- United States

- /

- Pharma

- /

- NasdaqGM:SUPN

Subdued Growth No Barrier To Supernus Pharmaceuticals, Inc.'s (NASDAQ:SUPN) Price

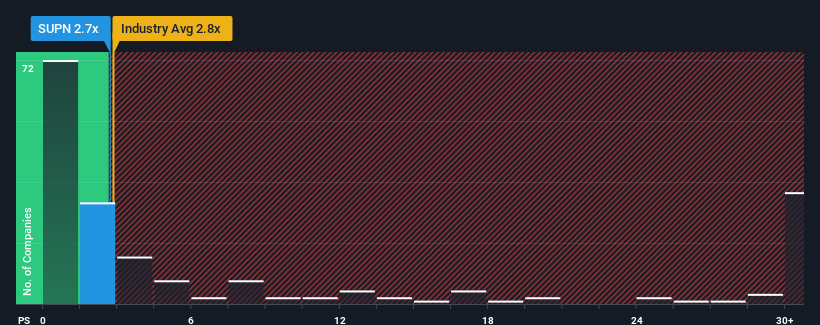

There wouldn't be many who think Supernus Pharmaceuticals, Inc.'s (NASDAQ:SUPN) price-to-sales (or "P/S") ratio of 2.7x is worth a mention when the median P/S for the Pharmaceuticals industry in the United States is similar at about 2.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Supernus Pharmaceuticals

How Supernus Pharmaceuticals Has Been Performing

While the industry has experienced revenue growth lately, Supernus Pharmaceuticals' revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Supernus Pharmaceuticals.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Supernus Pharmaceuticals would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.9%. Regardless, revenue has managed to lift by a handy 17% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next three years should generate growth of 4.5% per annum as estimated by the four analysts watching the company. With the industry predicted to deliver 17% growth per year, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Supernus Pharmaceuticals is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Supernus Pharmaceuticals' P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at the analysts forecasts of Supernus Pharmaceuticals' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Supernus Pharmaceuticals you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:SUPN

Supernus Pharmaceuticals

A biopharmaceutical company, focuses on the development and commercialization of products for the treatment of central nervous system (CNS) diseases in the United States.

Flawless balance sheet with proven track record.