- United States

- /

- Biotech

- /

- NasdaqGS:TSVT

2seventy bio, Inc. (NASDAQ:TSVT) Held Back By Insufficient Growth Even After Shares Climb 49%

Despite an already strong run, 2seventy bio, Inc. (NASDAQ:TSVT) shares have been powering on, with a gain of 49% in the last thirty days. But the last month did very little to improve the 59% share price decline over the last year.

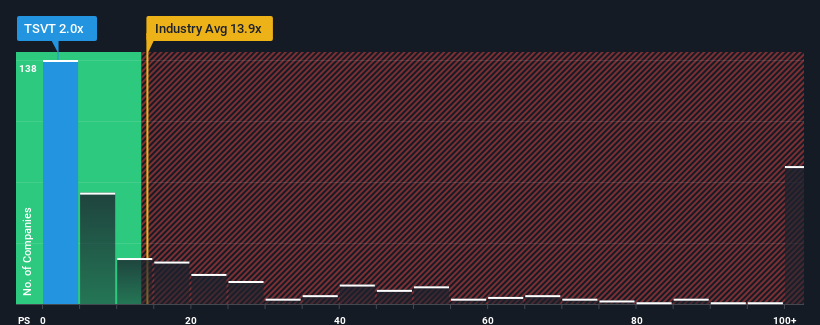

Even after such a large jump in price, 2seventy bio may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 2x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 13.9x and even P/S higher than 56x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for 2seventy bio

How Has 2seventy bio Performed Recently?

2seventy bio certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on 2seventy bio will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like 2seventy bio's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 184% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 41% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 12% each year as estimated by the seven analysts watching the company. With the industry predicted to deliver 231% growth per annum, that's a disappointing outcome.

With this information, we are not surprised that 2seventy bio is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Even after such a strong price move, 2seventy bio's P/S still trails the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's clear to see that 2seventy bio maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, 2seventy bio's poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 4 warning signs for 2seventy bio you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TSVT

2seventy bio

A cell and gene therapy company, focuses on the research, development, and commercialization of treatments for cancer in the United States.

Excellent balance sheet with reasonable growth potential.