- United States

- /

- Biotech

- /

- NasdaqGS:UTHR

Are United Therapeutics Shares Attractive After Recent FDA Approval Boosts Confidence?

Reviewed by Bailey Pemberton

If you have been eyeing United Therapeutics, you are definitely not alone. Investors are watching closely as this innovative biotech's stock continues its dynamic run. After a brief dip of 2.8% in the last week, United Therapeutics has bounced back impressively, gaining 8.7% in the last month and delivering a remarkable 20.1% return so far this year. Those who held the stock longer term have enjoyed even greater rewards, with shares up 16.1% over the past twelve months and an outstanding 100.5% over three years. Looking at the big picture, United Therapeutics has surged 254.4% in the past five years, cementing its reputation as a high-performing growth story in the biotech sector.

What has been driving these moves? Some recent market developments in the pharmaceutical space, combined with positive sentiment around United Therapeutics' pipeline and regulatory environment, have added fresh energy to the stock. Investors seem to be recalibrating risk and growth potential, and the market is rewarding that optimism.

But here is where it gets particularly interesting. When we look at various valuation checks, United Therapeutics scores a solid 5 out of 6 for being considered undervalued. That puts it firmly on the watch list for value-focused investors hunting for quality growth at a reasonable price. In the next section, we will dive into the specific valuation methods analysts use and see how United Therapeutics stacks up. Just when you think you have seen it all, a more holistic approach to valuation will be introduced that might provide the clearest picture yet.

Approach 1: United Therapeutics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting those amounts back to today's dollars. This method offers an objective way to size up growth stocks like United Therapeutics, especially when near-term profits are not the only value drivers.

Currently, United Therapeutics generates $1.09 billion in free cash flow. Analysts project this figure to grow to around $1.98 billion by 2029. The model uses a two-stage approach, applying analyst estimates for the next five years, then longer-range extrapolations based on expected growth rates provided by Simply Wall St. This frames a scenario where United Therapeutics is expected to deliver increasingly higher annual cash flows, reflecting confidence in its business momentum and pipeline.

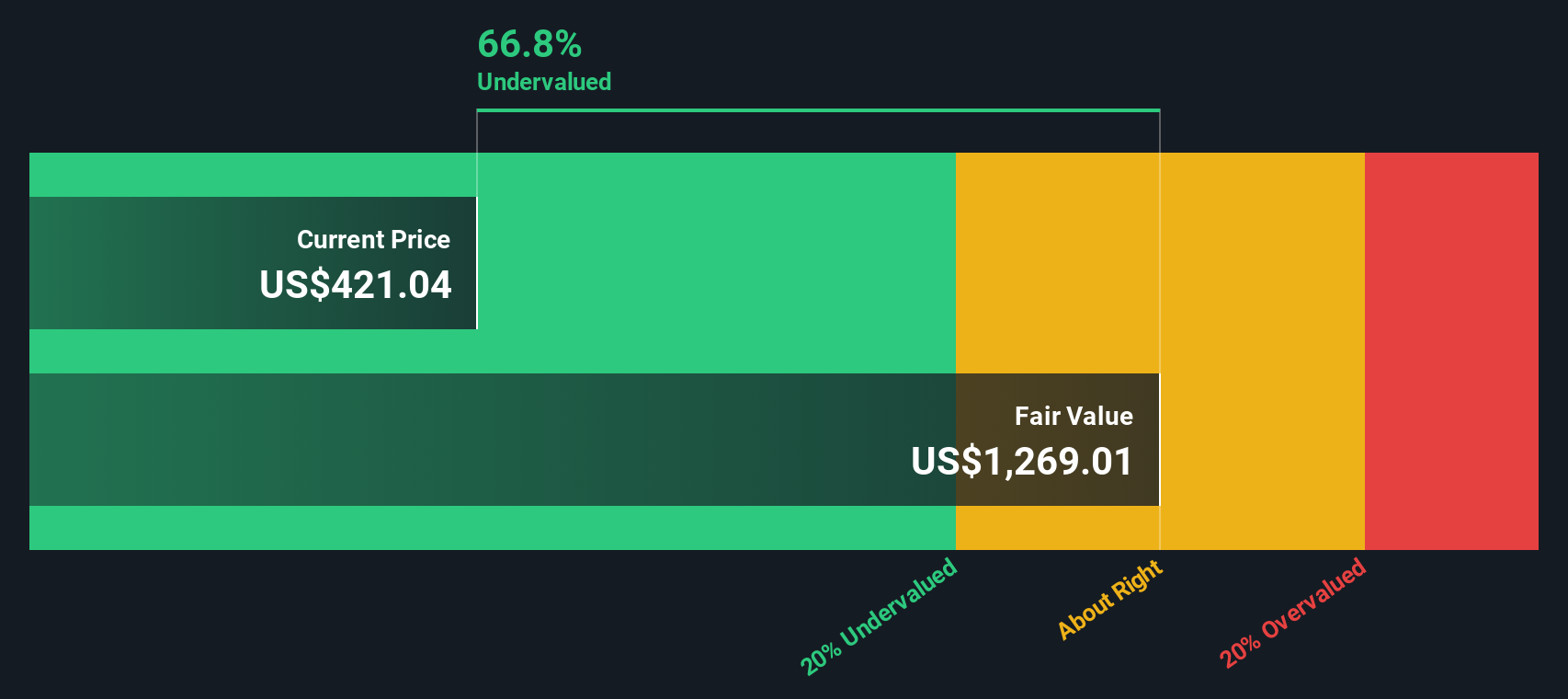

According to this DCF calculation, the fair value per share works out to $1,279.81. Compared to the current share price, this suggests the stock is trading at a 66.2% discount. In other words, United Therapeutics appears significantly undervalued based on this forward-looking cash flow analysis, which may interest value-oriented investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests United Therapeutics is undervalued by 66.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: United Therapeutics Price vs Earnings

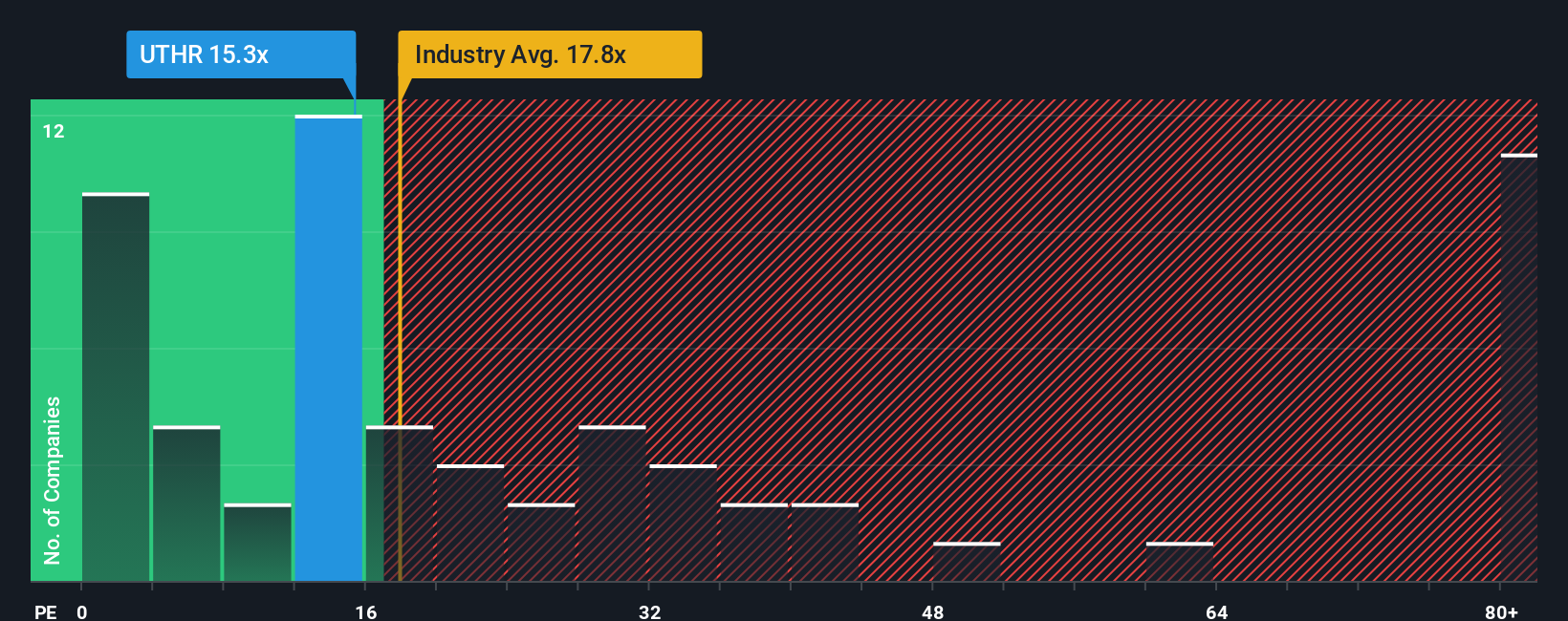

For profitable companies like United Therapeutics, the Price-to-Earnings (PE) ratio is a classic way to gauge valuation. This metric essentially reveals how much investors are willing to pay for each dollar of earnings, making it especially relevant when current profits are meaningful and reliable.

Whether a particular PE ratio is fair depends on prospects for growth, sector risks, and general market sentiment. Rapidly growing, resilient businesses often trade at higher PE ratios because investors are willing to pay a premium for future earnings power, while riskier or slower-growing firms warrant lower valuations.

United Therapeutics currently trades at a PE ratio of 15.8x, which sits just below the biotech industry average of 16.6x and noticeably under the peer group average of 22x. However, Simply Wall St's proprietary Fair Ratio for United Therapeutics is calculated at 22.7x. This Fair Ratio adjusts for details the simple industry average can miss, including the company’s distinctive earnings trajectory, risk profile, profitability, market cap, and broader industry characteristics.

Comparing to the Fair Ratio changes the picture. United Therapeutics is trading at a clear discount relative to what would be expected given its fundamentals. By incorporating company-specific insights, the Fair Ratio offers a much more holistic benchmark than the simple PE averages.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your United Therapeutics Narrative

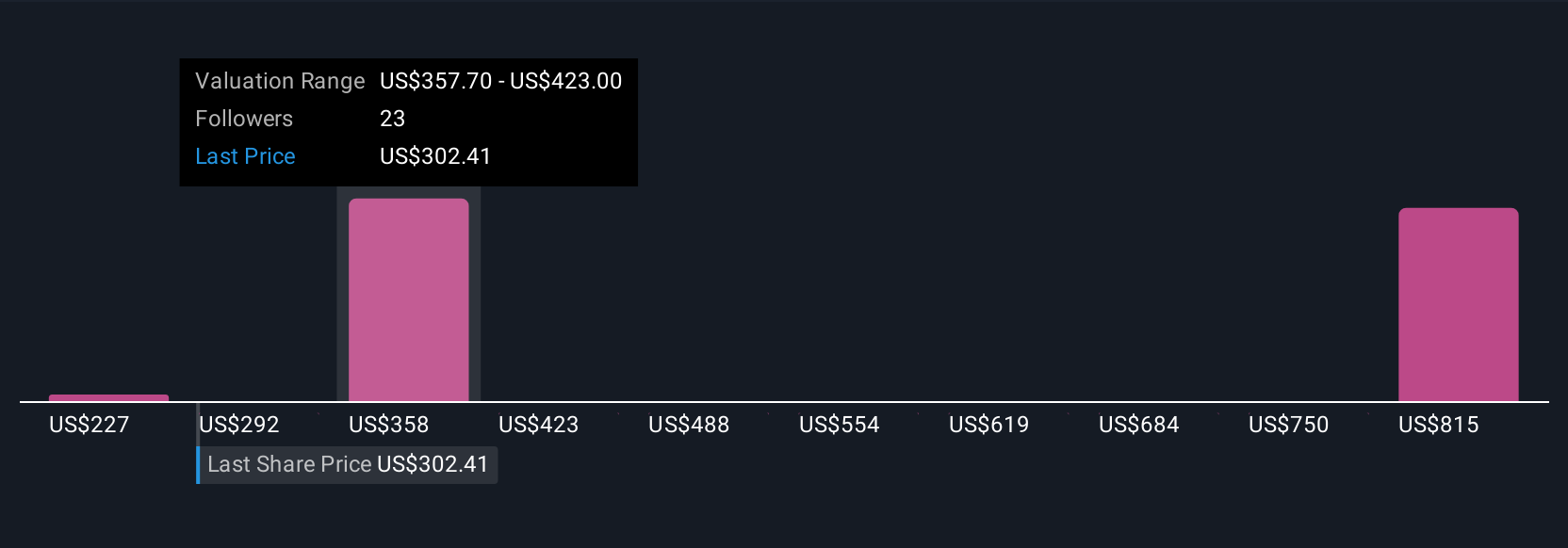

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple way for you to combine your own story or perspective about a company, such as where you think United Therapeutics is heading or what might drive its success or challenges, with your financial forecasts and estimated fair value.

Rather than focusing on just one number, Narratives link your view of the business to a forecast of future revenue, earnings, and margins. This approach ultimately produces a fair value that reflects your assumptions and reasoning. Narratives are easy and accessible to use on Simply Wall St's Community page, where millions of investors share and update their own stories for companies like United Therapeutics.

By comparing your Narrative’s Fair Value to the current price, you can decide whether you think United Therapeutics is a buy, hold, or sell. This makes your investment decisions more transparent and personal. The best part is Narratives are dynamic and automatically update whenever new information, such as earnings or significant news, emerges in the market.

For example, among investors building Narratives for United Therapeutics, some expect strong revenue growth from new therapies and see fair value as high as $575 per share. Others, who are more cautious about competition and clinical trial risks, put fair value at just $321. This shows how your investment decisions can reflect your unique view of the future.

Do you think there's more to the story for United Therapeutics? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UTHR

United Therapeutics

A biotechnology company, engages in the development and commercialization of products to address the unmet medical needs of patients with chronic and life-threatening diseases in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives