- United States

- /

- Pharma

- /

- NasdaqGS:TLRY

Tilray Brands (NasdaqGS:TLRY) Expands Hi*Ball Energy Amid Flat 0.9% Share Price Movement

Reviewed by Simply Wall St

Tilray Brands (NasdaqGS:TLRY) saw a flat share price movement of 0.85% over the last week, coinciding with notable developments such as the expansion of its collaboration with Whole Foods Market and the relaunch of its Hi*Ball Energy brand in the U.S. retail market. These events indicate renewed efforts within the food and beverage sector under Tilray Wellness, potentially stabilizing the company's market presence. This week also saw broader market optimism, driven by reports that the White House might reduce tariffs, yet Tilray's modest share movement reflects potential investor focus on its sector-specific activities rather than broader economic indicators.

Buy, Hold or Sell Tilray Brands? View our complete analysis and fair value estimate and you decide.

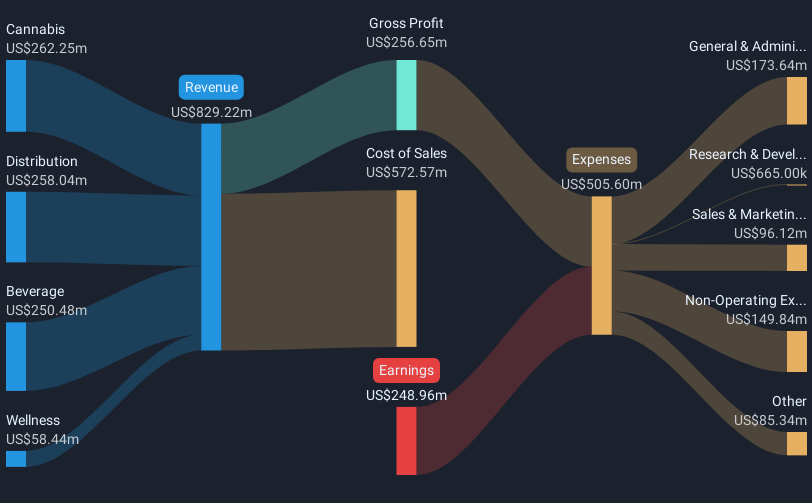

Tilray Brands experienced a total return of a 69.77% decline over the last year, significantly underperforming the US Pharmaceuticals industry, which saw a modest 0.6% return. During this period, Tilray's financial performance was marked by increased sales but persistent losses. Notably, Q4 FY2024 reported sales of US$229.88 million, with a net loss of US$15.38 million—substantially improved from the previous year's larger losses. Additionally, the settlement of a CAD 30 million class action lawsuit regarding Aphria and significant board appointments, like that of Steven M. Cohen in December 2024, could have influenced investor perceptions.

Amid these challenges, Tilray expanded its product lineup, introducing new medical cannabis products in Germany and launching innovative brands like Runner's High Brewing. These efforts demonstrate the company's commitment to growth and diversification in its offerings, despite its broader financial struggles. However, investor focus on ongoing losses and challenges in achieving profitability likely contributed to the past year's underwhelming market performance.

Evaluate Tilray Brands' historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tilray Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLRY

Tilray Brands

A lifestyle consumer products company, engages in the research, cultivation, processing, and distribution of medical cannabis products in Canada, the United States, Europe, Australia, New Zealand, Latin America, and internationally.

Undervalued with excellent balance sheet.