- United States

- /

- Biotech

- /

- NasdaqGS:UTHR

Positive TETON-2 Phase 3 Results Could Be a Game Changer for United Therapeutics (UTHR)

Reviewed by Simply Wall St

- United Therapeutics recently held a webcast to review data from the successful TETON-2 Phase 3 study, which evaluated nebulized Tyvaso (treprostinil) Inhalation Solution for idiopathic pulmonary fibrosis and showed significant improvements in forced vital capacity compared to placebo across a 597-patient, multi-country trial.

- An important insight is that this clinical success could potentially expand Tyvaso’s use into new therapeutic areas, reinforcing the company’s commitment to advancing care for chronic and life-threatening pulmonary diseases.

- We'll look at how these positive TETON-2 trial results for Tyvaso may shift the investment outlook for United Therapeutics.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

United Therapeutics Investment Narrative Recap

To own shares of United Therapeutics, you need to believe in its ability to expand Tyvaso beyond pulmonary arterial hypertension, tapping into new markets like idiopathic pulmonary fibrosis (IPF), while maintaining its lead in the face of increasing competition and innovation risk. The positive TETON-2 Phase 3 results for Tyvaso are a key short-term catalyst and materially reduce the risk of clinical failure in IPF, though competition and payer scrutiny remain central threats in the near term.

Among the recent updates, the June 23 announcement that enrollment was completed for the ADVANCE OUTCOMES study on ralinepag aligns closely with the company's strategy to extend its portfolio in pulmonary diseases. If future clinical milestones such as these are successful, they could support ongoing revenue growth and offset risks related to pipeline concentration.

Importantly, though, investors should also be aware that despite clinical momentum, the threat from branded and generic competitors like Liquidia could quickly affect Tyvaso's pricing power and revenue if...

Read the full narrative on United Therapeutics (it's free!)

United Therapeutics is projected to reach $3.7 billion in revenue and $1.5 billion in earnings by 2028. This outlook assumes a yearly revenue growth rate of 6.6% and represents a $300 million increase in earnings from the current $1.2 billion.

Uncover how United Therapeutics' forecasts yield a $466.82 fair value, a 12% upside to its current price.

Exploring Other Perspectives

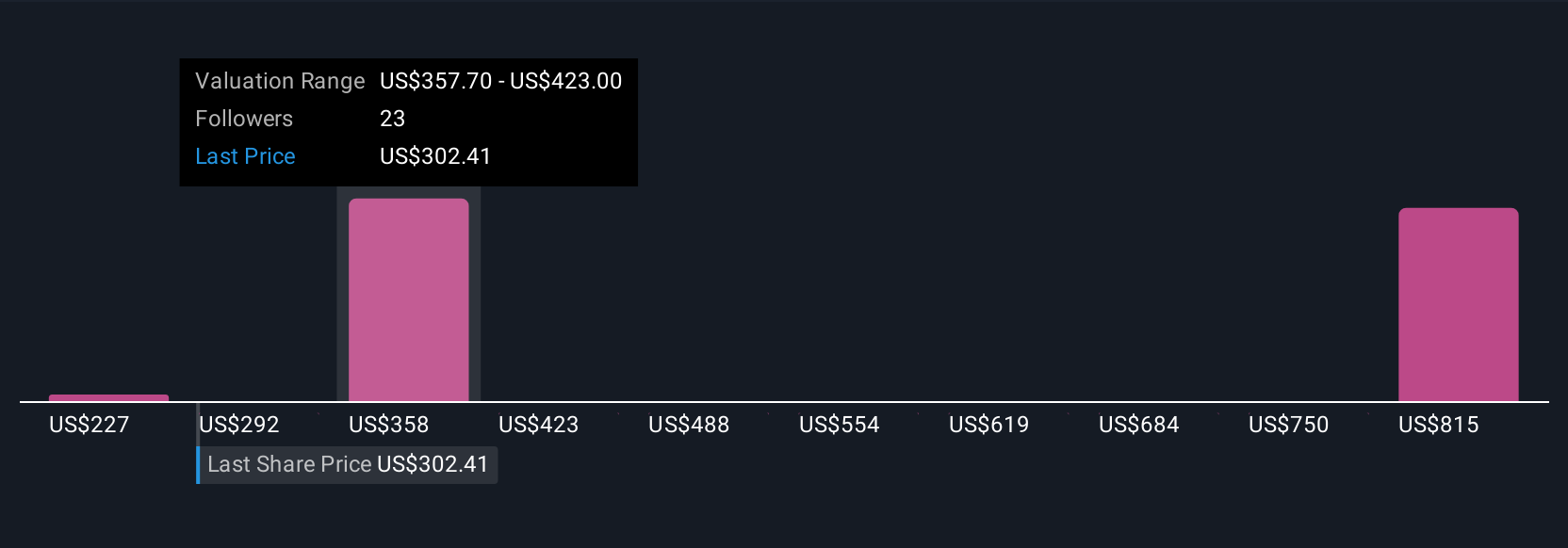

Five fair value estimates from the Simply Wall St Community range widely from US$227 to US$1,264. Some see extreme undervaluation while others do not. Opinions on competition and innovation highlight how much future performance depends on market share and keeping pipeline risks in check.

Explore 5 other fair value estimates on United Therapeutics - why the stock might be worth over 3x more than the current price!

Build Your Own United Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Therapeutics research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free United Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Therapeutics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UTHR

United Therapeutics

A biotechnology company, engages in the development and commercialization of products to address the unmet medical needs of patients with chronic and life-threatening diseases in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives