- United States

- /

- Biotech

- /

- NasdaqGM:TNGX

Risks Still Elevated At These Prices As Tango Therapeutics, Inc. (NASDAQ:TNGX) Shares Dive 30%

Tango Therapeutics, Inc. (NASDAQ:TNGX) shares have had a horrible month, losing 30% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 94% in the last year.

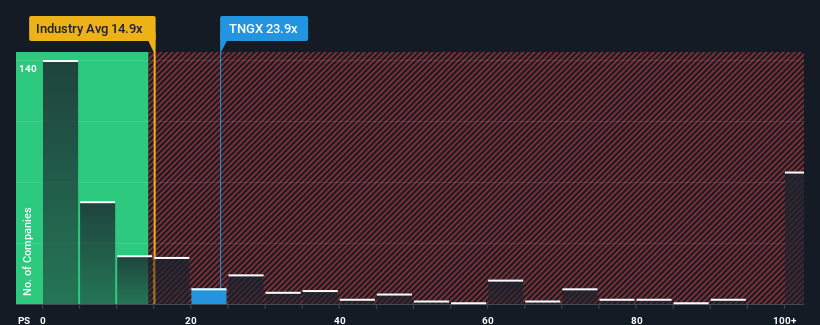

In spite of the heavy fall in price, Tango Therapeutics may still be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 23.9x, when you consider almost half of the companies in the Biotechs industry in the United States have P/S ratios under 14.9x and even P/S lower than 4x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Tango Therapeutics

How Tango Therapeutics Has Been Performing

Tango Therapeutics certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Tango Therapeutics, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Tango Therapeutics' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 55% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 133% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it worrying that Tango Therapeutics' P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Even after such a strong price drop, Tango Therapeutics' P/S still exceeds the industry median significantly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that Tango Therapeutics currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Before you settle on your opinion, we've discovered 4 warning signs for Tango Therapeutics (1 is a bit concerning!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Tango Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TNGX

Tango Therapeutics

A precision oncology company, focuses on the discovery and development of drugs in defined patient populations with unmet medical need.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives