- United States

- /

- Biotech

- /

- NasdaqGS:TSHA

Taysha Gene Therapies (TSHA) valuation after REVEAL Rett trial plans and insider sale drive fresh investor focus

Reviewed by Simply Wall St

Taysha Gene Therapies (TSHA) is back on traders radar after two very different signals hit at once: finalized REVEAL trial plans for its Rett syndrome gene therapy and a sizable insider share sale.

See our latest analysis for Taysha Gene Therapies.

Those cross currents help explain why, even with a recent 10.59% 1 day share price return pushing the stock to 4.49 dollars, Taysha still shows a powerful year to date share price return of 142.70 percent alongside an 88.66 percent 1 year total shareholder return. This suggests momentum is building but still comes with biotech style risk.

If this kind of asymmetric setup appeals to you, it could be worth exploring other early stage opportunities across healthcare stocks that might be flying under your radar.

With the stock still trading at a steep discount to analyst targets despite blockbuster style expectations around its Rett program, investors face a key question: is Taysha undervalued here or already pricing in its next leg of growth?

Most Popular Narrative: 57.4% Undervalued

With Taysha Gene Therapies last close at 4.49 dollars against a narrative fair value of about 10.54 dollars, the valuation hinges heavily on the Rett program’s trajectory and aggressive earnings assumptions.

The analysts have a consensus price target of $6.55 for Taysha Gene Therapies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.0, and the most bearish reporting a price target of just $5.0.

Curious how a loss making biotech earns such a rich future earnings multiple and soaring revenue outlook, yet still screens undervalued? The narrative stitches together rapid top line expansion, margin transformation, and a lofty profit multiple that would not look out of place in market leading growth stories. Want to see exactly which assumptions turn today’s price into that much higher fair value?

Result: Fair Value of $10.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in TSHA-102’s pivotal trials or tougher than expected FDA requirements could quickly erode today’s optimism and derail those aggressive growth assumptions.

Find out about the key risks to this Taysha Gene Therapies narrative.

Another View: Multiples Tell a Tougher Story

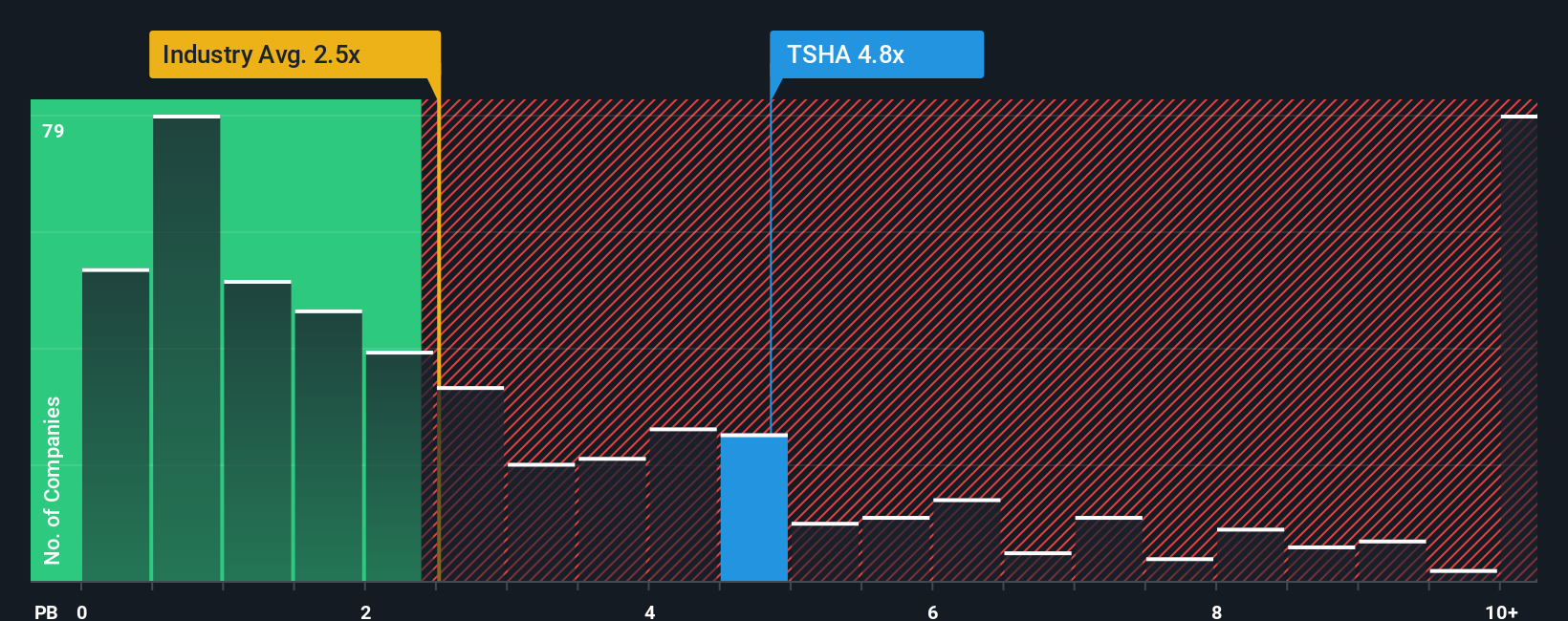

Look past the narrative fair value and the picture gets murkier. On a simple price to book basis, Taysha trades at about 5.6 times versus roughly 2.5 times for the wider US biotech group and around 10.5 times for peers, suggesting rich expectations baked into an unprofitable story.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Taysha Gene Therapies Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape a fresh perspective in minutes: Do it your way.

A great starting point for your Taysha Gene Therapies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider a few more smart opportunities by scanning targeted stock lists that can help uncover potential candidates long before the broader market pays attention.

- Find potential mispricings by targeting companies that appear inexpensive on cash flow and growth using these 915 undervalued stocks based on cash flows.

- Explore the next wave of innovation by focusing on smaller companies working with machine learning and automation through these 25 AI penny stocks.

- Support your income strategy by identifying companies with consistent payouts and competitive yields via these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taysha Gene Therapies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSHA

Taysha Gene Therapies

A clinical-stage biotechnology company, focuses on developing and commercializing adeno-associated virus-based gene therapies for the treatment of monogenic diseases of the central nervous system.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026