- United States

- /

- Biotech

- /

- NasdaqGS:STOK

Stoke Therapeutics (STOK) Is Up 11.1% After Positive Zorevunersen Data and CEO Appointment - What's Changed

Reviewed by Sasha Jovanovic

- Stoke Therapeutics and Biogen recently presented long-term clinical follow-up data from ongoing zorevunersen studies, showing sustained cognitive and behavioral improvements in Dravet syndrome patients at the Child Neurology Society Annual Meeting.

- Alongside these clinical developments, Stoke Therapeutics appointed experienced biotech executive Ian F. Smith as its permanent CEO, which may influence the company's leadership direction and growth plans.

- We’ll explore how the encouraging zorevunersen data enhances Stoke’s investment case amid its recent executive leadership transition.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Stoke Therapeutics' Investment Narrative?

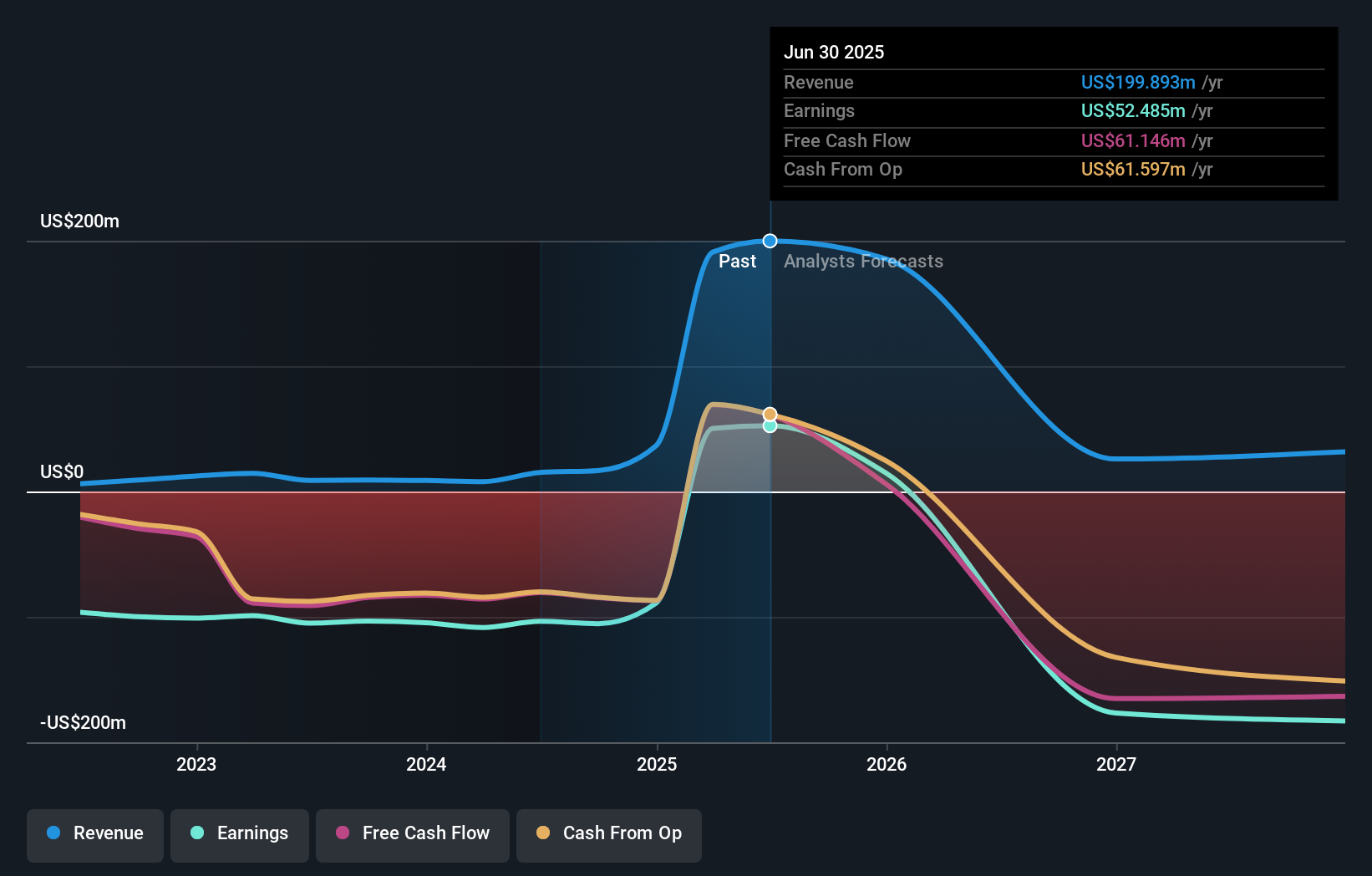

To be a Stoke Therapeutics shareholder right now, I’d need confidence in both the ongoing clinical progress of zorevunersen and the company’s ability to translate positive trial results into regulatory milestones and eventual revenue. The newly presented long-term data, showing cognitive, behavioral, and seizure control improvements for Dravet syndrome patients, does strengthen the short-term catalyst profile for Stoke, particularly by supporting its case in the pivotal Phase 3 EMPEROR study. This appears to lessen, for now, one of the most pressing risks: clinical or regulatory setbacks that could stall commercialization. The recent surge in the share price and analyst target adjustments further suggest this data is seen as a material event for Stoke, potentially shifting sentiment even as broader risks like future revenue decline projections, valuation concerns, and recent management turnover remain. With Ian F. Smith now installed as permanent CEO, investors will also be weighing the company’s leadership stability and ability to execute on its clinical and commercial strategy. Still, the risk of a pullback remains if upcoming trial results or FDA decisions do not meet high investor expectations.

Stoke Therapeutics' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on Stoke Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Stoke Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stoke Therapeutics research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Stoke Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stoke Therapeutics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STOK

Stoke Therapeutics

An early-stage biopharmaceutical company, engages in the development of treatments for severe genetic diseases by upregulating protein expression.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives