- United States

- /

- Pharma

- /

- NasdaqGS:TXMD

3 Promising US Penny Stocks With Over $9M Market Cap

Reviewed by Simply Wall St

As the U.S. stock market looks to recover from a recent losing streak, with major indices like the Dow Jones and Nasdaq showing signs of strength, investors are exploring diverse opportunities across various sectors. Penny stocks, though sometimes overlooked due to their historical connotations, remain a viable investment option when backed by strong financials. In this article, we explore three penny stocks that exhibit financial robustness and potential for growth, offering investors a chance to uncover hidden value in promising companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.11 | $1.85B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $110.4M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.838 | $5.59M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.58 | $9.9M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.3267 | $10.67M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.62 | $42.86M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.45 | $23.24M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.01 | $84.54M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.66 | $381.2M | ★★★★☆☆ |

Click here to see the full list of 726 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

23andMe Holding (NasdaqCM:ME)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: 23andMe Holding Co. is a consumer genetics testing company operating in the United States, the United Kingdom, Canada, and internationally, with a market cap of $83.97 million.

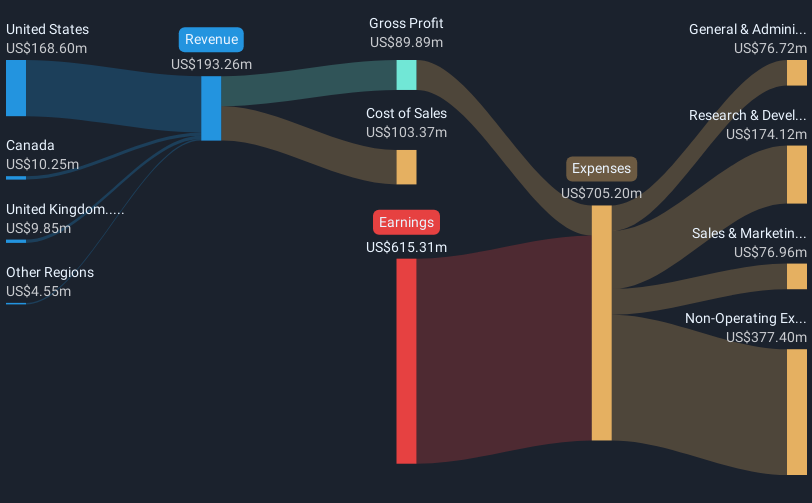

Operations: The company generates revenue of $193.26 million from its Consumer & Research Services segment.

Market Cap: $83.97M

23andMe Holding Co., with a market cap of US$83.97 million, faces significant challenges typical of penny stocks, including high volatility and recent shareholder dilution. The company is unprofitable, with earnings declining by 32.1% annually over the past five years. Despite having no debt and short-term assets exceeding liabilities, its cash runway is under a year due to negative free cash flow. Recent strategic shifts include discontinuing therapeutics development and exploring alternatives for these assets while forming new alliances like that with Mirador Therapeutics to leverage its extensive genetic database for precision medicine advancements.

- Unlock comprehensive insights into our analysis of 23andMe Holding stock in this financial health report.

- Gain insights into 23andMe Holding's historical outcomes by reviewing our past performance report.

TherapeuticsMD (NasdaqGS:TXMD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: TherapeuticsMD, Inc. operates as a pharmaceutical royalty company in the United States with a market cap of $9.92 million.

Operations: The company generates revenue of $1.60 million from creating and commercializing products targeted exclusively for women.

Market Cap: $9.92M

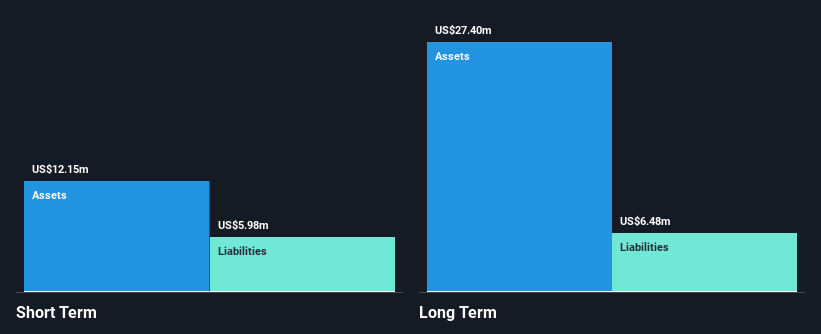

TherapeuticsMD, Inc., with a market cap of US$9.92 million, exemplifies the volatility and challenges associated with penny stocks. Despite being debt-free and having short-term assets of US$12.2 million exceeding both its short- and long-term liabilities, the company remains unprofitable, though it has significantly reduced losses over five years. Recent earnings reports show a narrowed net loss for the third quarter at US$0.609 million compared to US$3.38 million a year ago, reflecting improved financial management despite lacking meaningful revenue streams from its women's health products portfolio. The company's share price has been highly volatile recently, complicating investor sentiment further.

- Click here and access our complete financial health analysis report to understand the dynamics of TherapeuticsMD.

- Explore historical data to track TherapeuticsMD's performance over time in our past results report.

Eventbrite (NYSE:EB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Eventbrite, Inc. operates a two-sided marketplace offering self-service ticketing and marketing tools for event creators globally, with a market cap of approximately $325.52 million.

Operations: The company's revenue is primarily generated from its Internet Software & Services segment, totaling $336.37 million.

Market Cap: $325.52M

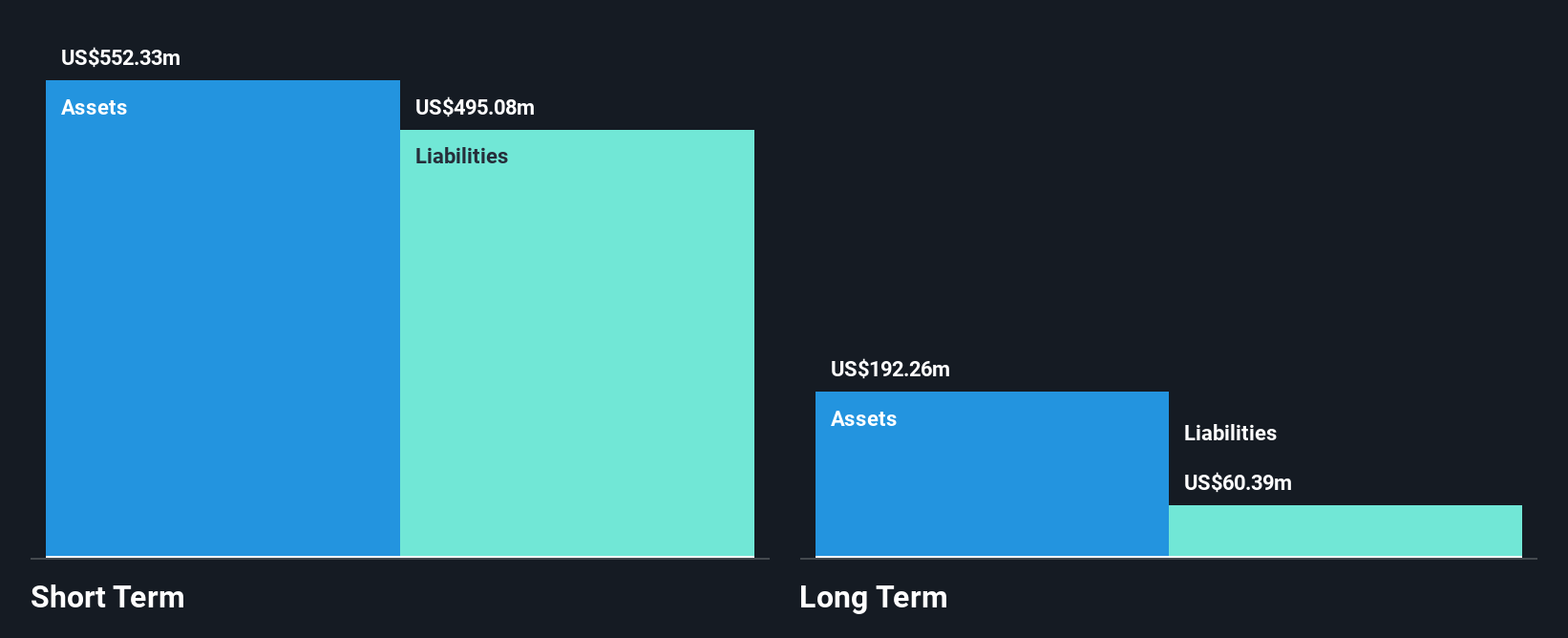

Eventbrite, Inc., with a market cap of US$325.52 million, faces the typical challenges and opportunities associated with penny stocks. While unprofitable, it has reduced losses significantly over the past five years and maintains sufficient cash runway for over three years. Recent financial results show a narrowed net loss of US$3.77 million for Q3 2024 compared to US$9.94 million in the previous year, indicating improved financial management. Despite insider selling and leadership changes, including appointing Anand Gandhi as CFO, Eventbrite continues its strategic transformation efforts while trading below its estimated fair value by 47.6%.

- Jump into the full analysis health report here for a deeper understanding of Eventbrite.

- Learn about Eventbrite's future growth trajectory here.

Where To Now?

- Unlock our comprehensive list of 726 US Penny Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TherapeuticsMD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXMD

TherapeuticsMD

Operates as a pharmaceutical royalty company in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives