- United States

- /

- Biotech

- /

- NasdaqGM:VCYT

A Fresh Look at Veracyte (VCYT) Valuation Following Recent 18% Share Price Rally

Reviewed by Kshitija Bhandaru

Veracyte (VCYT) shares have been drawing attention after an extended period of solid gains over the past month, with the stock up 18%. Investors are evaluating whether the recent positive momentum can be sustained.

See our latest analysis for Veracyte.

Veracyte's recent 18% climb over the past month is catching eyes, but it is worth noting that the stock's momentum has been somewhat mixed over the year, with the 1-year total shareholder return sitting just above break-even. Overall, investor interest appears to be building, which could suggest that the market is reassessing Veracyte’s growth outlook or risk profile after a stretch of muted performance.

If the latest moves in Veracyte have you thinking about the broader sector, it might be the perfect moment to discover See the full list for free.

With shares now trading about 13% below the consensus analyst price target, the key question is whether Veracyte is undervalued at these levels or if the recent gains simply reflect expectations for future growth. Is there still an opportunity for buyers, or is the market already looking ahead?

Most Popular Narrative: 10.4% Undervalued

The most closely followed narrative values Veracyte shares above their most recent close, suggesting room for further upside if its core assumptions play out. This context sets the stage for a deep dive into the arguments underpinning this outlook.

Pipeline momentum, with five major product launches and a pivotal clinical study (OPTIMA) completing in the next 18 months, positions Veracyte to further diversify revenue, drive cross-selling, penetrate new markets (for example, MRD in bladder cancer and Prosigna for breast cancer), and significantly expand addressable markets, supporting long-term topline acceleration.

Want to uncover why this narrative is seeing opportunity where others hesitate? The story revolves around a powerful mix of planned product launches, market expansion, and a bold earnings acceleration that could reshape expectations. Get the inside scoop on the key financial projections driving this eye-catching fair value.

Result: Fair Value of $39.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on just a few core products and reimbursement pressures could quickly undermine Veracyte’s projected growth story.

Find out about the key risks to this Veracyte narrative.

Another View: What About Discounted Cash Flow?

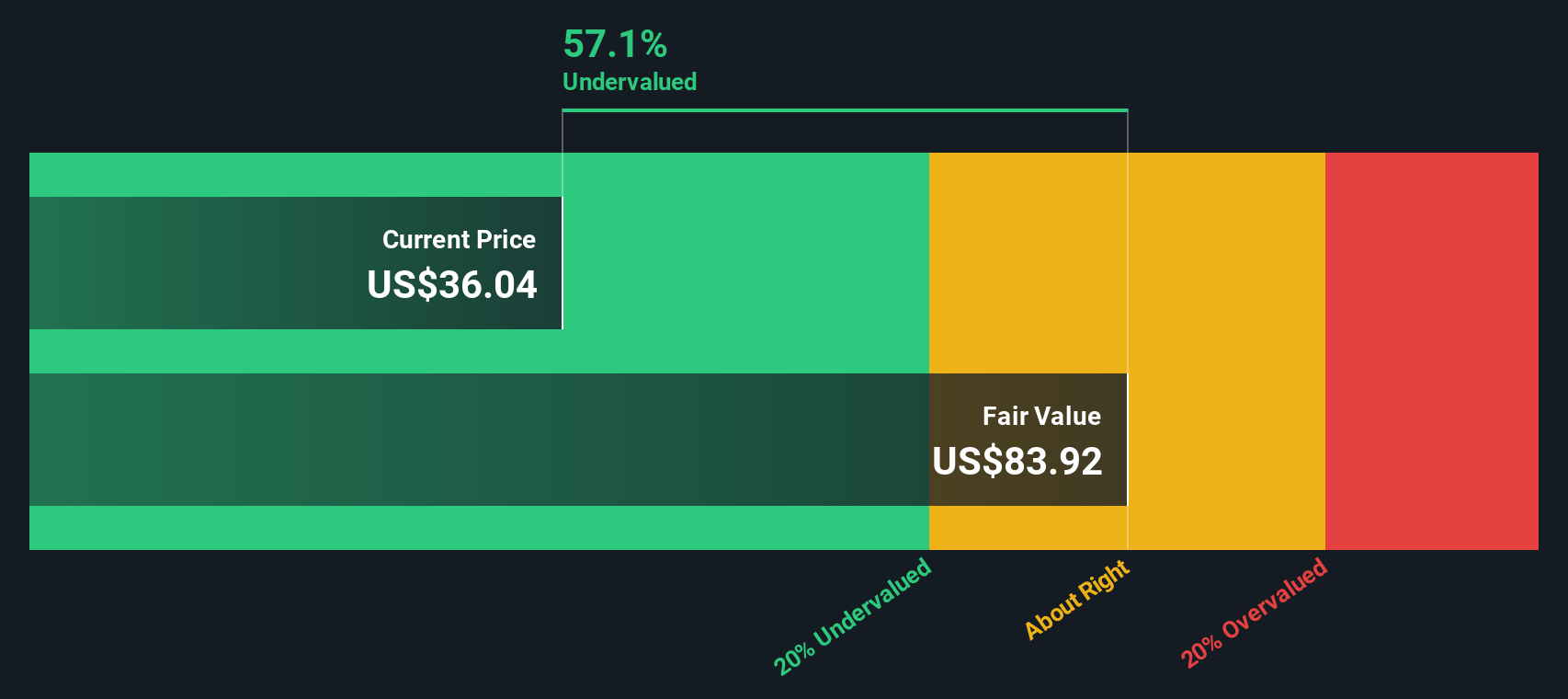

While analysts see upside based on future earnings growth and market multiples, our DCF model takes a different approach. According to our DCF model, Veracyte’s shares are trading at a steep 57.7% discount to their estimated fair value. Such a large gap highlights potential opportunity, but also raises questions. Do you trust the growth forecasts enough to bridge it?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Veracyte Narrative

If you have a different perspective or want to investigate the numbers firsthand, you can quickly assemble your own narrative in just a few minutes. Do it your way

A great starting point for your Veracyte research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep options open. Level up your portfolio by checking out three powerful ways to spot value, growth, or fresh market trends right now.

- Uncover untapped potential with these 914 undervalued stocks based on cash flows featuring strong fundamentals and the possibility of a breakout.

- Catch the next wave of innovation by targeting these 23 AI penny stocks driving breakthroughs in artificial intelligence and emerging tech sectors.

- Supercharge your returns and enjoy steady payouts by considering these 19 dividend stocks with yields > 3% currently delivering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VCYT

Veracyte

Operates as a diagnostics company in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives