- United States

- /

- Life Sciences

- /

- NasdaqGS:TXG

Investors Still Aren't Entirely Convinced By 10x Genomics, Inc.'s (NASDAQ:TXG) Revenues Despite 30% Price Jump

Those holding 10x Genomics, Inc. (NASDAQ:TXG) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 60% share price drop in the last twelve months.

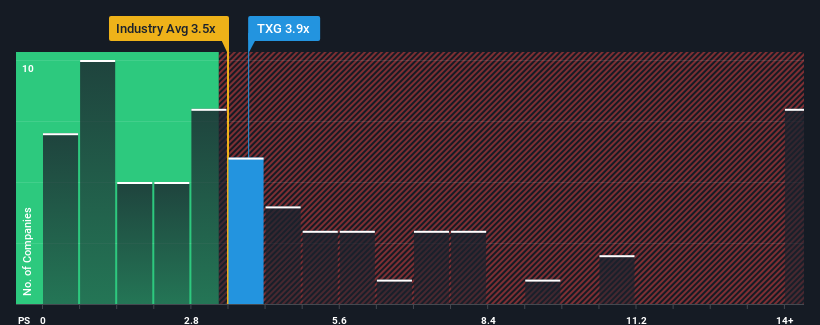

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about 10x Genomics' P/S ratio of 3.9x, since the median price-to-sales (or "P/S") ratio for the Life Sciences industry in the United States is also close to 3.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for 10x Genomics

How 10x Genomics Has Been Performing

Recent times have been pleasing for 10x Genomics as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting its current strong performance to taper off in accordance to the rest of the industry, which has kept the P/S contained. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on 10x Genomics will help you uncover what's on the horizon.How Is 10x Genomics' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like 10x Genomics' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. This was backed up an excellent period prior to see revenue up by 56% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 9.7% per year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 7.2% per year, which is noticeably less attractive.

With this in consideration, we find it intriguing that 10x Genomics' P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

10x Genomics' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite enticing revenue growth figures that outpace the industry, 10x Genomics' P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Plus, you should also learn about these 3 warning signs we've spotted with 10x Genomics.

If you're unsure about the strength of 10x Genomics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TXG

10x Genomics

A life science technology company, develops and sells instruments, consumables, and software for analyzing biological systems in the Americas, Europe, the Middle East, Africa, China, and the Asia Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives