- United States

- /

- Healthtech

- /

- NasdaqGS:SOPH

3 Promising US Penny Stocks With Market Caps Over $20M

Reviewed by Simply Wall St

As the U.S. stock market navigates the complexities of new tariffs and Federal Reserve policies, investors are keenly observing how these factors impact various indices. Amidst this backdrop, penny stocks—often representing smaller or emerging companies—continue to capture attention due to their potential for growth at lower price points. Despite their vintage name, these stocks can offer significant value when backed by strong financials and a clear growth strategy. In this article, we explore three promising penny stocks that stand out for their financial robustness and potential upside in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.870625 | $6.51M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $131.87M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.26 | $9.2M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.99 | $89.48M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.44 | $46.86M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.71 | $48.23M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.46 | $25.54M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8876 | $80.72M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.61 | $388.67M | ★★★★☆☆ |

Click here to see the full list of 717 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

CPS Technologies (NasdaqCM:CPSH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CPS Technologies Corporation offers advanced material solutions across various sectors including transportation, automotive, energy, and aerospace, with a market capitalization of $25.71 million.

Operations: The company generates revenue of $21.94 million from its advanced material solutions segment.

Market Cap: $25.71M

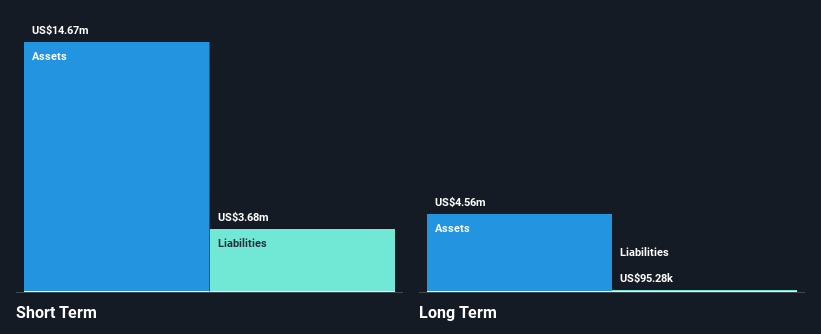

CPS Technologies Corporation, despite being unprofitable, has made strides in reducing its losses over the past five years. The company boasts a strong balance sheet with short-term assets significantly exceeding both short and long-term liabilities. Recent developments include a new $13.3 million supply contract and a Phase I SBIR contract from the U.S. Army valued at $250,000 for developing advanced materials. CPS's debt management is commendable with cash reserves surpassing total debt, although operating cash flow remains negative. The seasoned board and management team further bolster the company's strategic direction amidst these financial challenges.

- Dive into the specifics of CPS Technologies here with our thorough balance sheet health report.

- Assess CPS Technologies' previous results with our detailed historical performance reports.

Tiziana Life Sciences (NasdaqCM:TLSA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tiziana Life Sciences Ltd is a biotechnology company that focuses on discovering and developing molecules to treat human diseases in oncology and immunology in the United States, with a market cap of $75.28 million.

Operations: Currently, there are no reported revenue segments for the biotechnology company focused on oncology and immunology treatments in the United States.

Market Cap: $75.28M

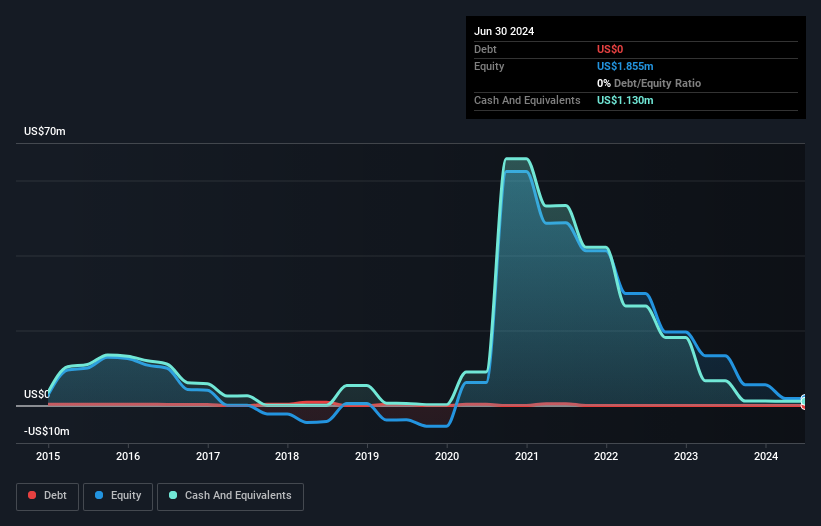

Tiziana Life Sciences is navigating the challenging landscape of biotechnology as a pre-revenue company with a focus on innovative treatments for neurodegenerative diseases. Recent announcements highlight promising developments with its nasal anti-CD3 monoclonal antibody, Foralumab, which has shown potential in reducing inflammation in conditions like spinal cord injury and Alzheimer's disease. The company is expanding clinical trials for non-active secondary progressive multiple sclerosis across prestigious institutions, aiming to address significant unmet medical needs without systemic immune suppression. Despite financial constraints and high volatility, Tiziana's debt-free status and strategic advancements bolster its pursuit of groundbreaking therapies.

- Click to explore a detailed breakdown of our findings in Tiziana Life Sciences' financial health report.

- Understand Tiziana Life Sciences' track record by examining our performance history report.

SOPHiA GENETICS (NasdaqGS:SOPH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SOPHiA GENETICS SA is a cloud-native software technology company in the healthcare sector with a market cap of $255.79 million.

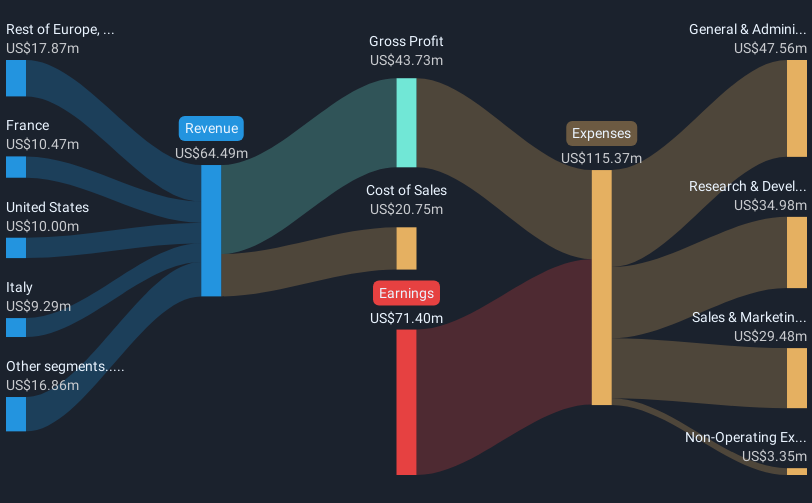

Operations: The company generates revenue primarily from its Healthcare Software segment, which amounted to $64.49 million.

Market Cap: $255.79M

SOPHiA GENETICS, with a market cap of US$255.79 million, is navigating the healthcare software sector as an unprofitable entity but boasts a revenue stream of US$64.49 million from its core segment. The company has more cash than debt and sufficient cash runway for over a year if current free cash flow trends persist. Despite high share price volatility and negative return on equity, SOPHiA's recent launch of the OncoPortal™ Mutation Tracker enhances its platform's capabilities in oncology by enabling precise monitoring of genomic variants, underscoring its commitment to advancing cancer care through innovative data-driven solutions.

- Click here to discover the nuances of SOPHiA GENETICS with our detailed analytical financial health report.

- Review our growth performance report to gain insights into SOPHiA GENETICS' future.

Where To Now?

- Click through to start exploring the rest of the 714 US Penny Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SOPH

SOPHiA GENETICS

Operates as a cloud-native software technology company in the healthcare space.

Excellent balance sheet very low.

Similar Companies

Market Insights

Community Narratives