- United States

- /

- Biotech

- /

- NasdaqCM:TGTX

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

The United States market remained flat over the last week, yet it has shown a commendable 11% rise over the past 12 months with earnings projected to grow by 14% annually. In this context, identifying high growth tech stocks involves looking for companies that can capitalize on technological advancements and maintain strong growth trajectories in line with or exceeding market expectations.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.38% | 39.09% | ★★★★★★ |

| Ardelyx | 20.57% | 59.97% | ★★★★★★ |

| Legend Biotech | 26.73% | 58.77% | ★★★★★★ |

| Travere Therapeutics | 25.82% | 65.45% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.65% | 61.11% | ★★★★★★ |

| AVITA Medical | 27.28% | 60.66% | ★★★★★★ |

| Alkami Technology | 20.54% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.16% | 60.26% | ★★★★★★ |

| Lumentum Holdings | 21.59% | 110.32% | ★★★★★★ |

Click here to see the full list of 234 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

TG Therapeutics (NasdaqCM:TGTX)

Simply Wall St Growth Rating: ★★★★★★

Overview: TG Therapeutics, Inc. is a commercial stage biopharmaceutical company dedicated to acquiring, developing, and commercializing innovative treatments for B-cell mediated diseases both in the United States and globally, with a market cap of $5.10 billion.

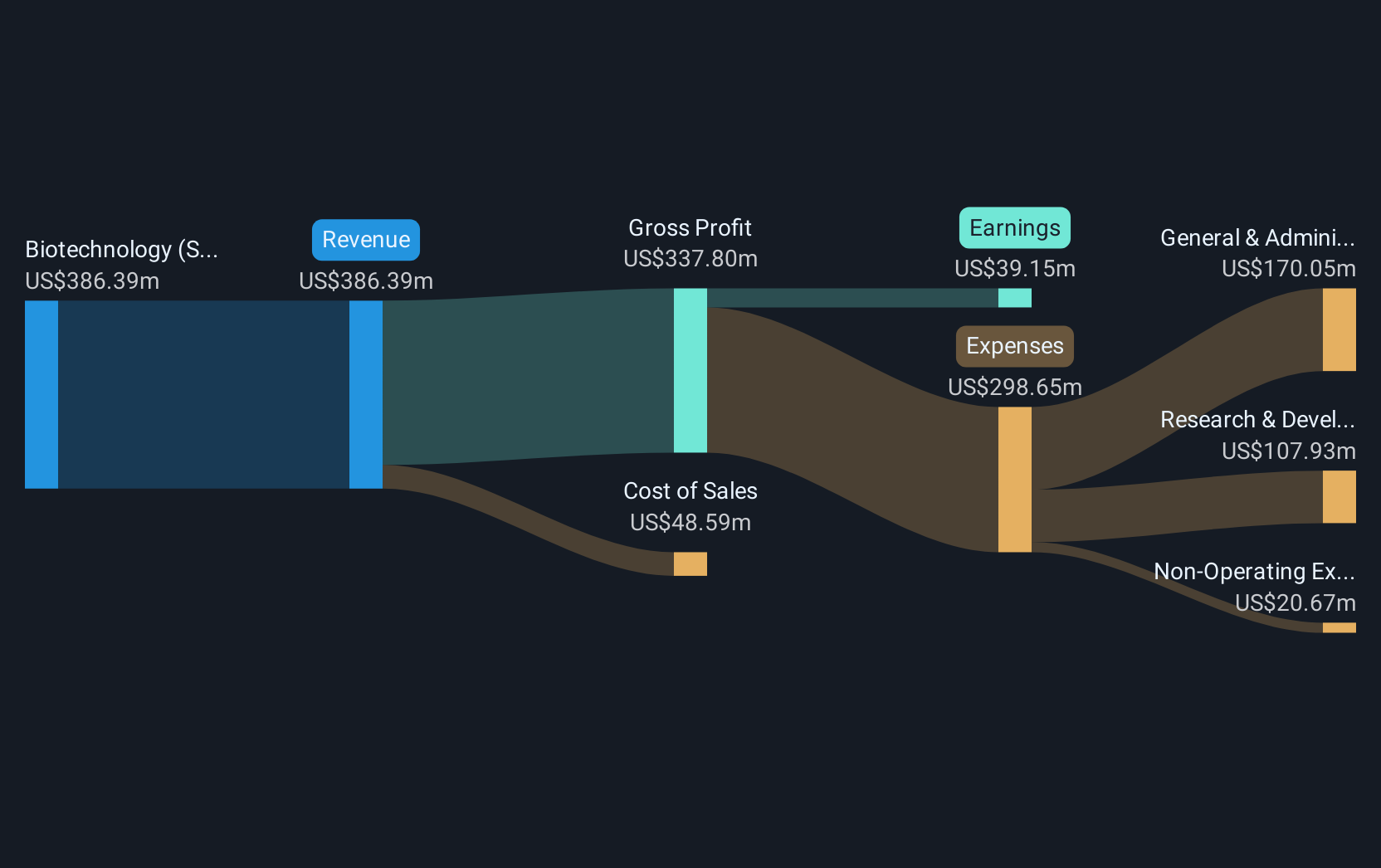

Operations: TG Therapeutics focuses on developing and commercializing treatments for B-cell mediated diseases, generating revenue primarily from its biotechnology segment, which amounts to $386.39 million.

TG Therapeutics has demonstrated robust growth with a projected annual revenue increase of 26.5% and earnings growth of 38.8%. This performance is significantly above the U.S. market averages, highlighting its strong position in biotech innovation, particularly in therapies for multiple sclerosis as evidenced by their recent BRIUMVI® presentations. The company's strategic R&D investments are reflected in their raised guidance, projecting $575 million in global revenues for 2025, an adjustment from the initial $540 million due to better-than-expected product uptake and positive clinical data outcomes. Their commitment to enhancing shareholder value is evident from repurchasing shares worth $7.89 million last quarter, underscoring confidence in their financial health and future prospects.

- Navigate through the intricacies of TG Therapeutics with our comprehensive health report here.

Examine TG Therapeutics' past performance report to understand how it has performed in the past.

Rhythm Pharmaceuticals (NasdaqGM:RYTM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rhythm Pharmaceuticals, Inc. is a commercial-stage biopharmaceutical company specializing in therapies for rare neuroendocrine diseases, with a market cap of $3.90 billion.

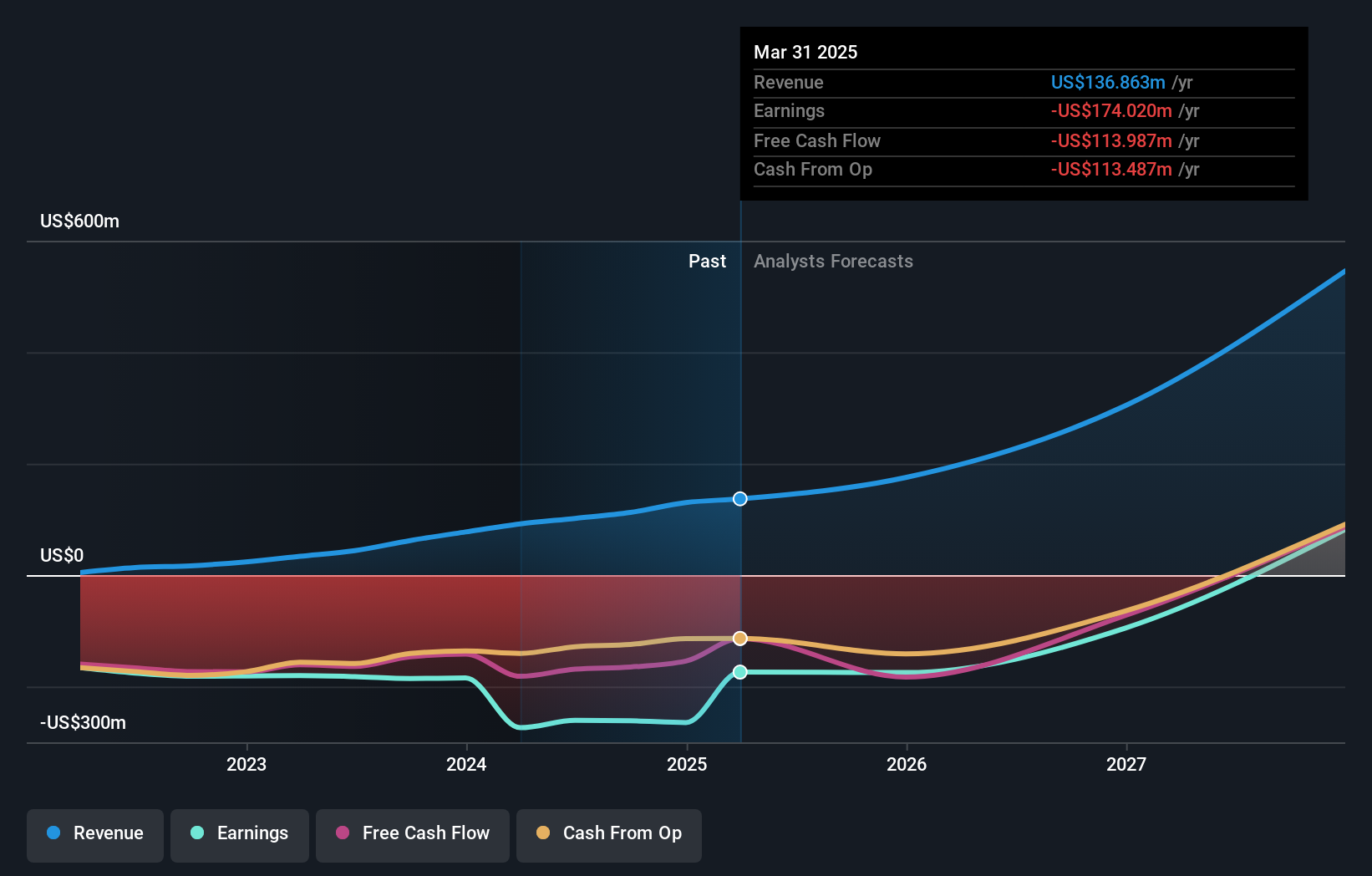

Operations: The company generates revenue primarily from the development and commercialization of therapies for patients with rare diseases, amounting to $136.86 million.

Rhythm Pharmaceuticals has been actively enhancing its market position through significant R&D investments, which are evident from their recent presentations and clinical advancements. The company reported a substantial revenue increase to $32.7 million in Q1 2025, up from $25.97 million the previous year, showcasing a growth trajectory despite a net loss reduction to $49.5 million from $141.37 million year-over-year. These financial dynamics are coupled with promising clinical results for setmelanotide in treating hypothalamic obesity, highlighted by the TRANSCEND study's findings which showed a mean BMI reduction of 16.5%. This focus on specialized treatments underpins Rhythm’s potential in the high-growth biotech sector, particularly as they prepare for new regulatory submissions aimed at expanding treatment approvals in 2025.

Natera (NasdaqGS:NTRA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Natera, Inc. is a diagnostics company that offers molecular testing services globally, with a market capitalization of approximately $20.93 billion.

