- United States

- /

- Biotech

- /

- NasdaqGS:TWST

Can Twist Bioscience’s (TWST) Path to Profitability Reshape Its Competitive Position in Synthetic Biology?

Reviewed by Simply Wall St

- At the recent Baird Global Healthcare Conference, Twist Bioscience's management presented updates on profitability, operating efficiency, and future strategic priorities, emphasizing that gross margins now exceed 50% and targeting adjusted EBITDA breakeven by fiscal 2026.

- An interesting takeaway is the company's focus on expanding minimal residual disease detection, transitioning customers to sequencing solutions, and integrating synthetic biology with biopharma amid a challenging funding environment.

- We'll explore how management's emphasis on improved margins and a clear path toward EBITDA breakeven could impact Twist Bioscience's investment outlook.

Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

Twist Bioscience Investment Narrative Recap

To own shares of Twist Bioscience, an investor must believe in the company's ability to achieve meaningful, sustainable profitability in synthetic DNA and genomics, while managing significant risks like heavy customer concentration and ongoing losses. The recent focus on margin improvements and a clear path to adjusted EBITDA breakeven is encouraging, but does not eliminate concerns over revenue volatility from reliance on a few large next-generation sequencing (NGS) clients, which remains the most important short-term risk alongside possible capital needs. Thus, the latest news may support sentiment around profitability and operating execution, but does not materially change the biggest near-term catalyst: expansion of the customer base and recurring revenue streams, paired with sustainable cost discipline, is still the main factor that could shift the narrative. Among recent announcements, the August launch of the Twist Oncology DNA Comprehensive Genomic Profiling Panel stands out for its relevance, as it positions the company to increase the utility of sequencing solutions and better serve oncology researchers and clinicians, a key growth area referenced at the Baird Global Healthcare Conference. This aligns with management’s emphasis on expanding minimal residual disease detection and integrating new products into customer workflows, which could contribute to incremental revenue for the NGS segment if adoption accelerates. By contrast, investors should be aware that even as margins improve, ongoing dependency on a handful of NGS customers means that a single relationship loss could...

Read the full narrative on Twist Bioscience (it's free!)

Twist Bioscience's narrative projects $575.2 million in revenue and $92.4 million in earnings by 2028. This requires 16.7% yearly revenue growth and a $177.6 million increase in earnings from the current $-85.2 million.

Uncover how Twist Bioscience's forecasts yield a $42.14 fair value, a 51% upside to its current price.

Exploring Other Perspectives

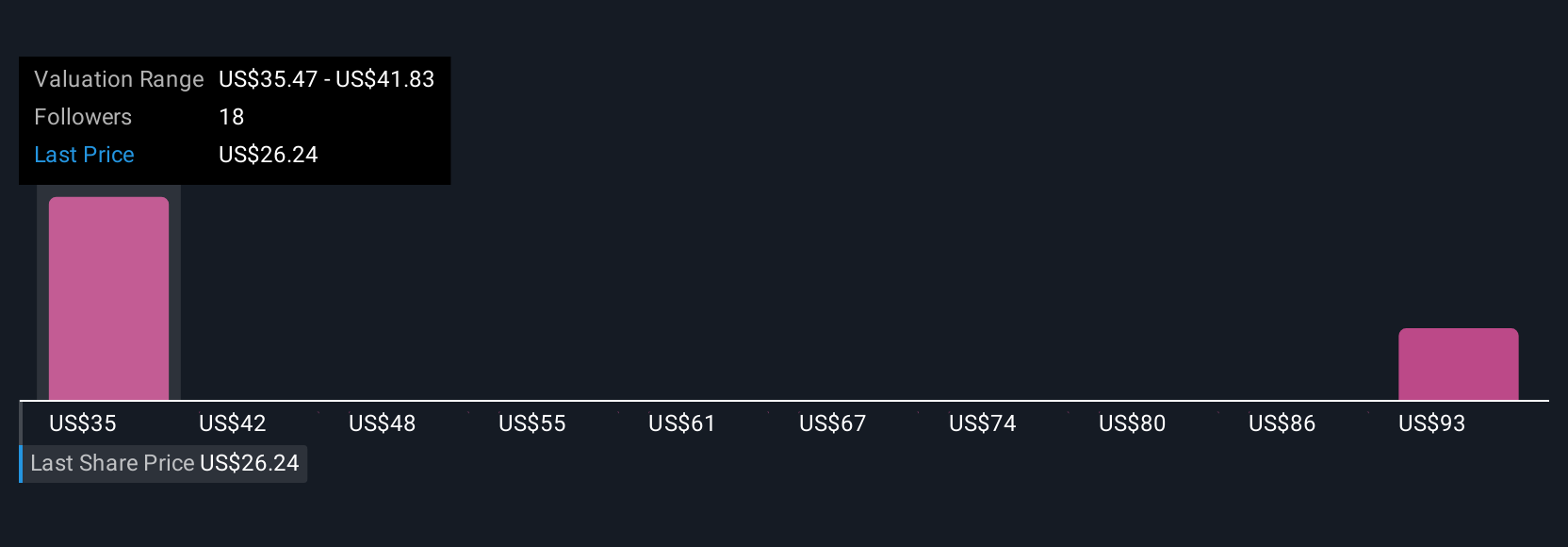

Three independent fair value estimates from the Simply Wall St Community range from US$35.47 to US$98.86 per share. While some participants see strong upside, many are weighing customer concentration risks that could impact future revenue stability, explore these alternative viewpoints for a fuller picture.

Explore 3 other fair value estimates on Twist Bioscience - why the stock might be worth just $35.47!

Build Your Own Twist Bioscience Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Twist Bioscience research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Twist Bioscience research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Twist Bioscience's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Twist Bioscience might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TWST

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives