- United States

- /

- Life Sciences

- /

- NasdaqGS:TXG

10x Genomics (TXG) Is Up 8.7% After Return to Profit and Tariff-Driven Sales Surge

Reviewed by Simply Wall St

- 10x Genomics, Inc. reported second quarter 2025 earnings earlier this month, posting revenue of US$172.91 million and a return to net profitability compared with a net loss in the same period last year.

- The company noted that its revenue guidance for the upcoming quarter reflects accelerated purchases from customers in China anticipating possible tariff changes, highlighting how regulatory factors can shift demand and impact reported results.

- We'll explore how 10x Genomics's return to profitability and insights on tariff-driven buying could influence the company's investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

10x Genomics Investment Narrative Recap

To invest in 10x Genomics, you need to believe in the expanding role of single-cell and spatial genomics in research and precision medicine, as well as the company's ability to monetize innovation with high-volume consumables. The Q2 earnings beat and swing to profitability are positive, but the larger story hinges on sustainable demand rather than temporary boosts, especially since tariff-related customer acceleration in China clouds the short-term outlook. Macroeconomic and funding headwinds remain the most pressing risk for future revenue consistency.

One of the most relevant updates linked to these results is management's Q3 revenue guidance, which explicitly cited US$4 million in Chinese customer purchases pulled forward due to tariff concerns. This move highlights how external policy changes can distort reported growth and create visibility challenges for ongoing sales momentum.

But despite the apparent sales outperformance, investors should be aware that revenue growth can be temporarily inflated by one-off factors like...

Read the full narrative on 10x Genomics (it's free!)

10x Genomics is projected to reach $688.4 million in revenue and $97.6 million in earnings by 2028. This scenario assumes annual revenue growth of 2.2% and an earnings increase of $182.2 million from current earnings of -$84.6 million.

Uncover how 10x Genomics' forecasts yield a $15.08 fair value, a 13% upside to its current price.

Exploring Other Perspectives

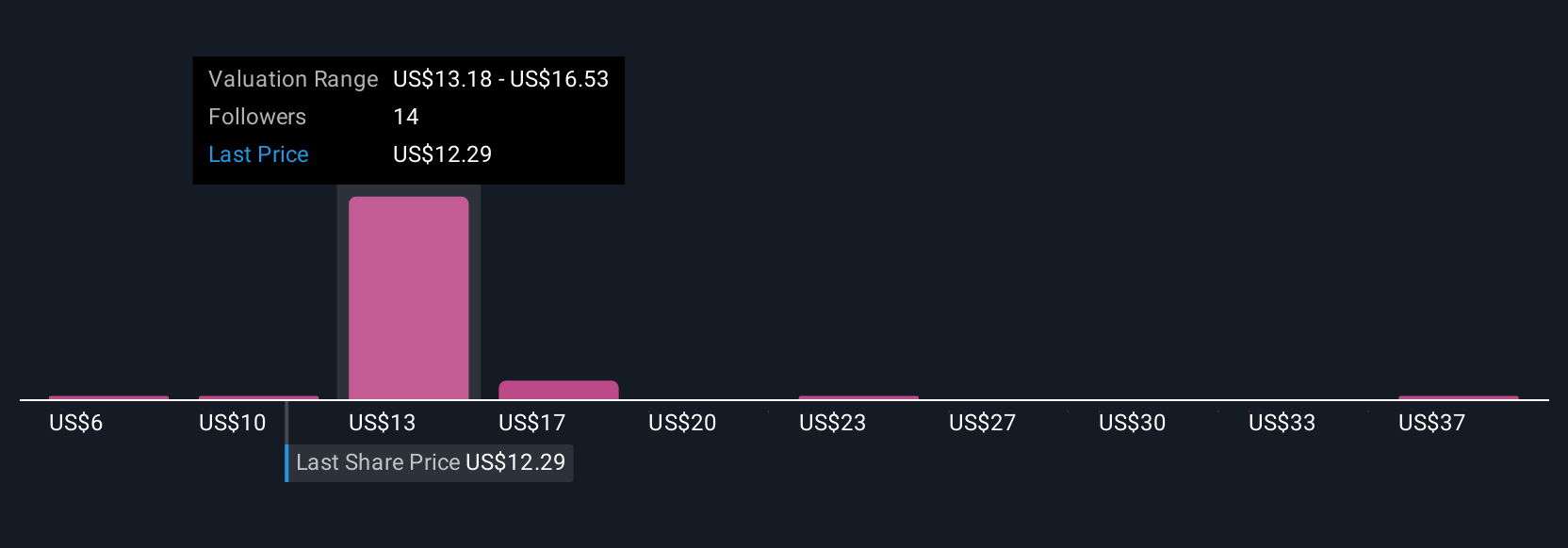

Seven private investors in the Simply Wall St Community put fair value for 10x Genomics between US$6.47 and US$40 per share. With revenue volatility tied to factors like tariff-driven orders, these varied perspectives show why it's important to compare different analyses before forming your own view.

Explore 7 other fair value estimates on 10x Genomics - why the stock might be worth over 2x more than the current price!

Build Your Own 10x Genomics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your 10x Genomics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free 10x Genomics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate 10x Genomics' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXG

10x Genomics

A life science technology company, develops and sells instruments, consumables, and software for analyzing biological systems in the Americas, Europe, the Middle East, Africa, China, and the Asia Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives