- United States

- /

- Biotech

- /

- NasdaqGS:UTHR

The Bull Case For United Therapeutics (UTHR) Could Change Following Positive TETON-2 Results for Tyvaso in IPF

Reviewed by Simply Wall St

- United Therapeutics recently announced that its phase 3 TETON-2 trial showed nebulized Tyvaso significantly improved lung function for patients with idiopathic pulmonary fibrosis compared to placebo over 52 weeks.

- The trial’s positive outcomes were observed across all major patient subgroups, including those on existing therapies, highlighting Tyvaso's potential to fulfill a pressing unmet need in IPF treatment.

- We'll explore how the successful TETON-2 results for Tyvaso may expand United Therapeutics’ addressable market and future growth prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

United Therapeutics Investment Narrative Recap

Owning United Therapeutics stock means believing in the company’s ability to successfully expand beyond its current pulmonary focus and deliver innovations that unlock new market opportunities, like the IPF space. The landmark TETON-2 results for Tyvaso address the most important short-term catalyst by signaling potential regulatory advancements, but competitive risks from branded and generic rivals continue to loom as a key challenge for the business.

The company’s recent $1 billion share repurchase authorization stands out, especially amid a period of strong clinical milestones. Buybacks could offset some volatility from major trial outcomes, helping to reinforce shareholder confidence as pivotal study readouts, like TETON-2, reshape the company’s growth story.

Yet, despite promising trial data, risks tied to the threat of generics and physician adoption trends remain information that investors should be aware of...

Read the full narrative on United Therapeutics (it's free!)

United Therapeutics' narrative projects $3.7 billion in revenue and $1.5 billion in earnings by 2028. This requires 6.6% yearly revenue growth and a $0.3 billion increase in earnings from the current level of $1.2 billion.

Uncover how United Therapeutics' forecasts yield a $456.82 fair value, a 15% upside to its current price.

Exploring Other Perspectives

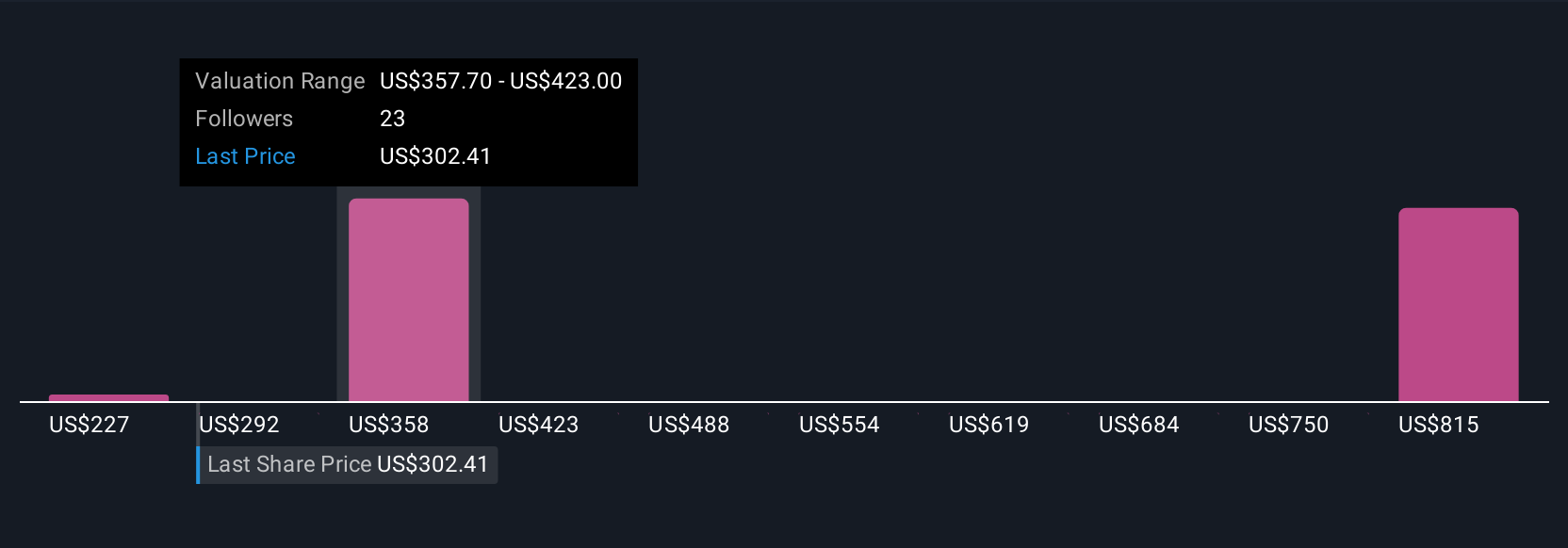

Five individual fair value estimates from the Simply Wall St Community range from US$227 to US$1,264 per share, showing broad differences in expectations. While several community members expect meaningful upside, potential long-term competition and shifting treatment options remain crucial for future company performance.

Explore 5 other fair value estimates on United Therapeutics - why the stock might be worth over 3x more than the current price!

Build Your Own United Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Therapeutics research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free United Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Therapeutics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UTHR

United Therapeutics

A biotechnology company, engages in the development and commercialization of products to address the unmet medical needs of patients with chronic and life-threatening diseases in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives