- United States

- /

- Biotech

- /

- NasdaqCM:SNGX

Soligenix Second Quarter 2024 Earnings: EPS Beats Expectations, Revenues Lag

Soligenix (NASDAQ:SNGX) Second Quarter 2024 Results

Key Financial Results

- Net loss: US$1.64m (loss widened by 2.0% from 2Q 2023).

- US$1.31 loss per share.

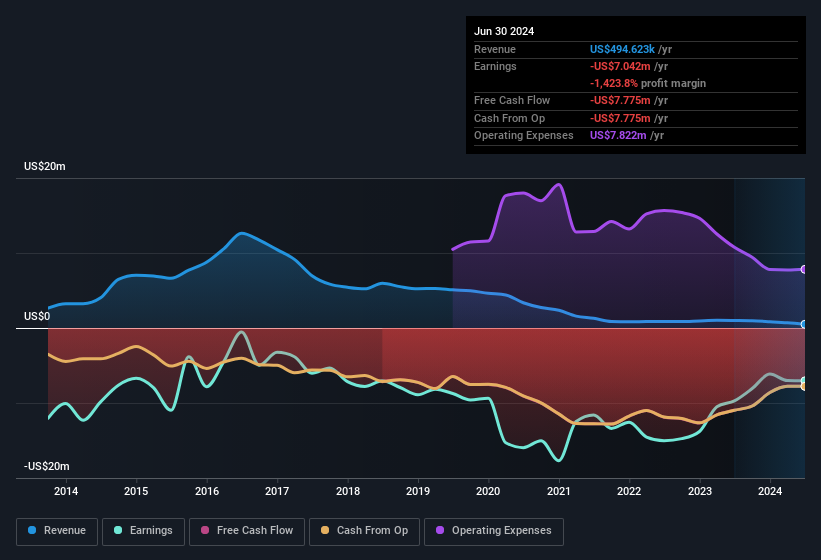

All figures shown in the chart above are for the trailing 12 month (TTM) period

Soligenix EPS Beats Expectations, Revenues Fall Short

Revenue missed analyst estimates by 99%. Earnings per share (EPS) exceeded analyst estimates by 26%.

Looking ahead, revenue is forecast to grow 21% p.a. on average during the next 3 years, compared to a 23% growth forecast for the Biotechs industry in the US.

Performance of the American Biotechs industry.

The company's shares are down 11% from a week ago.

Risk Analysis

Before we wrap up, we've discovered 6 warning signs for Soligenix (5 are potentially serious!) that you should be aware of.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SNGX

Soligenix

A late-stage biopharmaceutical company, focuses on the development and commercialization of products to treat rare diseases in the United States.

Medium-low risk with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026