- United States

- /

- Pharma

- /

- NasdaqGS:TLRY

Tilray (TLRY) Reverse Split Triggers Volatility: What the New Capital Structure Means for Valuation

Reviewed by Simply Wall St

Tilray Brands (TLRY) just put through a one-for-10 reverse stock split, lifting its share price while shrinking the float, a classic move to stay compliant and court bigger investors.

See our latest analysis for Tilray Brands.

That move lands in a rough stretch for holders, with a 30 day share price return of about negative 43 percent and a one year total shareholder return near negative 46 percent. This suggests sentiment and momentum are still fading despite decent valuation talk.

If Tilray’s volatility has you rethinking concentration risk, this could be a good moment to explore fast growing stocks with high insider ownership for other interesting ideas beyond cannabis.

With shares down sharply despite a cleaner capital structure and analysts still seeing upside to their price targets, is Tilray now a misunderstood value play or is the market already discounting all the future growth it can deliver?

Most Popular Narrative: 295.9% Overvalued

Compared to Tilray Brands’ last close at $7.06, the most followed narrative anchors fair value far lower, setting up a sharp valuation gap to unpack.

Tilray's international cannabis business is achieving rapid organic growth, with European cannabis revenue up 112% YoY (excluding Australia) and significant share gains in Germany due to regulatory tailwinds, broader medical adoption, and expanding legalization, supporting a long runway for top-line revenue acceleration as global cannabis markets open.

Want to know how modest revenue growth, a major margin reset, and a re-rated earnings multiple can still imply such a steep downside? The narrative’s full math might surprise you.

Result: Fair Value of $1.78 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory setbacks in key markets and Tilray’s persistent operating losses could quickly unravel the bullish narrative and reset expectations.

Find out about the key risks to this Tilray Brands narrative.

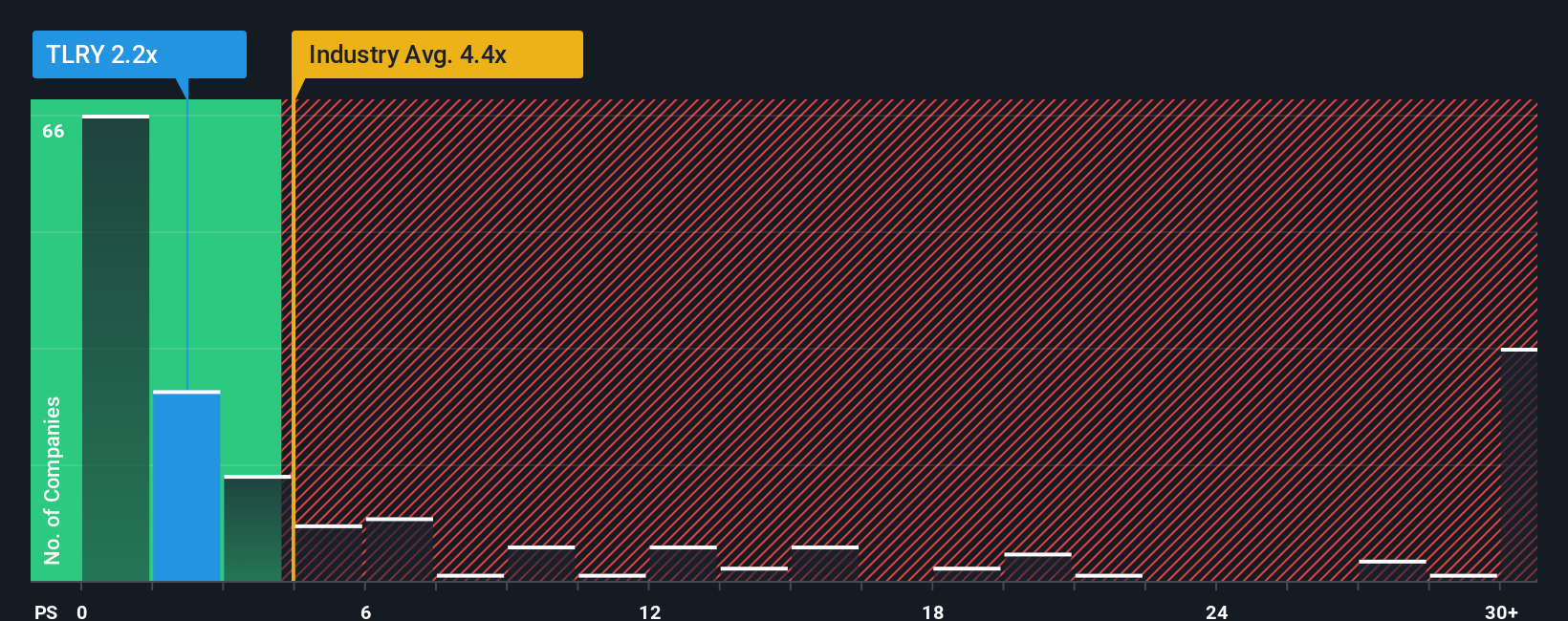

Another View: Market Multiple Says Cheap, Not Rich

While the narrative model flags Tilray as almost 300 percent overvalued, the simple price to sales lens tells a very different story. At roughly 1 times sales versus 4 times for US pharma peers and a 2.1 times fair ratio, the stock screens as inexpensive. This suggests the market may already be heavily pricing in execution and solvency risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tilray Brands Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a complete view in minutes: Do it your way.

A great starting point for your Tilray Brands research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider running targeted screens on Simply Wall Street to identify a few fresh prospects, so your next potential opportunity does not slip past.

- Identify possible high-upside moves earlier by scanning these 3572 penny stocks with strong financials that pair speculative potential with underlying financial substance.

- Explore opportunities at the center of developments in artificial intelligence through these 25 AI penny stocks involved in automation, data intelligence, and next generation platforms.

- Build a more resilient long-term core by examining these 916 undervalued stocks based on cash flows where current prices appear low relative to estimated future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tilray Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLRY

Tilray Brands

A lifestyle consumer products company, engages in the research, cultivation, processing, and distribution of medical cannabis products in Canada, the United States, Europe, the Middle East, Africa, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026