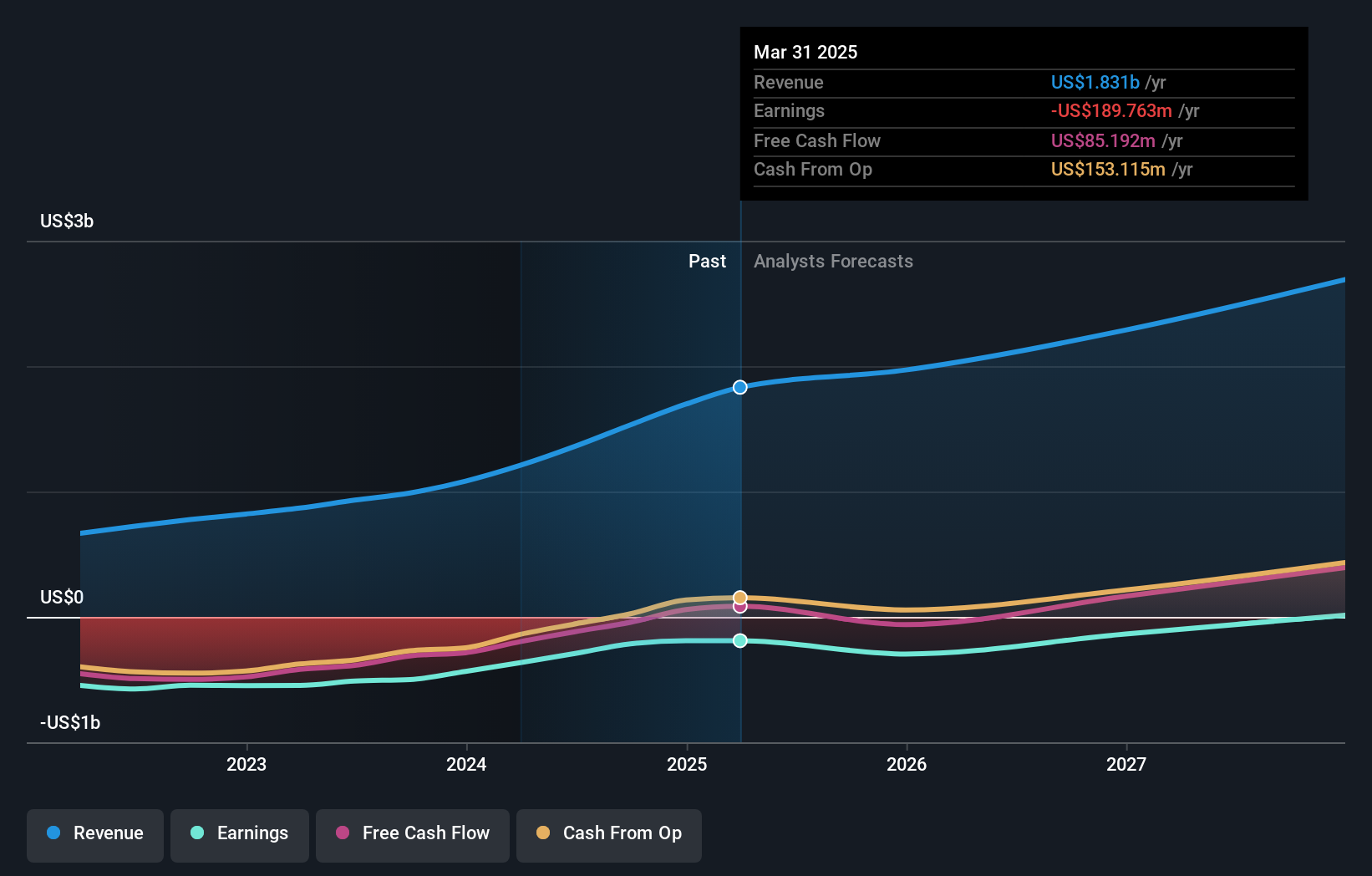

Operations: The company generates revenue primarily through the development and commercialization of molecular testing services, amounting to $1.83 billion.

Natera, Inc. has demonstrated resilience and potential within the high-growth tech landscape, particularly in the genetic testing market. In Q1 2025, the company saw a significant revenue jump to $501.83 million from $367.74 million in the previous year, indicating a robust annual growth rate of 36%. This performance is underpinned by strategic R&D investments which have enabled advancements like the Prospera Heart with DQS and Signatera tests—tools that are setting new standards in precision medicine. With recent clinical trials showing promising results, such as those from the I-SPY 2 for breast cancer indicating a threefold increase in recurrence risk prediction accuracy, Natera is poised to enhance its market presence further despite a slight reduction in net loss to $66.94 million from $67.6 million year-over-year.

- Take a closer look at Natera's potential here in our health report.

Understand Natera's track record by examining our Past report.

Seize The Opportunity

- Get an in-depth perspective on all 234 US High Growth Tech and AI Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TG Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TGTX

TG Therapeutics

A commercial stage biopharmaceutical company, focuses on the acquisition, development, and commercialization of novel treatments for B-cell mediated diseases in the United States and internationally.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives