- United States

- /

- Biotech

- /

- NasdaqGS:SVRA

Easy Come, Easy Go: How Savara (NASDAQ:SVRA) Shareholders Got Unlucky And Saw 83% Of Their Cash Evaporate

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's not a secret that every investor will make bad investments, from time to time. But it's not unreasonable to try to avoid truly shocking capital losses. It must have been painful to be a Savara Inc. (NASDAQ:SVRA) shareholder over the last year, since the stock price plummeted 83% in that time. A loss like this is a stark reminder that portfolio diversification is important. We wouldn't rush to judgement on Savara because we don't have a long term history to look at. Unfortunately the share price momentum is still quite negative, with prices down 79% in thirty days.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for Savara

Savara didn't have any revenue in the last year, so it's fair to say it doesn't yet have a proven product (or at least not one people are paying for). This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that Savara has the funding to invent a new product before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. It certainly is a dangerous place to invest, as Savara investors might realise.

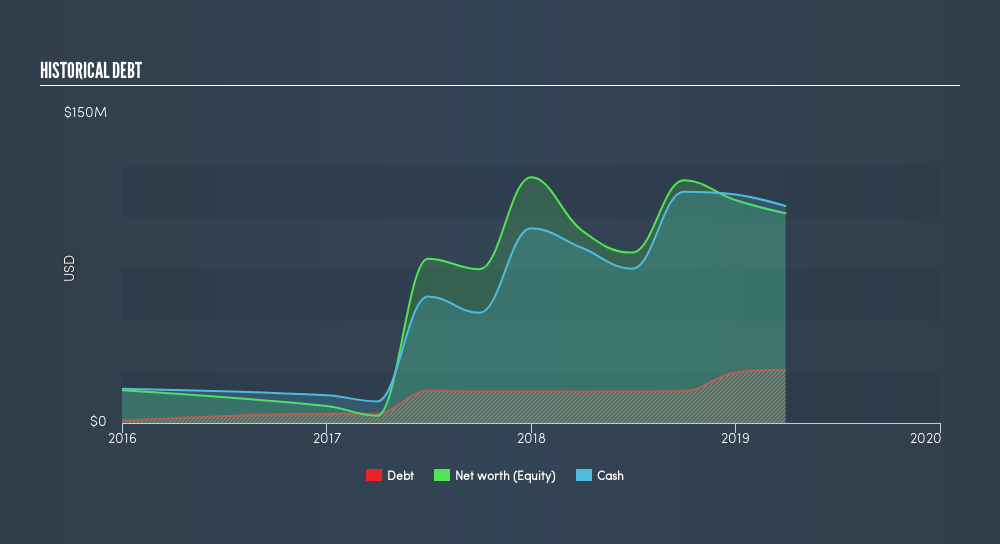

Savara had cash in excess of all liabilities of US$59m when it last reported (March 2019). That's not too bad but management may have to think about raising capital or taking on debt, unless the company is close to breaking even. We'd venture that shareholders are concerned about the need for more capital, because the share price has dropped 83% in the last year. You can click on the image below to see (in greater detail) how Savara's cash levels have changed over time.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. What if insiders are ditching the stock hand over fist? I would feel more nervous about the company if that were so. You can click here to see if there are insiders selling.

A Different Perspective

Given that the market gained 4.6% in the last year, Savara shareholders might be miffed that they lost 83%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 70% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Savara is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:SVRA

Savara

A clinical stage biopharmaceutical company, focuses on rare respiratory diseases.

Flawless balance sheet low.