- United States

- /

- Biotech

- /

- NasdaqGM:TVTX

Travere Therapeutics, Inc.'s (NASDAQ:TVTX) Share Price Boosted 48% But Its Business Prospects Need A Lift Too

Travere Therapeutics, Inc. (NASDAQ:TVTX) shareholders are no doubt pleased to see that the share price has bounced 48% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 55% share price drop in the last twelve months.

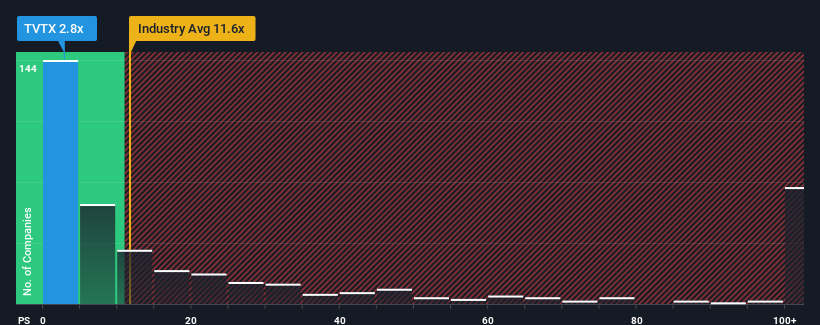

Even after such a large jump in price, Travere Therapeutics' price-to-sales (or "P/S") ratio of 2.8x might still make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 11.6x and even P/S above 49x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Travere Therapeutics

What Does Travere Therapeutics' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Travere Therapeutics has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Travere Therapeutics will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Travere Therapeutics' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered an exceptional 69% gain to the company's top line. As a result, it also grew revenue by 20% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 27% per annum during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 221% per annum growth forecast for the broader industry.

In light of this, it's understandable that Travere Therapeutics' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Travere Therapeutics' recent share price jump still sees fails to bring its P/S alongside the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of Travere Therapeutics' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Travere Therapeutics (at least 1 which is a bit concerning), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Travere Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TVTX

Travere Therapeutics

A biopharmaceutical company, identifies, develops, and delivers therapies to people living with rare kidney and metabolic diseases.

Exceptional growth potential and fair value.