- United States

- /

- Pharma

- /

- NasdaqGS:TXMD

TherapeuticsMD (NASDAQ:TXMD) Share Prices Have Dropped 87% In The Last Five Years

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We really hate to see fellow investors lose their hard-earned money. Anyone who held TherapeuticsMD, Inc. (NASDAQ:TXMD) for five years would be nursing their metaphorical wounds since the share price dropped 87% in that time. We also note that the stock has performed poorly over the last year, with the share price down 50%. It's down 8.3% in the last seven days.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for TherapeuticsMD

TherapeuticsMD isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, TherapeuticsMD grew its revenue at 27% per year. That's better than most loss-making companies. So on the face of it we're really surprised to see the share price has averaged a fall of 13% each year, in the same time period. You'd have to assume the market is worried that profits won't come soon enough. We'd recommend carefully checking for indications of future growth - and balance sheet threats - before considering a purchase.

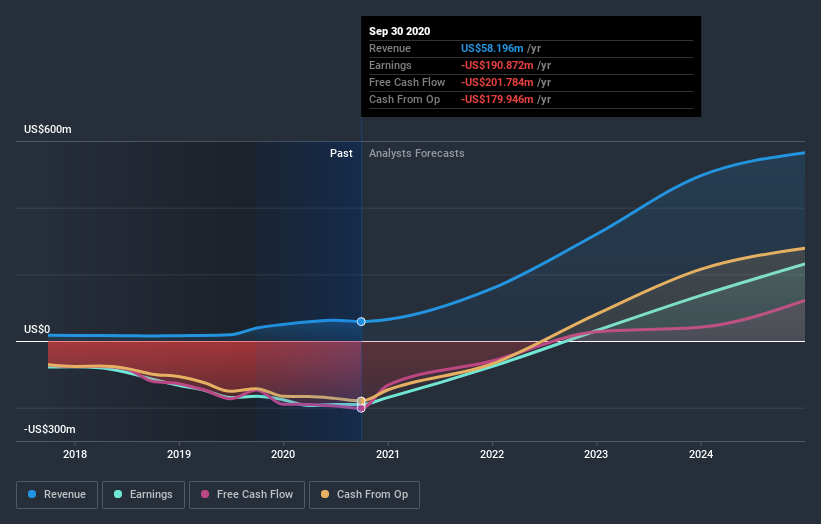

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for TherapeuticsMD in this interactive graph of future profit estimates.

A Different Perspective

TherapeuticsMD shareholders are down 50% for the year, but the market itself is up 26%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 13% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with TherapeuticsMD , and understanding them should be part of your investment process.

TherapeuticsMD is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade TherapeuticsMD, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TherapeuticsMD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:TXMD

TherapeuticsMD

Operates as a pharmaceutical royalty company in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives