- United States

- /

- Biotech

- /

- NasdaqGM:VCYT

Evaluating Veracyte After Strong Quarterly Results and a 17.6% Share Price Surge

Reviewed by Bailey Pemberton

Thinking about what to do with Veracyte stock right now? You are not alone, and it is easy to see why this innovative biotech name is back in the spotlight. Over the past week, shares have jumped by 7.7%, and they are up an impressive 17.6% over the last month. That kind of action always catches the eye, hinting at renewed optimism or perhaps changing risk perceptions among traders. Still, it is impossible to ignore that Veracyte is down 11% year-to-date, even as the one-year figure stands at a healthy 9.6% gain. The truly long-term holders have seen big swings too, with a three-year price rise of 104.9% balanced by a five-year decline of 13.2%.

Market watchers have noted that recent developments in the molecular diagnostics space are putting companies like Veracyte in the conversation more and more. As investors size up these moves, two burning questions emerge: Has the stock finally become undervalued, or is there more room to run if the underlying story gets stronger?

To get a clear read, many turn to valuation scores. Veracyte’s current value score is 2, with that number reflecting the company’s performance in 2 out of 6 possible checks for undervaluation. But as we will see, classic metrics only take us so far. Next, we will dig into the main valuation approaches, and later, explore an even more insightful way to think about what Veracyte stock is really worth.

Veracyte scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Veracyte Discounted Cash Flow (DCF) Analysis

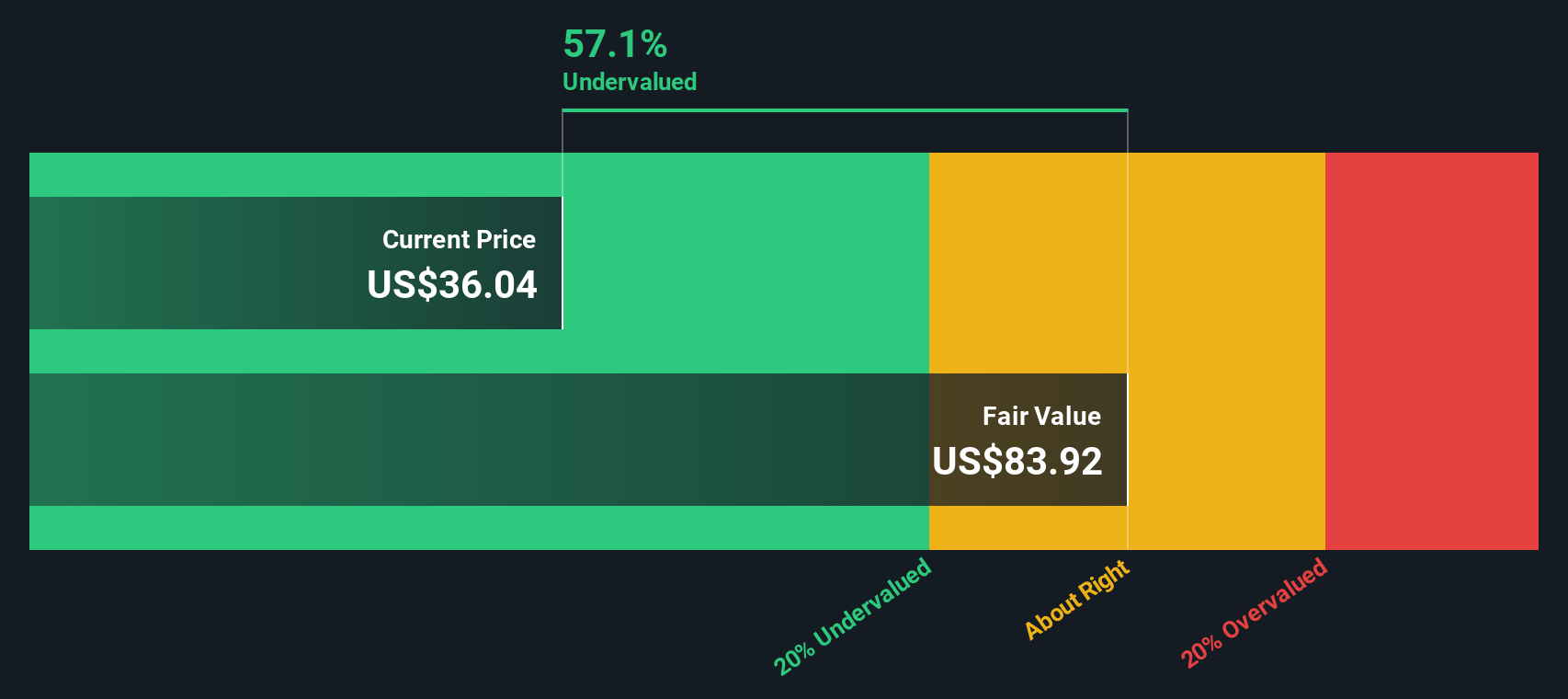

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to the present. For Veracyte, this means projecting how much cash the company will generate in coming years and considering what that money is worth in today's terms.

Currently, Veracyte’s Free Cash Flow (FCF) stands at $82.37 million. Projections show steady growth, with FCF expected to reach $90 million by the end of 2024. Looking further ahead, analyst models and extrapolations suggest that annual FCF could climb as high as approximately $343.84 million by 2035, indicating robust growth year after year.

After discounting all these estimated future cash flows using a standard rate, the DCF approach arrives at an intrinsic fair value of $84.11 per share. Compared to the stock’s current price, this figure suggests the share is trading at a 57.2% discount. In other words, the stock is considered significantly undervalued based on this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Veracyte is undervalued by 57.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Veracyte Price vs Earnings

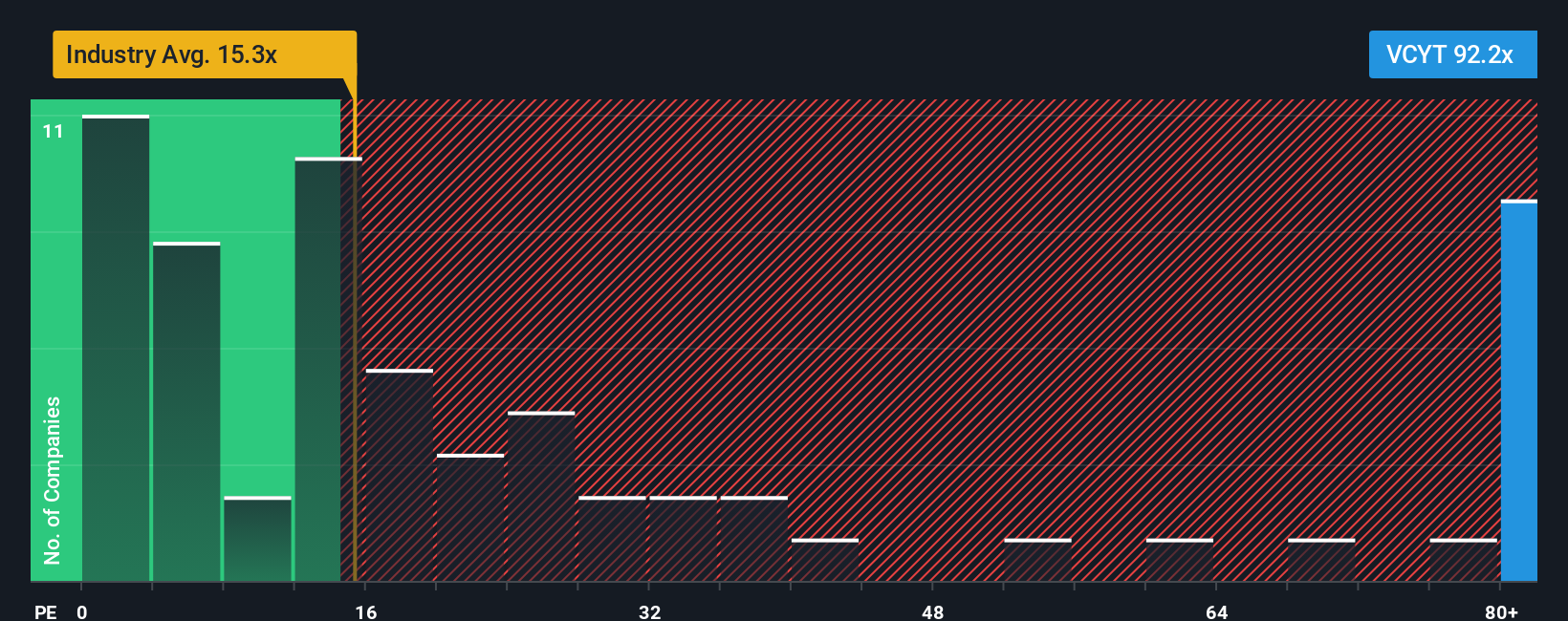

The price-to-earnings (PE) ratio is a popular tool for valuing profitable companies, as it relates a company’s stock price to its current earnings. Investors often use the PE ratio to gauge how much the market is willing to pay today for a dollar of future earnings. This is especially relevant for companies like Veracyte that are generating profits.

What counts as a "fair" PE ratio depends on several factors, including how quickly a company is expected to grow and the risks it faces in its sector. Higher growth prospects or lower risk typically justify a higher multiple. The opposite is true for slower-growing, riskier companies.

Right now, Veracyte trades at a PE ratio of 107.5x. This is much higher than the biotech industry average of 16.7x and also above the average for its peer group at 17.0x. At first glance, this might make Veracyte seem expensive, especially relative to these benchmarks.

However, the proprietary “Fair Ratio” calculated by Simply Wall St adjusts for Veracyte’s unique profile, factoring in its expected growth, risk, margins, industry, and market capitalization. For Veracyte, the Fair PE Ratio is 25.5x. This is considered a better yardstick than the raw comparison to industry averages or peers, as it accounts for growth opportunities and company-specific risks.

Given that Veracyte’s actual PE of 107.5x far exceeds its Fair Ratio of 25.5x, this suggests the stock is overvalued based on today's earnings fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Veracyte Narrative

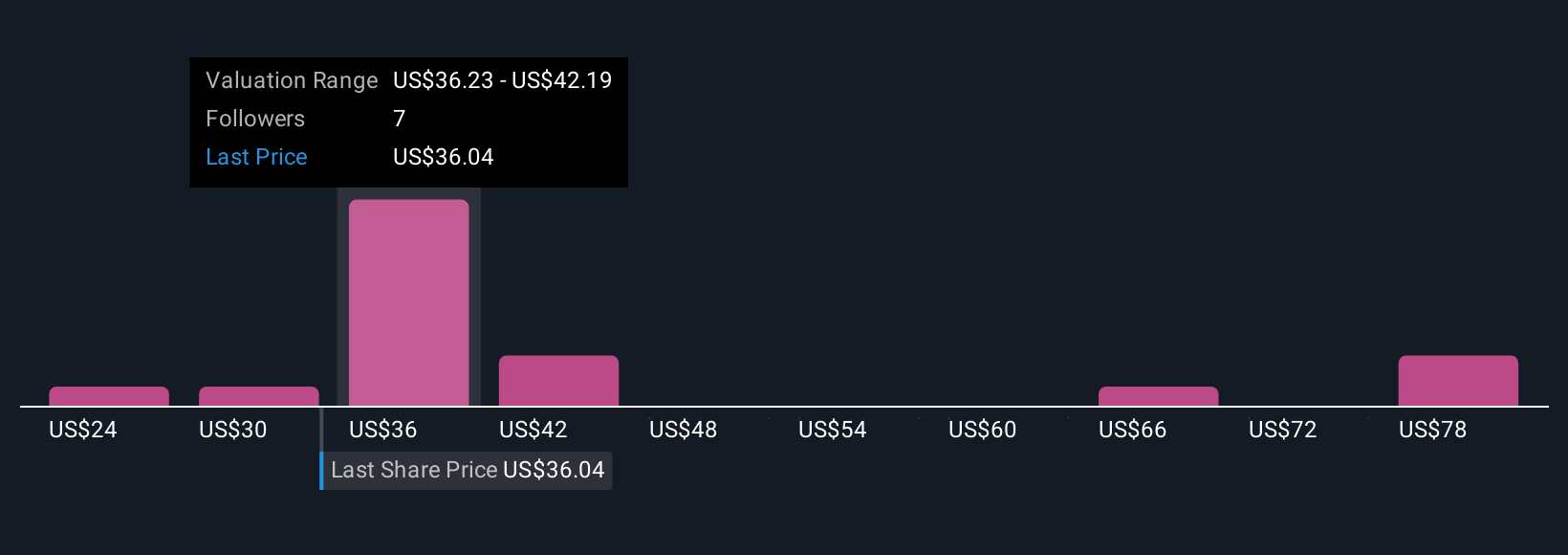

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is a simple, intuitive way for you to share and track your personal "story" for Veracyte, connecting your own estimates for future revenue, earnings, and profit margins to a fair value for the stock, all in one place.

Narratives go beyond the numbers by letting you explain the reasoning behind your forecasts and assumptions, tying Veracyte’s business outlook directly to your investment thesis. They are interactive and dynamic, updating automatically as new financial results or news are released, so your fair value stays relevant. On Simply Wall St’s Community page, millions of investors use Narratives to compare their outlooks with others and see at a glance whether their fair value points to a buy or a sell at current prices.

For example, optimistic Narratives for Veracyte might assume the company grows revenues and margins faster than analysts expect, giving a fair value as high as $45. More cautious Narratives set lower targets, producing fair value estimates around $28. Wherever you stand, Narratives help you invest with confidence by making your thinking explicit and comparing it dynamically to the market.

Do you think there's more to the story for Veracyte? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VCYT

Veracyte

Operates as a diagnostics company in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives