- United States

- /

- Biotech

- /

- NasdaqGS:STOK

Stoke Therapeutics (STOK): Evaluating Valuation Following Key Dravet Syndrome Study Results Published in Neurology

Reviewed by Simply Wall St

Stoke Therapeutics (STOK) just shared final data from its two-year BUTTERFLY study in Neurology. The findings outline how Dravet syndrome progresses and identify key clinical endpoints that can inform upcoming trials for new therapies.

See our latest analysis for Stoke Therapeutics.

Stoke Therapeutics has seen its share price surge 169% year-to-date, with momentum building on anticipation for novel treatments after its latest trial results and a string of progress updates. Over the past year, total shareholder return reached an impressive 158%, highlighting strong investor confidence in both the science and the company’s direction.

If clinical breakthroughs are top of mind, this is the perfect moment to explore other healthcare innovators making waves. See the full list here: See the full list for free.

With shares soaring and anticipation running high after breakout clinical results, investors may wonder if Stoke Therapeutics is trading below its true potential or if the market has already factored in all of the future growth.

Price-to-Earnings of 42.7x: Is it justified?

Stoke Therapeutics currently trades at a price-to-earnings (P/E) ratio of 42.7x, which is significantly higher than both its peer group and the broader biotech industry. The recent share price surge puts the company's valuation in sharper focus against sector benchmarks.

The price-to-earnings ratio expresses how much investors are willing to pay for each dollar of anticipated earnings. This serves as a basic gauge of market expectations for growth and profitability. For Stoke Therapeutics, this premium multiple suggests that investors are pricing in substantial future progress, possibly beyond what current forecasts indicate.

The company's P/E ratio of 42.7x stands well above the US Biotechs industry average of 18.2x and the peer average of 27.5x. Compared to an estimated fair P/E ratio of 14.2x, Stoke's shares are trading at nearly triple the level the market could potentially revert toward if sentiment or earnings outlook fades.

Explore the SWS fair ratio for Stoke Therapeutics

Result: Price-to-Earnings of 42.7x (OVERVALUED)

However, slowing annual revenue growth and negative net income trends could temper optimism and spark a shift in market sentiment for Stoke Therapeutics.

Find out about the key risks to this Stoke Therapeutics narrative.

Another View: SWS DCF Model Shows a Different Story

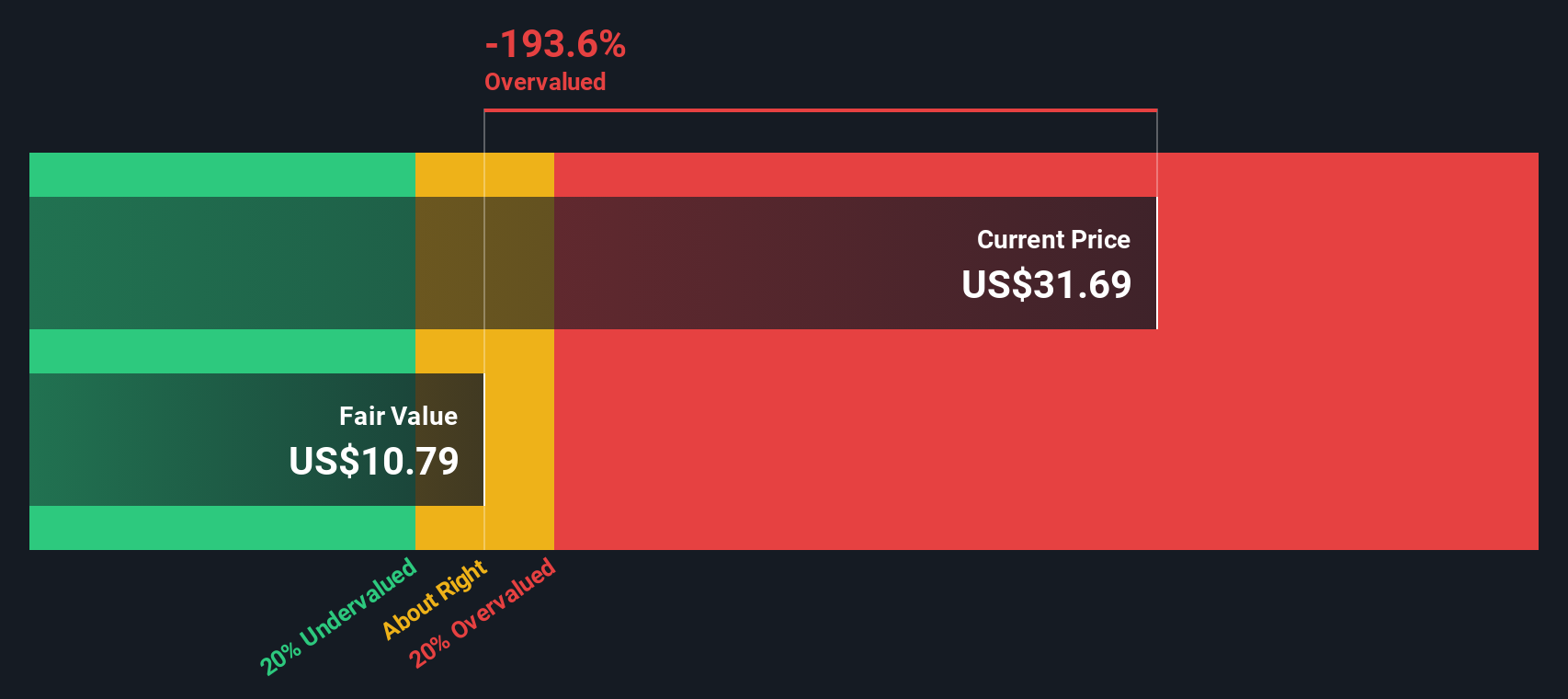

While the price-to-earnings ratio presents Stoke Therapeutics as richly valued, our DCF model offers a much more reserved outlook. It estimates the fair value at just $12.50, which is significantly below today’s price. Is the market anticipating breakthroughs that the numbers do not yet reflect?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Stoke Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Stoke Therapeutics Narrative

If you see the numbers differently, or want to dig deeper into the latest developments, you can shape your own Stoke Therapeutics perspective in just a few minutes: Do it your way.

A great starting point for your Stoke Therapeutics research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Put your capital to work by checking out other investment angles you might be missing with these unique stock themes:

- Capitalize on innovative healthcare trends by reviewing these 30 healthcare AI stocks, which is transforming medicine through advanced artificial intelligence and data-driven breakthroughs.

- Secure steady income streams when you scan these 14 dividend stocks with yields > 3%, offering yields above 3 percent and strong financial fundamentals.

- Ride the wave of blockchain innovation and check out these 81 cryptocurrency and blockchain stocks, which is set to benefit from the growth of decentralized technology and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STOK

Stoke Therapeutics

An early-stage biopharmaceutical company, engages in the development of treatments for severe genetic diseases by upregulating protein expression.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026