- United States

- /

- Biotech

- /

- NasdaqGS:UTHR

How Positive TETON-2 Results for Tyvaso Have Changed United Therapeutics' (UTHR) Investment Story

Reviewed by Sasha Jovanovic

- United Therapeutics recently announced positive results from the TETON-2 phase 3 study, showing that nebulized Tyvaso® significantly improved lung function in patients with idiopathic pulmonary fibrosis (IPF) compared to placebo.

- These findings position Tyvaso as a potential new treatment option for IPF and highlight advances in United Therapeutics' pulmonary disease pipeline.

- We'll explore how the strong TETON-2 data readout could reshape United Therapeutics' investment narrative and long-term market opportunity.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

United Therapeutics Investment Narrative Recap

To feel comfortable as a United Therapeutics shareholder, you need to believe in the company’s ability to expand the Tyvaso franchise beyond pulmonary arterial hypertension and into new indications like idiopathic pulmonary fibrosis (IPF). The strong TETON-2 results could unlock a major new market and support long-term revenue growth, but also set up high expectations for upcoming trial readouts. However, the biggest short-term risk around generic and branded competition remains present, and the TETON-2 news does not change this materially.

Given this context, United Therapeutics' recent $1 billion share repurchase program stands out. The buyback provides capital flexibility and can help counteract near-term pressures as the company awaits pivotal trial milestones and manages potential headwinds in its core PAH and pulmonary product lines.

But in contrast, investors should be aware that market share erosion from rising generic and branded alternatives could still impact future earnings power, especially if...

Read the full narrative on United Therapeutics (it's free!)

United Therapeutics is projected to reach $3.7 billion in revenue and $1.5 billion in earnings by 2028. This outlook assumes annual revenue growth of 6.6% and an increase in earnings of $0.3 billion from the current $1.2 billion.

Uncover how United Therapeutics' forecasts yield a $484.77 fair value, a 9% upside to its current price.

Exploring Other Perspectives

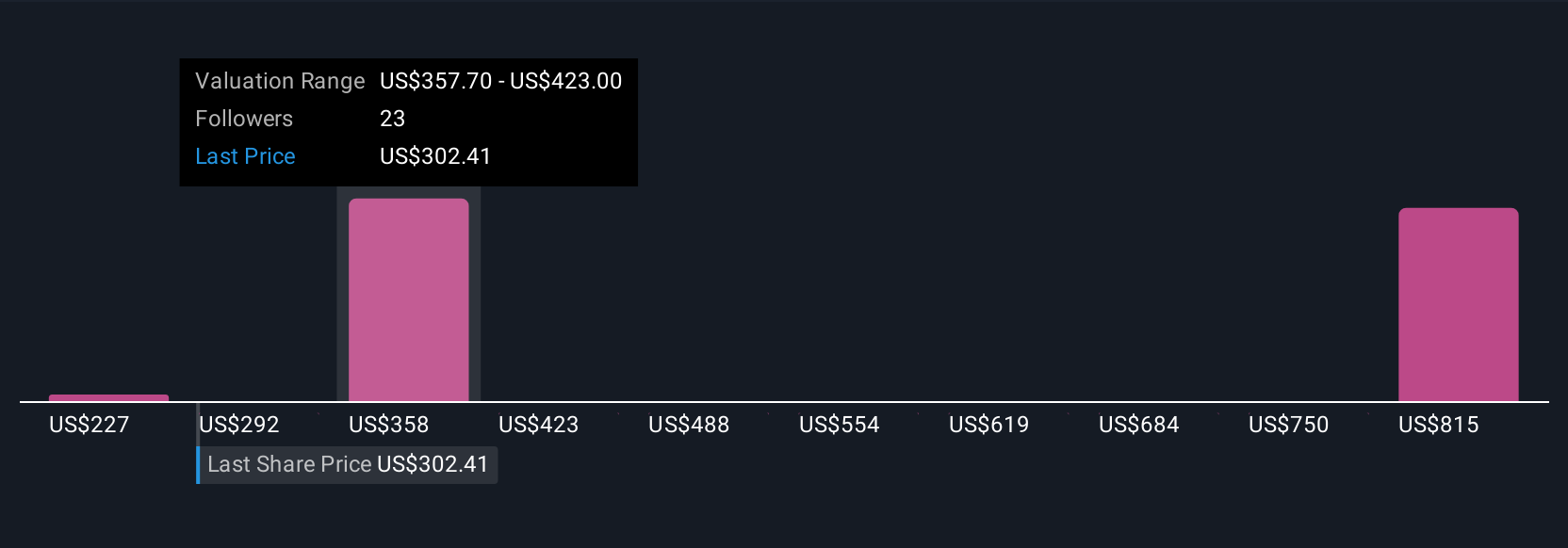

Five Simply Wall St Community members estimate United Therapeutics’ fair value between US$227 and US$1,291 per share. Opinions vary widely, especially as the TETON-2 catalyst could increase the company’s addressable market and shift overall expectations.

Explore 5 other fair value estimates on United Therapeutics - why the stock might be worth 49% less than the current price!

Build Your Own United Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Therapeutics research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free United Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Therapeutics' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UTHR

United Therapeutics

A biotechnology company, engages in the development and commercialization of products to address the unmet medical needs of patients with chronic and life-threatening diseases in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives