- United States

- /

- Biotech

- /

- NasdaqGS:SRRK

Do Scholar Rock’s (SRRK) Rising Losses Hint at an Inflection Point for Its R&D Strategy?

Reviewed by Sasha Jovanovic

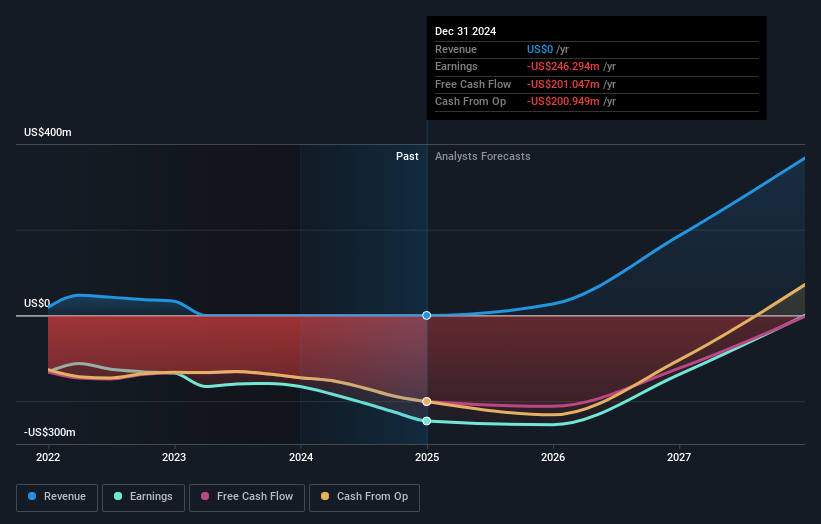

- Scholar Rock Holding Corporation recently reported third quarter and nine-month financial results, with net losses of US$102.22 million and US$286.97 million, respectively, both higher than the prior year periods.

- The widening net loss highlights rising expenses and ongoing financial pressures as the company advances its clinical and research programs.

- We'll explore how this increase in net loss shapes Scholar Rock Holding's investment narrative and signals about its path to future profitability.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Scholar Rock Holding's Investment Narrative?

To be a shareholder in Scholar Rock Holding, you have to believe in the long-term potential of innovative therapies like apitegromab for spinal muscular atrophy, even as the path is marked by regulatory obstacles and rising financial pressures. The latest news of a widening net loss underscores the company’s heavy investment in research and development, and while recent price movements have been positive, this level of spending sharply increases the stakes for near-term regulatory and clinical catalysts. The September FDA complete response letter already delayed the launch of apitegromab, putting more weight on successful resolution of facility issues and positive trial outcomes as immediate triggers. This earnings report signals that Scholar Rock’s margin for error is thinner, with limited cash from recent offerings and no recognizable revenue yet. Therefore, financial durability and clinical execution stand out as increasingly critical risks right now. But what if regulatory delays persist and cash reserves run thin?

Scholar Rock Holding's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Scholar Rock Holding - why the stock might be worth just $47.33!

Build Your Own Scholar Rock Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Scholar Rock Holding research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Scholar Rock Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Scholar Rock Holding's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRRK

Scholar Rock Holding

A biopharmaceutical company, focuses on the discovery, development, and delivery of medicines for the treatment of serious diseases in which signaling by protein growth factors plays a fundamental role.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026