- United States

- /

- Biotech

- /

- NasdaqGS:SRRK

Scholar Rock (SRRK) Valuation in Focus as Apitegromab Nears Potential U.S. Debut

Reviewed by Simply Wall St

If you have been watching Scholar Rock Holding (SRRK), you know investors are buzzing as the company gears up for a potential U.S. launch of apitegromab, their lead drug candidate. As the first and only muscle-targeted therapy to deliver real, statistically significant functional improvement in spinal muscular atrophy, apitegromab holds promise for a rare but challenging disease. The build-up to a possible regulatory green light and mounting optimism about the drug’s commercial chance is having a tangible effect on market sentiment, even as questions about timing hang in the air.

The journey has not been a straight line for Scholar Rock Holding. Shares have been up and down lately, reflecting both enthusiasm around drug development and broader uncertainty in biotech. Over the past year, the stock has delivered a 2.7% total return to investors, with more modest results over three and five years. The movement this year suggests investors are starting to build momentum again, despite recent volatility linked to regulatory hurdles and market expectations.

After this latest flurry of activity, the real question emerges: is Scholar Rock Holding now trading at a bargain given its future growth potential, or has the market already priced in the buzz around apitegromab?

Price-to-Book of 13x: Is it justified?

Scholar Rock Holding is currently trading at a price-to-book (P/B) ratio of 13x, which is notably higher than the US Biotechs industry average of 2.2x. This suggests investors are paying a premium for each dollar of net asset value, potentially reflecting high expectations for future growth or market opportunities tied to pipeline developments.

The price-to-book ratio compares a company’s market value to its book value and offers insights into how much investors are willing to pay for the business’s net assets. In the biotech sector, a high P/B can indicate optimism about unproven assets or pending breakthroughs rather than current profitability.

In Scholar Rock’s case, the elevated ratio suggests the market is pricing in future revenues and potential for its lead therapy rather than current fundamentals. However, compared to direct peers, the stock offers a better relative value since the average peer trades at 15.6x book value. It remains expensive for the broader industry.

Result: Fair Value of $31.67 (OVERVALUED)

See our latest analysis for Scholar Rock Holding.However, uncertainty remains around regulatory approval timelines and the company’s ability to convert clinical progress into sustainable commercial success. Both of these factors could impact future valuation.

Find out about the key risks to this Scholar Rock Holding narrative.Another View: What Does the DCF Model Say?

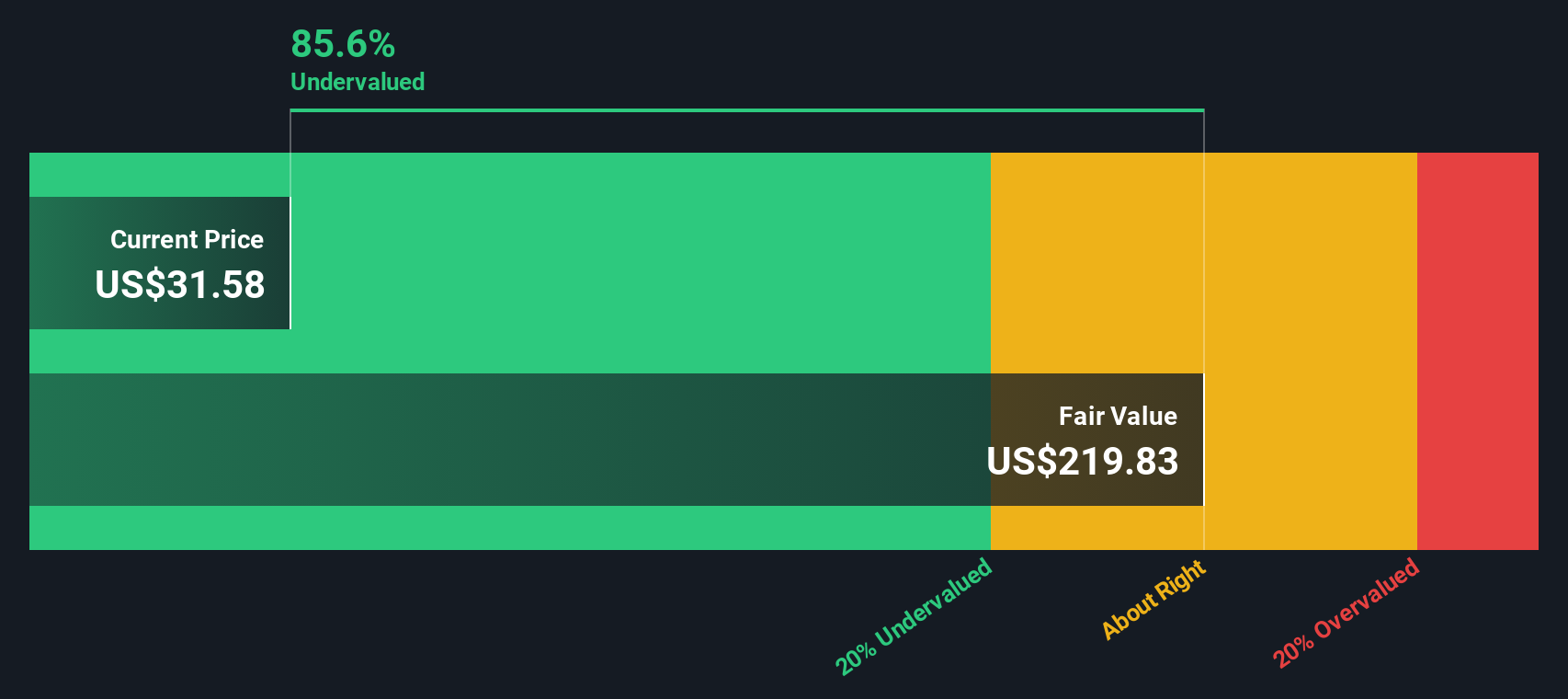

While the current market price appears overvalued by book value standards, our DCF model paints a completely different story. It suggests the stock could be deeply undervalued. This sharp disagreement raises new questions: can future cash flows really outweigh present uncertainty?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Scholar Rock Holding Narrative

If you want to dig into the numbers or build your own thesis around Scholar Rock Holding, the tools are here for you to craft a personal perspective in just minutes: Do it your way.

A great starting point for your Scholar Rock Holding research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for More Investment Opportunities?

Don’t limit yourself to just one stock. Give yourself an edge by tapping into other high-potential sectors with tailored tools designed for ambitious investors like you.

- Target stronger income streams when you prioritize stability and yield by scanning the latest opportunities with dividend stocks with yields > 3%.

- Unlock growth earlier than the crowd by spotting promising tech leaders in tomorrow’s breakthroughs through the lens of quantum computing stocks.

- Capitalize on mispriced gems by finding companies trading below their true value using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRRK

Scholar Rock Holding

A biopharmaceutical company, focuses on the discovery, development, and delivery of medicines for the treatment of serious diseases in which signaling by protein growth factors plays a fundamental role.

Good value with adequate balance sheet.

Market Insights

Community Narratives