- United States

- /

- Biotech

- /

- NasdaqGS:TSHA

Taysha Gene Therapies (TSHA) Is Up 5.9% After FDA Breakthrough for Rett Drug and Regained Program Rights - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Taysha Gene Therapies announced that its TSHA-102 gene therapy for Rett Syndrome received FDA Breakthrough Therapy Designation, with plans to begin dosing in the REVEAL pivotal trial this quarter and regained full program rights following the expiration of a previous option agreement.

- This milestone clinical and regulatory progress may boost confidence in the company’s late-stage pipeline and future commercialization prospects within the gene therapy sector.

- We will now review how the FDA Breakthrough Therapy Designation for TSHA-102 could influence Taysha’s future growth expectations.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Taysha Gene Therapies Investment Narrative Recap

To be a shareholder in Taysha Gene Therapies, you need to believe in the company's ability to deliver meaningful clinical results and secure regulatory approval for TSHA-102, transforming ongoing investments into eventual commercialization for Rett syndrome. The recent FDA Breakthrough Therapy Designation boosts visibility and may accelerate the clinical path, but the primary short-term catalyst, the pivotal REVEAL trial, remains contingent on successful patient dosing and trial outcomes. However, the company’s rising R&D costs and persistent net losses continue to pose significant financial risk in the near term, and this news does not remove that challenge.

The appointment of David McNinch as Chief Commercial Officer stands out as a recent business move that directly supports Taysha’s growth plans. With extensive gene therapy launch experience, McNinch’s addition to the leadership team could improve the company’s preparations for possible commercialization milestones and add credibility as TSHA-102 progresses through REVEAL and approaches decision points for market entry.

In contrast, investors should remain aware of the persistent risk that ongoing net losses and high R&D spending could...

Read the full narrative on Taysha Gene Therapies (it's free!)

Taysha Gene Therapies' narrative projects $88.9 million in revenue and $14.1 million in earnings by 2028. This requires 120.1% yearly revenue growth and an $103.4 million increase in earnings from -$89.3 million today.

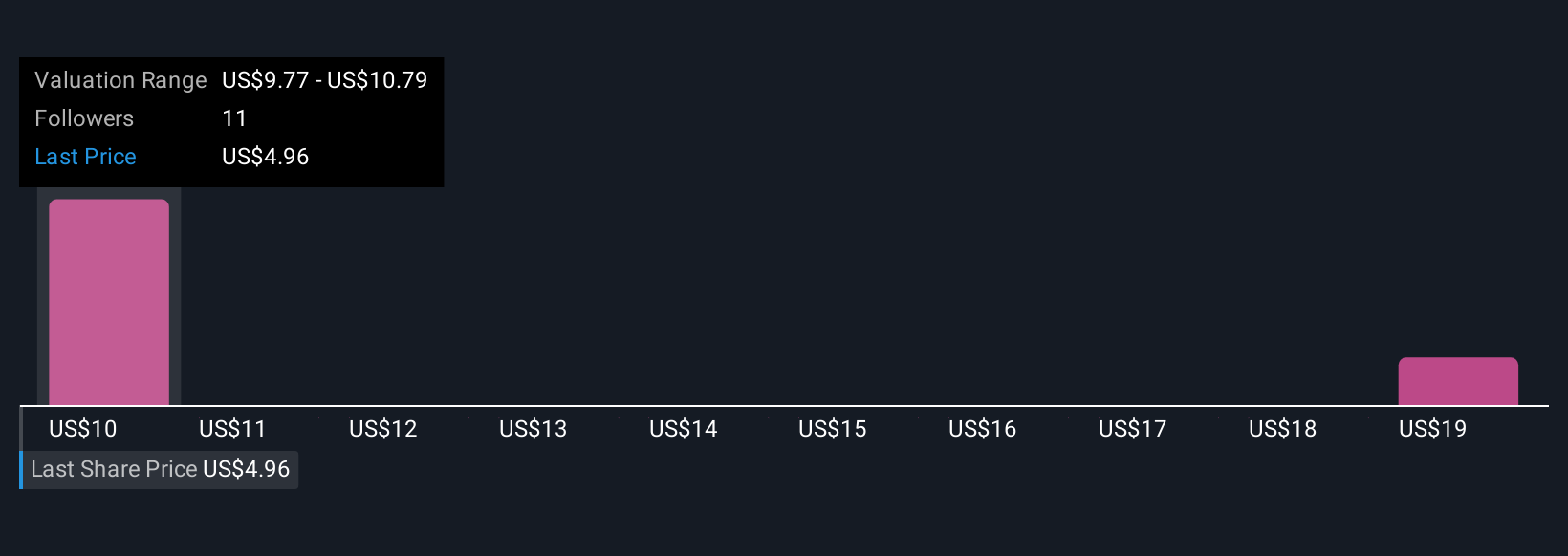

Uncover how Taysha Gene Therapies' forecasts yield a $10.08 fair value, a 145% upside to its current price.

Exploring Other Perspectives

Retail investors in the Simply Wall St Community estimate Taysha’s fair value between US$10.08 and US$41.50 across two analyses. While clinical progress offers optimism for future revenue growth, the diversity in these views highlights how expectations for regulatory outcomes can significantly shape confidence in the company’s prospects.

Explore 2 other fair value estimates on Taysha Gene Therapies - why the stock might be worth over 10x more than the current price!

Build Your Own Taysha Gene Therapies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Taysha Gene Therapies research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Taysha Gene Therapies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Taysha Gene Therapies' overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taysha Gene Therapies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSHA

Taysha Gene Therapies

A clinical-stage biotechnology company, focuses on developing and commercializing adeno-associated virus-based gene therapies for the treatment of monogenic diseases of the central nervous system.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026