- United States

- /

- Biotech

- /

- NasdaqGS:TPTX

Turning Point Therapeutics, Inc. (NASDAQ:TPTX) Just Reported First-Quarter Earnings: Have Analysts Changed Their Mind On The Stock?

It's been a mediocre week for Turning Point Therapeutics, Inc. (NASDAQ:TPTX) shareholders, with the stock dropping 15% to US$64.96 in the week since its latest first-quarter results. Revenues of US$25m crushed expectations, although expenses increased commensurately, with statutory losses hitting US$0.73 per share, -11% above what the analysts expected. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

Check out our latest analysis for Turning Point Therapeutics

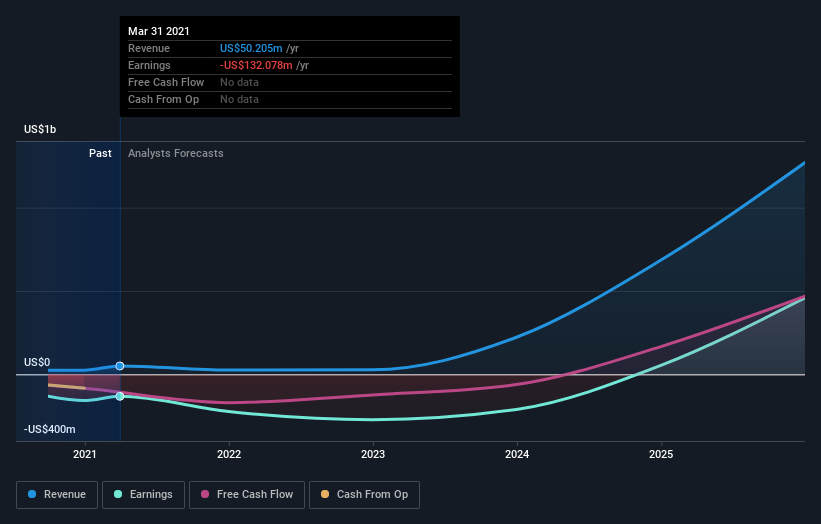

Taking into account the latest results, the five analysts covering Turning Point Therapeutics provided consensus estimates of US$26.2m revenue in 2021, which would reflect a disturbing 48% decline on its sales over the past 12 months. Per-share losses are expected to explode, reaching US$4.43 per share. Before this earnings announcement, the analysts had been modelling revenues of US$18.0m and losses of US$3.95 per share in 2021. So there's been quite a change-up of views after the recent consensus updates, with the analysts significantly increasing their revenue forecasts while also expecting losses per share to increase. It looks like the revenue growth will not be achieved without incremental costs.

There was no major change to the consensus price target of US$153, with growing revenues seemingly enough to offset the concern of growing losses. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Turning Point Therapeutics analyst has a price target of US$186 per share, while the most pessimistic values it at US$120. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

The Bottom Line

The most important thing to note is the forecast of increased losses next year, suggesting all may not be well at Turning Point Therapeutics. They also upgraded their revenue estimates for next year, even though sales are expected to grow slower than the wider industry. The consensus price target held steady at US$153, with the latest estimates not enough to have an impact on their price targets.

With that in mind, we wouldn't be too quick to come to a conclusion on Turning Point Therapeutics. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for Turning Point Therapeutics going out to 2025, and you can see them free on our platform here..

However, before you get too enthused, we've discovered 3 warning signs for Turning Point Therapeutics that you should be aware of.

If you decide to trade Turning Point Therapeutics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Turning Point Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:TPTX

Turning Point Therapeutics

Turning Point Therapeutics, Inc., a clinical-stage precision oncology biopharmaceutical company, engages in designing and developing therapies that target genetic drivers of cancer.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives