- United States

- /

- Banks

- /

- NasdaqGS:MCBS

ARS Pharmaceuticals And 2 Other Growth Leaders With Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market experiences a pause in its recent rally, with investors closely monitoring developments on tariffs and Federal Reserve decisions, the focus shifts to companies that can weather economic uncertainties. In this environment, growth companies with high insider ownership often stand out due to their potential alignment of interests between management and shareholders, which can be particularly appealing when navigating volatile markets.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.1% | 34.1% |

| Hims & Hers Health (NYSE:HIMS) | 13.1% | 21.9% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39% |

| FTC Solar (NasdaqCM:FTCI) | 32.7% | 65.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.2% | 65.1% |

| Niu Technologies (NasdaqGM:NIU) | 36% | 82.8% |

| Clene (NasdaqCM:CLNN) | 19.4% | 64% |

| Astera Labs (NasdaqGS:ALAB) | 15.3% | 61.4% |

| BBB Foods (NYSE:TBBB) | 16.2% | 29.9% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 100.2% |

We're going to check out a few of the best picks from our screener tool.

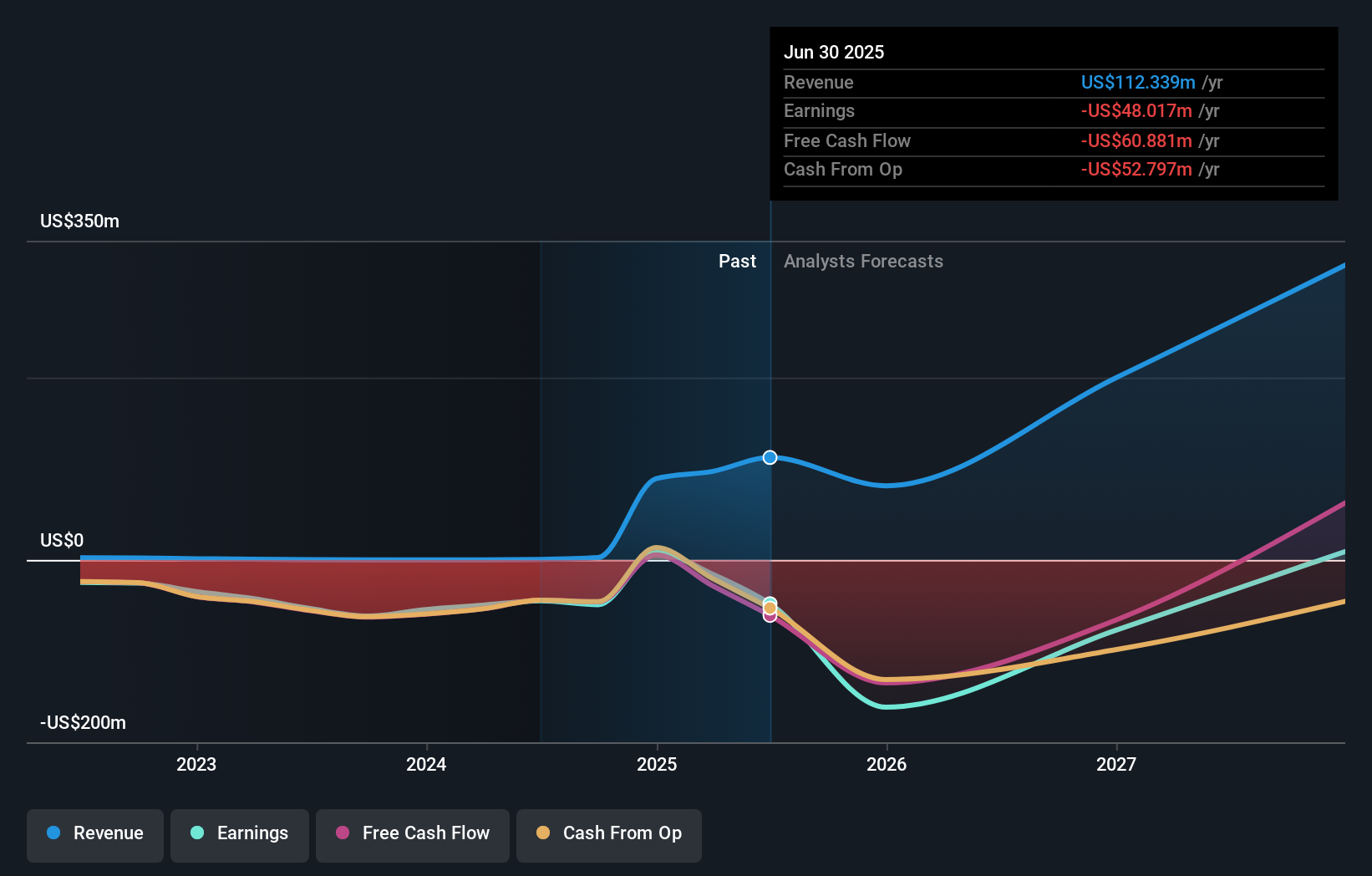

ARS Pharmaceuticals (NasdaqGM:SPRY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ARS Pharmaceuticals, Inc. is a biopharmaceutical company focused on developing and commercializing treatments for severe allergic reactions, with a market cap of approximately $1.42 billion.

Operations: The company generates revenue from its pharmaceuticals segment, amounting to $89.15 million.

Insider Ownership: 19%

Revenue Growth Forecast: 35.6% p.a.

ARS Pharmaceuticals is experiencing significant growth, with revenue jumping to US$89.15 million from just US$0.03 million the previous year, and turning profitable with a net income of US$8 million. The company recently partnered with ALK-Abello to promote neffy, an innovative needle-free epinephrine nasal spray for allergic reactions. Analysts forecast robust annual earnings growth of 52.9%, supported by expected revenue expansion of 35.6% per year, outpacing market averages.

- Click to explore a detailed breakdown of our findings in ARS Pharmaceuticals' earnings growth report.

- Our valuation report unveils the possibility ARS Pharmaceuticals' shares may be trading at a discount.

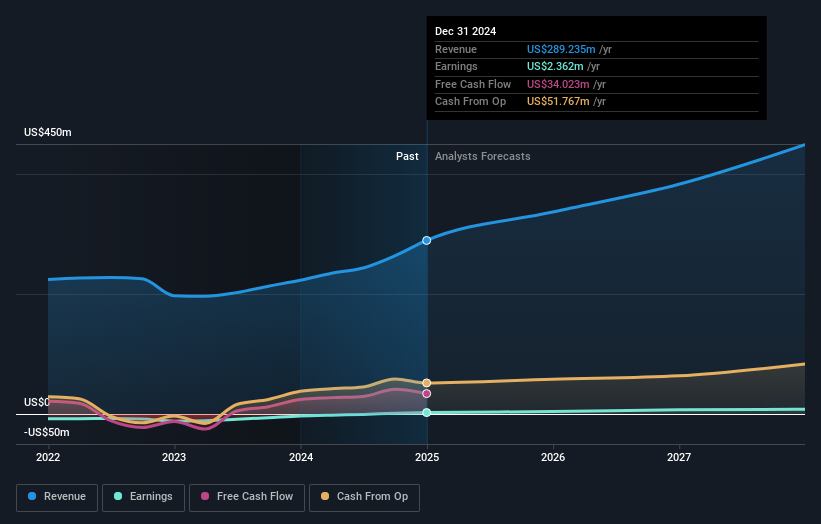

Viant Technology (NasdaqGS:DSP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Viant Technology Inc. is an advertising technology company with a market cap of approximately $914.43 million.

Operations: The company's revenue primarily comes from its Internet Information Providers segment, which generated $289.24 million.

Insider Ownership: 12.1%

Revenue Growth Forecast: 13% p.a.

Viant Technology is trading significantly below its estimated fair value, with analysts projecting a 47.8% price increase. The company's earnings are forecast to grow at 26.1% annually, surpassing the US market average of 13.9%. Despite recent volatility, Viant became profitable last year and reported Q4 sales of US$90.05 million, up from US$64.41 million a year ago, with net income rising to US$1.75 million from US$0.626 million previously.

- Click here and access our complete growth analysis report to understand the dynamics of Viant Technology.

- Our expertly prepared valuation report Viant Technology implies its share price may be lower than expected.

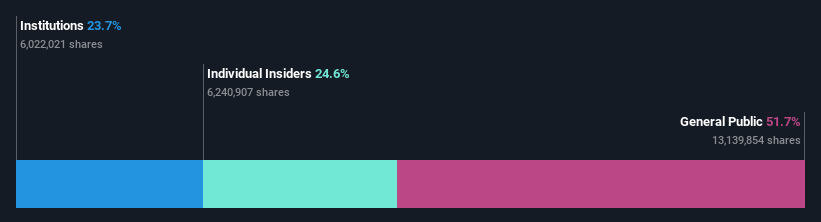

MetroCity Bankshares (NasdaqGS:MCBS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MetroCity Bankshares, Inc. is the bank holding company for Metro City Bank, offering a range of banking products and services across the United States, with a market cap of $722.71 million.

Operations: The company generates revenue primarily through its Community Banking segment, which accounted for $143.78 million.

Insider Ownership: 24.6%

Revenue Growth Forecast: 22.7% p.a.

MetroCity Bankshares is trading at 48.6% below its estimated fair value, with revenue and earnings expected to grow over 22% annually, outpacing the US market. Recent Q1 results showed net interest income of US$30.55 million and net income of US$16.3 million, both up from last year. Insider ownership remains significant despite no recent insider trading activity. A board member's resignation was announced without any operational disagreements affecting company stability or growth prospects.

- Navigate through the intricacies of MetroCity Bankshares with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of MetroCity Bankshares shares in the market.

Next Steps

- Embark on your investment journey to our 204 Fast Growing US Companies With High Insider Ownership selection here.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCBS

MetroCity Bankshares

Operates as the bank holding company for Metro City Bank that provides banking products and services in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives