- United States

- /

- Machinery

- /

- NasdaqCM:NNDM

Nano Dimension And 2 Other Penny Stocks To Watch Now

Reviewed by Simply Wall St

As the U.S. stock market faces volatility with tech stocks leading a sell-off amid tariff concerns, investors are searching for opportunities that may offer potential growth despite uncertain conditions. Penny stocks, although an outdated term, continue to represent smaller or newer companies that can provide value at lower price points. By focusing on those with strong financial foundations and promising growth prospects, investors might find hidden gems among these often overlooked stocks.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.860025 | $6.53M | ★★★★★★ |

| Safe Bulkers (NYSE:SB) | $3.71 | $400.14M | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $121.65M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.38 | $73.1M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.52 | $48.18M | ★★★★★★ |

| Tuya (NYSE:TUYA) | $3.52 | $1.95B | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.88 | $76.36M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.23 | $21.46M | ★★★★★☆ |

| TETRA Technologies (NYSE:TTI) | $3.39 | $454.11M | ★★★★☆☆ |

Click here to see the full list of 749 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Nano Dimension (NasdaqCM:NNDM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nano Dimension Ltd. and its subsidiaries provide additive manufacturing solutions in Israel and internationally, with a market capitalization of approximately $477.94 million.

Operations: The company generates revenue of $57.66 million from its Printers & Related Products segment.

Market Cap: $477.94M

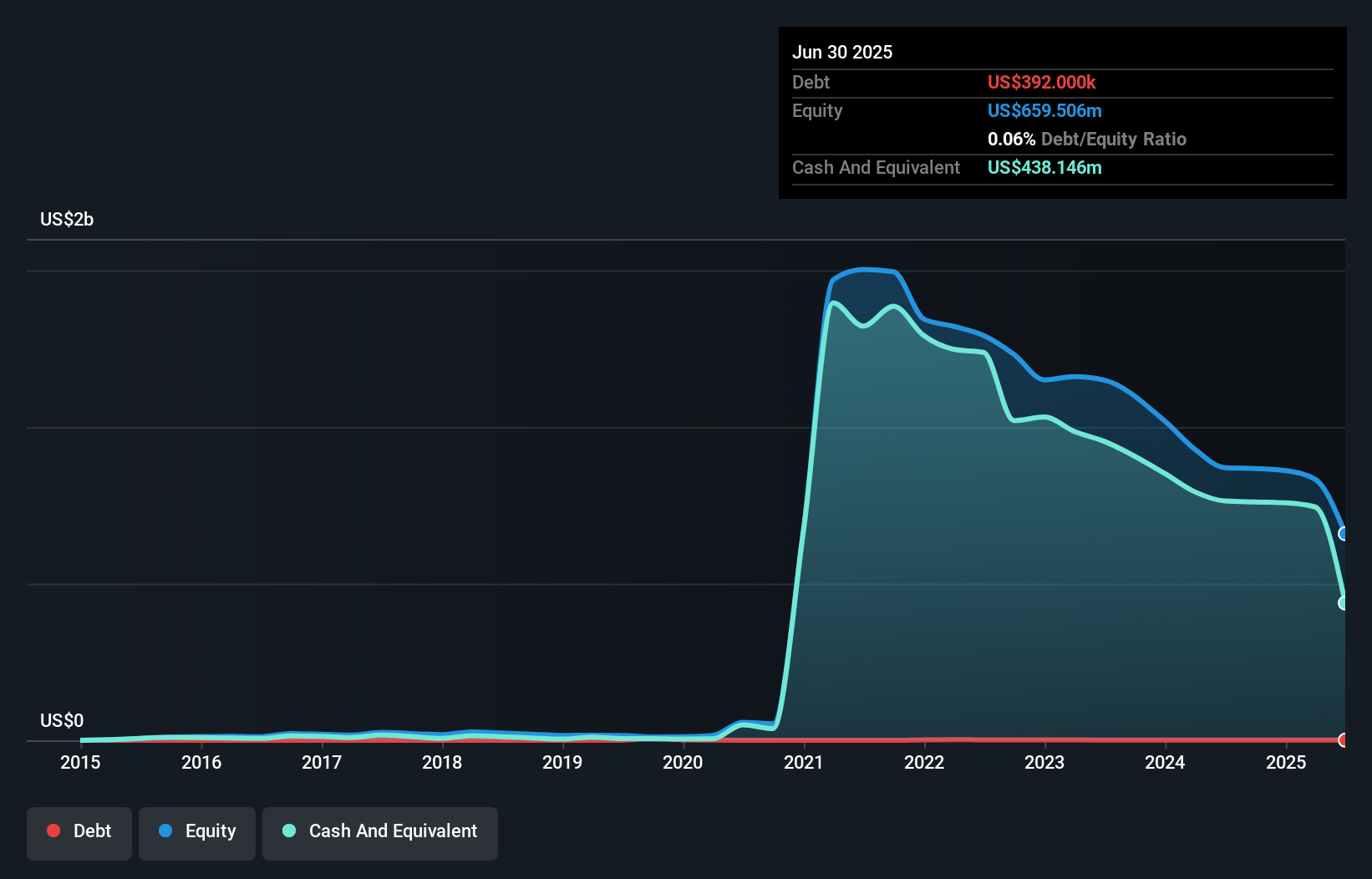

Nano Dimension, with a market capitalization of US$477.94 million, is navigating significant corporate changes and legal challenges. Despite being unprofitable and experiencing declining earnings over the past five years, the company maintains a strong financial position with cash exceeding its total debt and a cash runway extending beyond three years. Recent board reshuffling includes appointing David Stehlin to leverage his technology sector expertise amidst ongoing merger disputes with Desktop Metal Inc., which could impact strategic growth opportunities. A proposed US$150 million share repurchase program reflects confidence in future prospects, pending Israeli court approval.

- Click to explore a detailed breakdown of our findings in Nano Dimension's financial health report.

- Gain insights into Nano Dimension's historical outcomes by reviewing our past performance report.

CarParts.com (NasdaqGS:PRTS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CarParts.com, Inc. operates as an online provider of aftermarket auto parts and accessories in the United States and the Philippines, with a market cap of $50.58 million.

Operations: The company generates revenue primarily from its Base USAP segment, totaling $611.71 million.

Market Cap: $50.58M

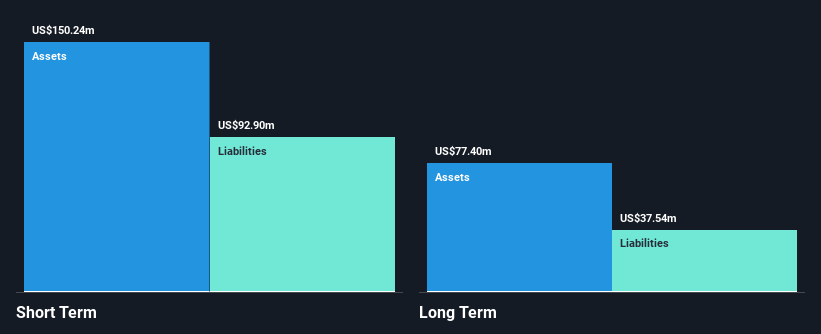

CarParts.com, with a market cap of US$50.58 million, remains unprofitable but has made strides in reducing losses over the past five years. The company is debt-free and its short-term assets of US$150.2 million comfortably cover both short and long-term liabilities. Recent initiatives include a partnership with Extend, enhancing customer satisfaction through shipping and product protection services. Despite high volatility in share price and no forecast for profitability within three years, CarParts.com trades at good value compared to peers while maintaining a stable cash runway that supports operations beyond one year without additional funding needs.

- Jump into the full analysis health report here for a deeper understanding of CarParts.com.

- Gain insights into CarParts.com's future direction by reviewing our growth report.

Taysha Gene Therapies (NasdaqGS:TSHA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Taysha Gene Therapies, Inc. is a gene therapy company that develops and commercializes adeno-associated virus-based treatments for monogenic central nervous system diseases, with a market cap of $334.15 million.

Operations: The company's revenue segment is entirely derived from developing adeno-associated virus-based gene therapies for the treatment of rare monogenic diseases, totaling $8.33 million.

Market Cap: $334.15M

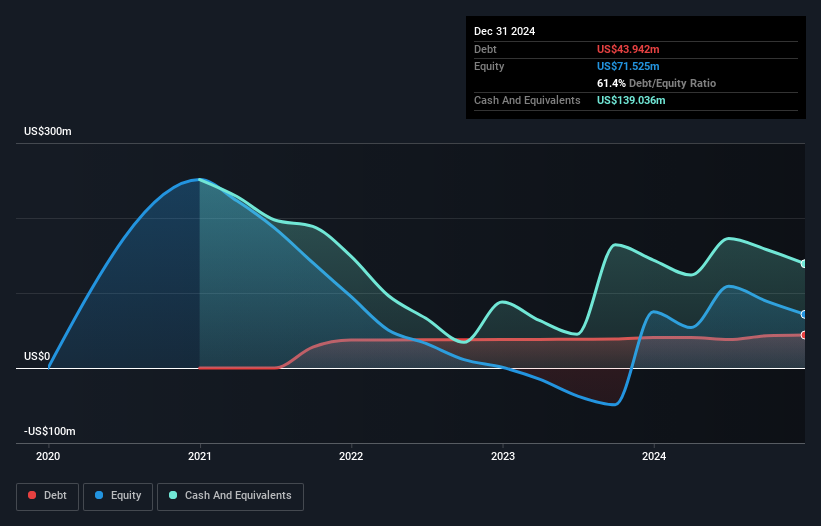

Taysha Gene Therapies, with a market cap of US$334.15 million, is currently unprofitable and pre-revenue, focusing on developing gene therapies for rare diseases. Despite a decline in sales from US$15.45 million to US$8.33 million year-over-year, the company reduced its net loss from US$111.57 million to US$89.3 million in 2024. Taysha has more cash than debt and its short-term assets exceed liabilities, providing some financial stability amid ongoing losses and increased debt-to-equity ratio over five years. The company filed shelf registrations totaling over $326 million recently and remains part of the S&P Biotechnology Select Industry Index.

- Dive into the specifics of Taysha Gene Therapies here with our thorough balance sheet health report.

- Assess Taysha Gene Therapies' future earnings estimates with our detailed growth reports.

Summing It All Up

- Access the full spectrum of 749 US Penny Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nano Dimension might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NNDM

Nano Dimension

Engages in additive manufacturing solutions in Israel and internationally.

Flawless balance sheet minimal.

Market Insights

Community Narratives