- United States

- /

- Pharma

- /

- NasdaqGS:TARS

With A 26% Price Drop For Tarsus Pharmaceuticals, Inc. (NASDAQ:TARS) You'll Still Get What You Pay For

Tarsus Pharmaceuticals, Inc. (NASDAQ:TARS) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Still, a bad month hasn't completely ruined the past year with the stock gaining 52%, which is great even in a bull market.

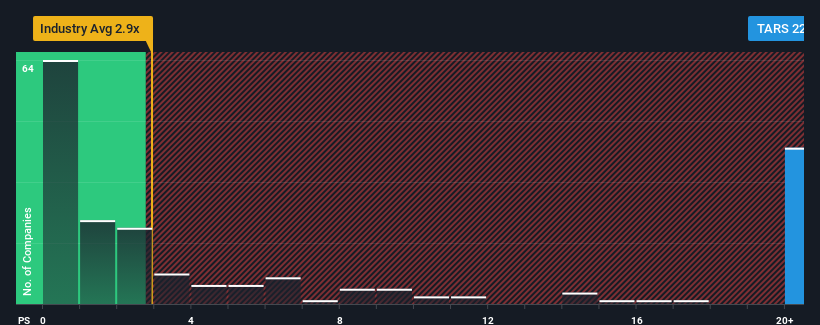

Even after such a large drop in price, Tarsus Pharmaceuticals may still be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 22.9x, since almost half of all companies in the Pharmaceuticals industry in the United States have P/S ratios under 2.9x and even P/S lower than 0.8x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Tarsus Pharmaceuticals

How Tarsus Pharmaceuticals Has Been Performing

Tarsus Pharmaceuticals certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Tarsus Pharmaceuticals' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

Tarsus Pharmaceuticals' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 53%. As a result, it also grew revenue by 27% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 125% per year during the coming three years according to the seven analysts following the company. With the industry only predicted to deliver 17% per annum, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Tarsus Pharmaceuticals' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Tarsus Pharmaceuticals' P/S

Even after such a strong price drop, Tarsus Pharmaceuticals' P/S still exceeds the industry median significantly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Tarsus Pharmaceuticals' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 1 warning sign for Tarsus Pharmaceuticals that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Tarsus Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TARS

Tarsus Pharmaceuticals

A commercial stage biopharmaceutical company, focuses on the development and commercialization of therapeutic candidates for eye care in the United States.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives