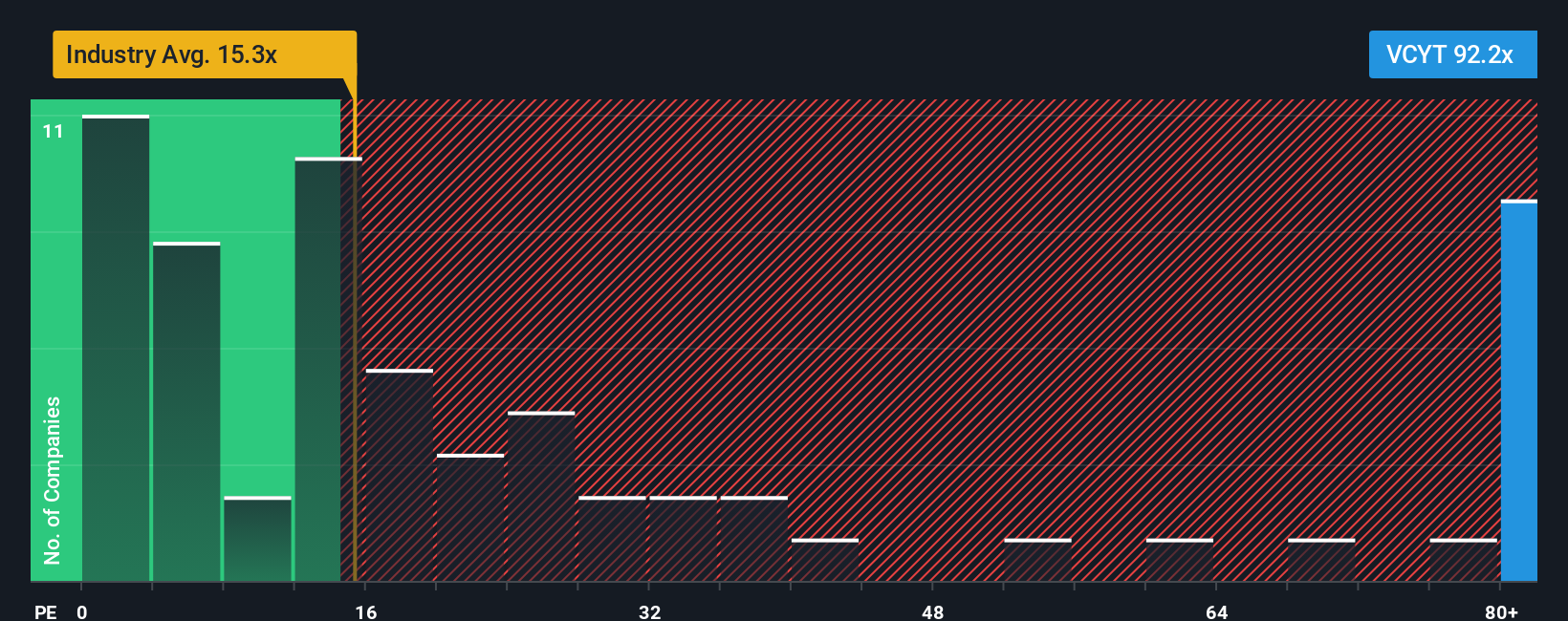

While the narrative fair value suggests Veracyte is only modestly undervalued, a simple earnings multiple paints a very different picture. At roughly 116 times earnings versus 19 times for the biotech industry and a fair ratio nearer 26 times, investors are paying a hefty premium that could unwind fast if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Veracyte Narrative

If you see things differently or want to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Veracyte research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before the next move in Veracyte plays out, lock in a smarter watchlist by jumping on curated stock ideas that other investors may be overlooking right now.

- Capitalize on mispriced opportunities by scanning these 908 undervalued stocks based on cash flows that combine solid fundamentals with attractive upside potential.

- Ride powerful secular growth trends by targeting these 26 AI penny stocks positioned at the forefront of automation, data intelligence, and next generation software.

- Strengthen your income stream by reviewing these 15 dividend stocks with yields > 3% that can boost portfolio yields while maintaining quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VCYT

Veracyte

Operates as a diagnostics company in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026