- United States

- /

- Biotech

- /

- NasdaqGM:VCEL

Is Vericel’s Rebound After FDA Updates a Sign the Market Sees More Value?

Reviewed by Bailey Pemberton

If you have been eyeing Vericel lately and wondering whether it’s time to buy, hold, or move on, you are definitely not alone. Over just the past month, the stock has surged nearly 14%, a dramatic rebound that stands in stark contrast to its year-to-date decline of 34.6%. That kind of movement can make anyone question what is really going on beneath the surface.

For context, Vericel recently grabbed headlines with FDA updates on its cell therapy pipeline, sparking renewed enthusiasm among growth-focused investors. Longer-term, its five-year return of 77.2% shows that this is a company with staying power, even if its one-year and YTD numbers look tough. The sharp uptick in the past week (up 4%) hints that the market could be rethinking the company’s prospects and possibly shifting its perception of risk.

But as exciting as these price moves and news stories are, the real question you probably want answered is whether Vericel is actually undervalued right now, or if the recent bounce is just short-term noise. Using a six-point valuation framework, Vericel currently scores a 3, signaling it is undervalued in half the key ways analysts use to judge fair value. Of course, numbers never tell the whole story on their own.

Let’s break down each of these valuation approaches to see what’s really driving that score. Keep reading, because we will end the article with a perspective that might give you an even clearer way to judge if Vericel is worth your hard-earned investment dollars.

Why Vericel is lagging behind its peers

Approach 1: Vericel Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company’s future free cash flows and then discounts those amounts back to today’s value, aiming to estimate what the business is intrinsically worth. This approach helps investors decide if a stock’s market price makes sense relative to its projected ability to generate cash in the future.

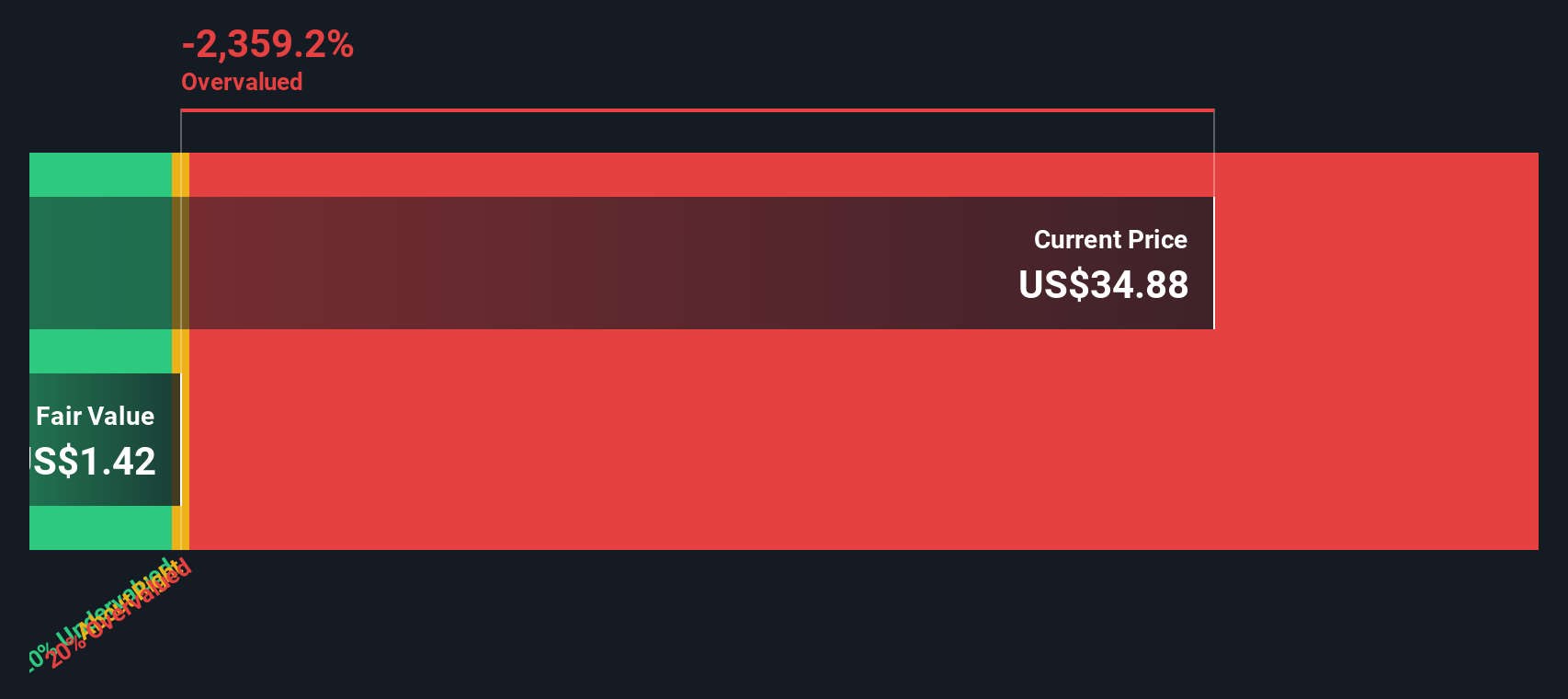

For Vericel, the latest twelve months free cash flow sits at $4.98 million. Analyst estimates predict the company’s cash flows will fluctuate over the coming decade, with projections for 2026 at $4.13 million, which then gradually trends lower. This may indicate cautious growth or operational constraints. These forecasts only extend five years out via analysts, so numbers beyond that are extrapolated. By 2035, the model estimates annual free cash flow around $3.43 million (discounted to $1.76 million in today’s dollars).

Putting these cash flow projections together, the DCF model estimates Vericel’s intrinsic value at $1.42 per share. Compared with the current market price, that suggests Vericel is trading at a hefty 2,439.7% premium to its underlying cash flow value, meaning the stock appears dramatically overvalued on this measure.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Vericel may be overvalued by 2439.7%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Vericel Price vs Sales

The Price-to-Sales (P/S) ratio is often the preferred metric for valuing companies like Vericel. It is especially useful for growth-focused businesses that may not yet be consistently profitable but are generating meaningful revenue. This ratio allows investors to gauge how much they are paying for each dollar of revenue, providing a useful benchmark even when earnings are volatile or minimal.

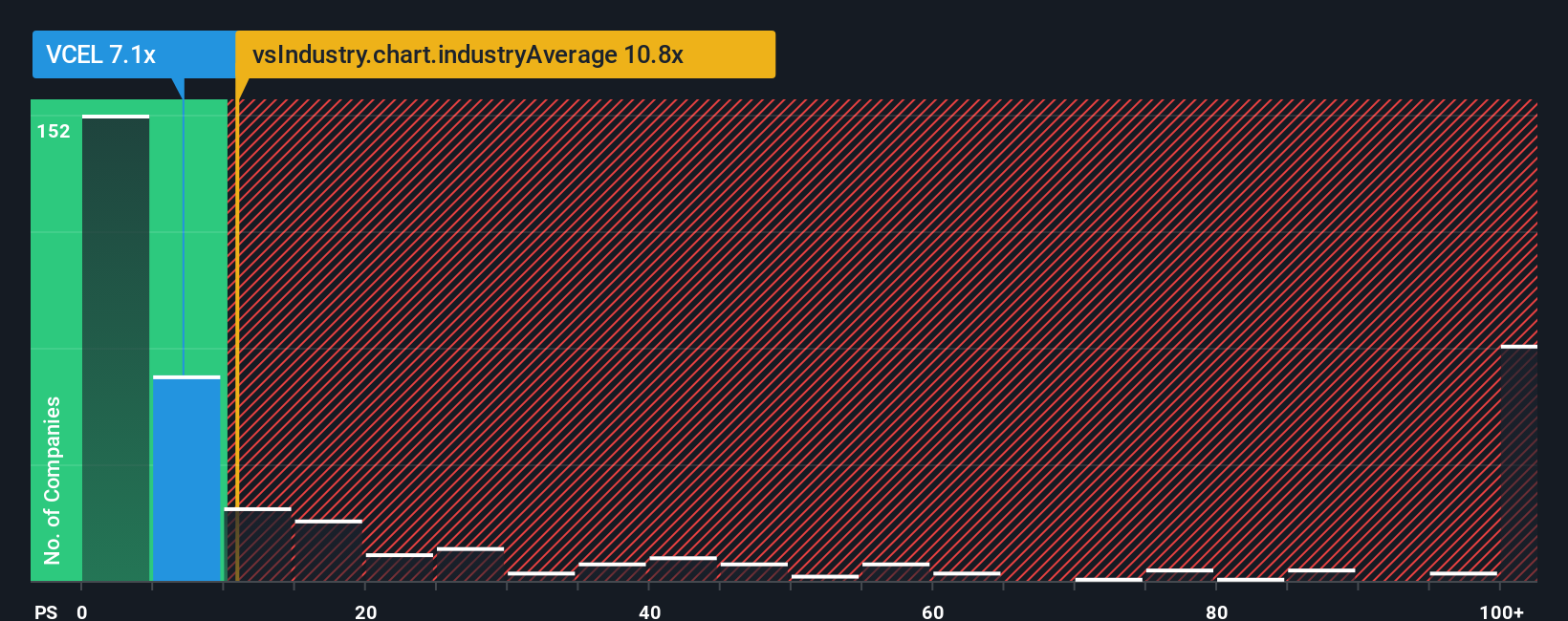

Typically, a company’s P/S ratio reflects growth expectations and the degree of perceived risk. Higher ratios suggest that investors expect strong revenue growth or industry-leading margins, while lower ratios may signal caution. For Vericel, the current P/S ratio stands at 7.3x. This is below the Biotechs industry average of 11.3x and the peer average of 16.5x. This suggests the market is pricing Vericel more conservatively than many of its competitors.

To get a sharper read, we use Simply Wall St’s Fair Ratio, a proprietary measure that adjusts the “right” P/S multiple for factors such as Vericel’s earnings growth, industry, profit margin, market cap, and risks. This Fair Ratio is 6.0x. Unlike broad peer or industry averages, the Fair Ratio tries to tailor the benchmark to Vericel’s unique profile, reflecting its risk-return tradeoff and company-specific fundamentals.

Comparing the Fair Ratio of 6.0x with Vericel’s actual P/S of 7.3x, the difference suggests the stock is trading at a moderate premium to its fundamental value based on revenue. While not wildly excessive, this does point to modest overvaluation at current prices.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vericel Narrative

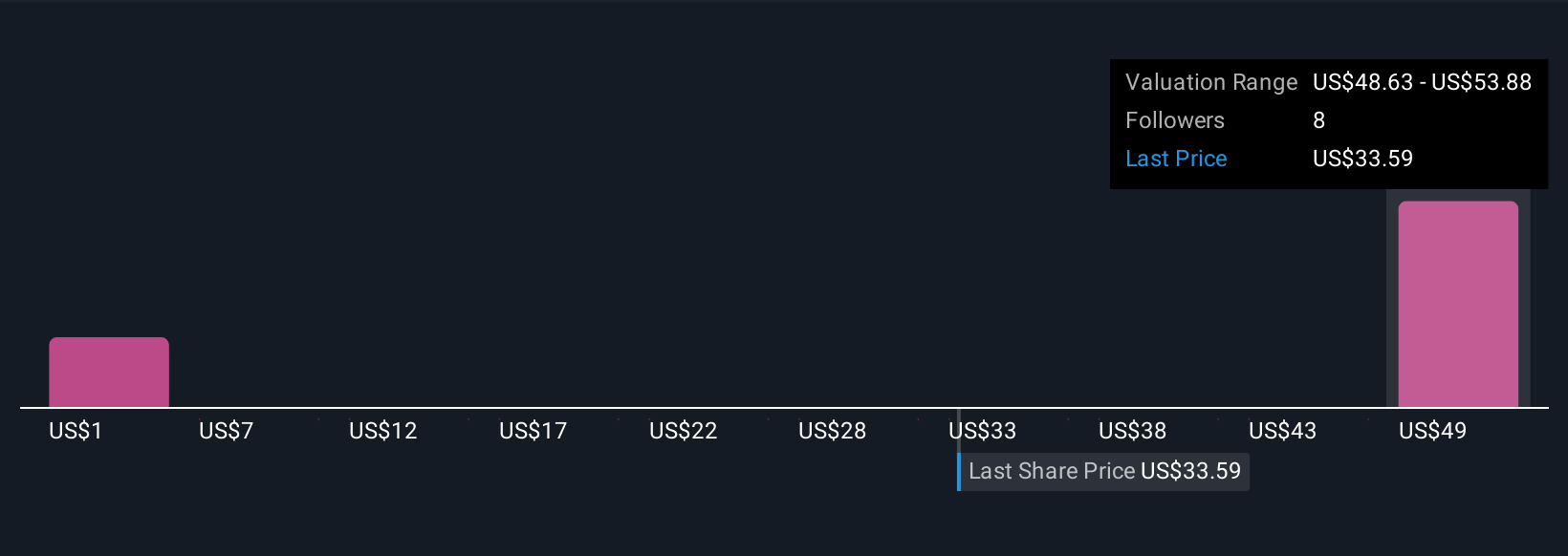

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Put simply, a Narrative is your story about a company, blending your perspective on its future prospects with the numbers behind its financial forecasts, such as fair value estimates, revenue growth, and profit margins. Narratives connect the why (your view of Vericel’s business drivers, risks, and opportunities) with the what (future earnings and a calculated fair value), creating a powerful lens for investment decision making.

On Simply Wall St’s Community page, used by millions of investors, Narratives serve as a dynamic and approachable tool to guide your investment choices. With Narratives, you can compare your own fair value estimate of Vericel to the current share price to help decide whether it might be the right time to buy or sell. In addition, these Narratives are continually updated as new developments, such as earnings releases or regulatory changes, are announced, so your viewpoint remains relevant and informed in real time.

For example, some investors see Vericel’s expanding regenerative therapy portfolio and aggressive surgeon network growth as the foundation for a high price target and strong upside, while others focus on reimbursement uncertainties and narrow product focus to support a more cautious view, setting their fair value much lower. Your Narrative turns all the latest data and your beliefs into a clear, actionable investment picture, and it is just a click away.

Do you think there's more to the story for Vericel? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VCEL

Vericel

A commercial-stage biopharmaceutical company, engages in the research, development, manufacture, and distribution of cellular therapies and specialty biologic products for sports medicine and severe burn care markets in North America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives