- United States

- /

- Biotech

- /

- NasdaqGS:STOK

Stoke Therapeutics (STOK) Is Up 8.1% After Clinical Data With Biogen and Earnings Beat—Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In late September 2025, Stoke Therapeutics and Biogen announced new clinical data demonstrating significant seizure reduction and cognitive improvements in Dravet syndrome patients treated with zorevunersen, with these results set to be presented at the 36th International Epilepsy Congress.

- Alongside this, Stoke Therapeutics surpassed Q2 2025 analyst expectations by reporting a narrower-than-expected loss and higher revenue, highlighting momentum in both clinical and financial performance.

- We’ll explore how the promising clinical trial data with Biogen shapes Stoke Therapeutics’ investment narrative following its recent earnings outperformance.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Stoke Therapeutics' Investment Narrative?

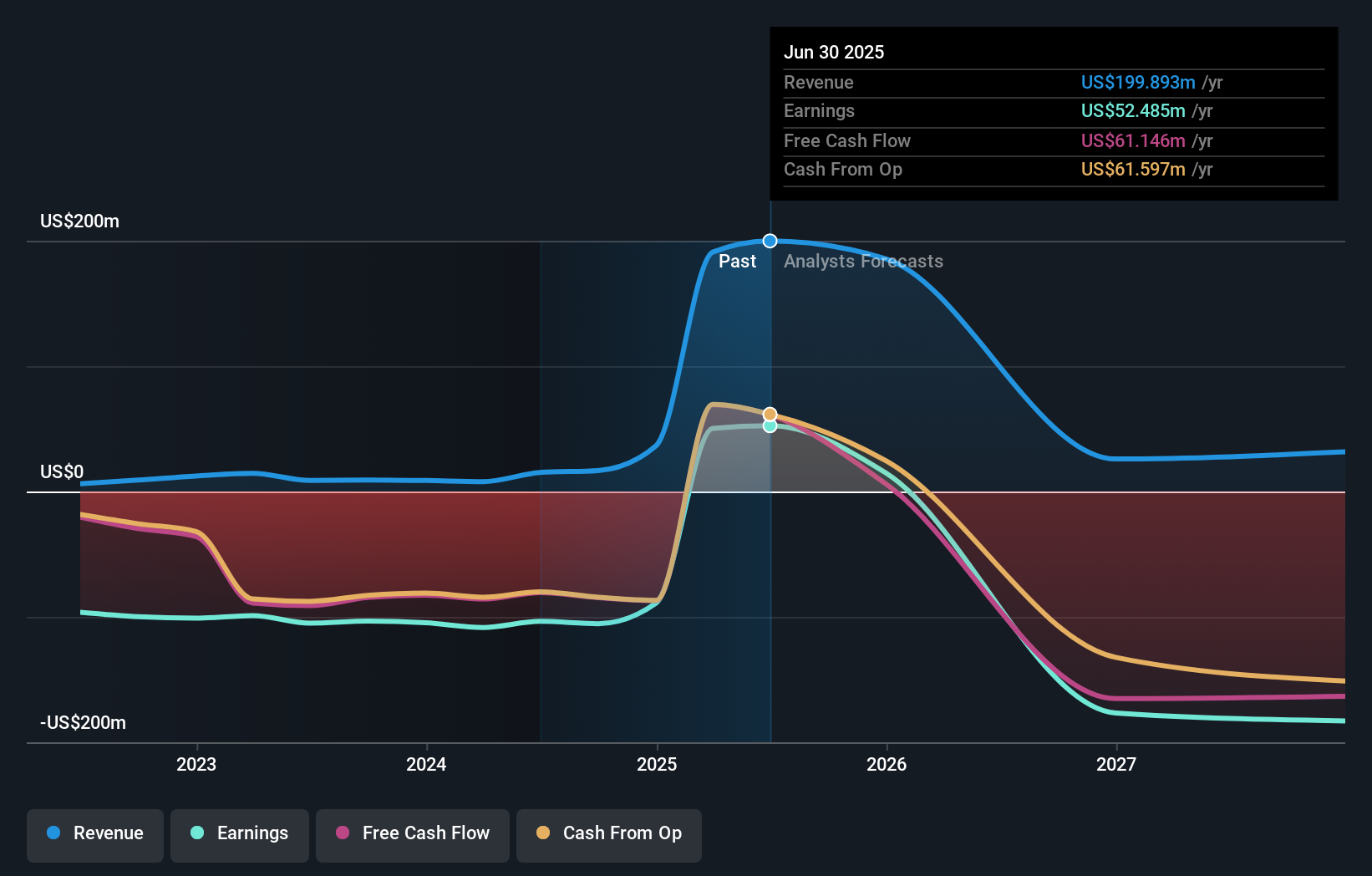

At the heart of Stoke Therapeutics’ investment narrative is the belief in breakthrough science, specifically, that zorevunersen could transform the outlook for Dravet syndrome patients as the first disease-modifying therapy. The latest clinical data bolstering cognitive and seizure outcomes, alongside the significant surge in Stoke’s share price to a 52-week high, indicate the market views this as a genuinely material development. While this momentum may alter short-term catalysts, with investor focus now shifting toward late-stage Phase 3 readouts and possible regulatory pathways, questions remain around execution risk, competitive responses, and translating trial results into commercial reality. Additionally, fundamentals reveal forecasted declines in earnings and revenue despite the pipeline enthusiasm, and Stoke is trading above both consensus and community fair value estimates. The bigger-picture risk is that even with promising science, the road to successful and sustainable commercialization can be unpredictable.

However, execution on late-stage trials and commercial strategy could pose hurdles worth considering.

Exploring Other Perspectives

Explore 3 other fair value estimates on Stoke Therapeutics - why the stock might be worth as much as $5.12!

Build Your Own Stoke Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stoke Therapeutics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Stoke Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stoke Therapeutics' overall financial health at a glance.

No Opportunity In Stoke Therapeutics?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STOK

Stoke Therapeutics

An early-stage biopharmaceutical company, engages in the development of treatments for severe genetic diseases by upregulating protein expression.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives