- United States

- /

- Biotech

- /

- NasdaqGM:URGN

UroGen Pharma Ltd.'s (NASDAQ:URGN) Share Price Boosted 35% But Its Business Prospects Need A Lift Too

UroGen Pharma Ltd. (NASDAQ:URGN) shareholders would be excited to see that the share price has had a great month, posting a 35% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 42%.

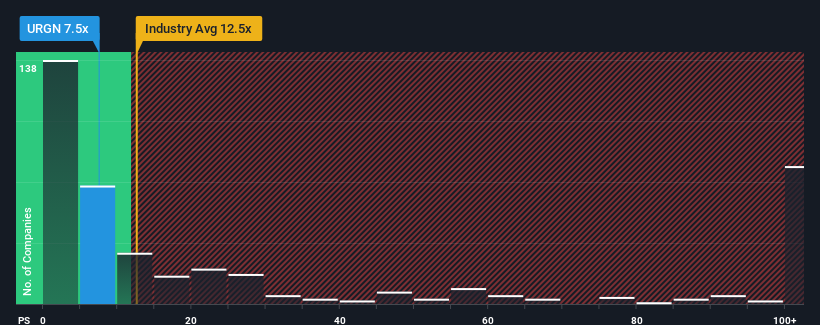

Although its price has surged higher, UroGen Pharma may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 7.5x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 12.5x and even P/S higher than 68x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for UroGen Pharma

How UroGen Pharma Has Been Performing

Recent times haven't been great for UroGen Pharma as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think UroGen Pharma's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, UroGen Pharma would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 24% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 46% each year as estimated by the five analysts watching the company. With the industry predicted to deliver 208% growth each year, the company is positioned for a weaker revenue result.

With this information, we can see why UroGen Pharma is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

The latest share price surge wasn't enough to lift UroGen Pharma's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of UroGen Pharma's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

You need to take note of risks, for example - UroGen Pharma has 5 warning signs (and 2 which are concerning) we think you should know about.

If these risks are making you reconsider your opinion on UroGen Pharma, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:URGN

UroGen Pharma

Engages in the development and commercialization of solutions for urothelial and specialty cancers.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives