- United States

- /

- Pharma

- /

- NasdaqGS:TXMD

Introducing TherapeuticsMD (NASDAQ:TXMD), The Stock That Dropped 17% In The Last Five Years

TherapeuticsMD, Inc. (NASDAQ:TXMD) shareholders will doubtless be very grateful to see the share price up 51% in the last quarter. But if you look at the last five years the returns have not been good. In fact, the share price is down 17%, which falls well short of the return you could get by buying an index fund.

View our latest analysis for TherapeuticsMD

TherapeuticsMD isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

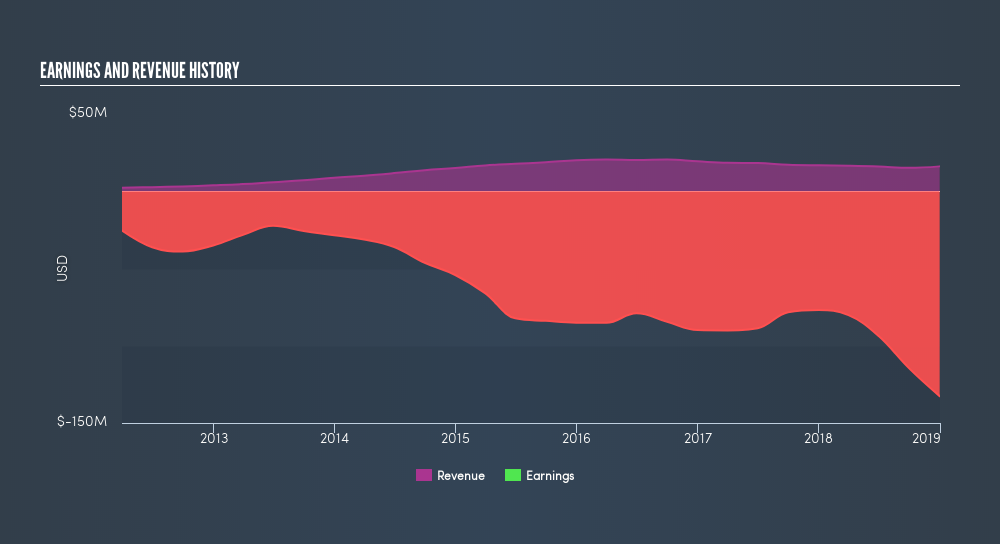

Over five years, TherapeuticsMD grew its revenue at 5.8% per year. That's not a very high growth rate considering it doesn't make profits. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 3.7% (annualized) in the same time frame. Investors should consider how bad the losses are, and whether the company can make it to profitability with ease. Shareholders will want the company to approach profitability if it can't grow revenue any faster.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

You can see how its balance sheet has strengthened (or weakened) over time in this freeinteractive graphic.

A Different Perspective

It's good to see that TherapeuticsMD has rewarded shareholders with a total shareholder return of 5.2% in the last twelve months. Notably the five-year annualised TSR loss of 3.7% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

But note: TherapeuticsMD may not be the best stock to buy. So take a peek at this freelist of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:TXMD

TherapeuticsMD

Operates as a pharmaceutical royalty company in the United States.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026