- United States

- /

- Pharma

- /

- NasdaqGS:TLRY

Tilray Brands, Inc.'s (NASDAQ:TLRY) Price Is Right But Growth Is Lacking

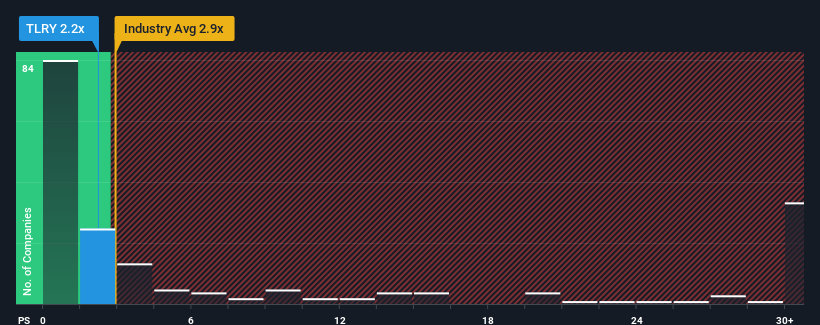

With a price-to-sales (or "P/S") ratio of 2.2x Tilray Brands, Inc. (NASDAQ:TLRY) may be sending bullish signals at the moment, given that almost half of all the Pharmaceuticals companies in the United States have P/S ratios greater than 2.9x and even P/S higher than 21x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Tilray Brands

How Tilray Brands Has Been Performing

With revenue growth that's inferior to most other companies of late, Tilray Brands has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tilray Brands.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Tilray Brands' to be considered reasonable.

Retrospectively, the last year delivered a decent 6.1% gain to the company's revenues. The latest three year period has also seen an excellent 53% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 18% per year over the next three years. That's shaping up to be materially lower than the 53% per year growth forecast for the broader industry.

With this information, we can see why Tilray Brands is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Tilray Brands' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Tilray Brands' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Tilray Brands that you need to be mindful of.

If you're unsure about the strength of Tilray Brands' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Tilray Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TLRY

Tilray Brands

A lifestyle consumer products company, engages in the research, cultivation, processing, and distribution of medical cannabis products in Canada, the United States, Europe, Australia, New Zealand, Latin America, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives