- United States

- /

- Biotech

- /

- NasdaqGS:SNDX

A Look at Syndax Pharmaceuticals's Valuation After Revuforj’s FDA Approval and NCCN Inclusion

Reviewed by Simply Wall St

Syndax Pharmaceuticals (SNDX) recently drew attention after its lead therapy, Revuforj, was included in NCCN guidelines and secured FDA approval for a broader range of patients. Investors are considering these milestones along with the company’s latest financials.

See our latest analysis for Syndax Pharmaceuticals.

Syndax’s share price has surged 19.5% over the past month, fueled by milestone approvals for Revuforj and a boost in quarterly revenue. Some investors remain cautious given the stock’s three-year total shareholder return of -23%. Momentum is building, with recent clinical successes shifting sentiment, but long-term holders are still waiting for a more sustained turnaround.

If Syndax’s recent momentum has you exploring what’s next in healthcare, now is the perfect time to discover See the full list for free.

With Syndax’s share price rebounding and analysts offering mixed signals after a string of clinical wins, the question remains: is the recent surge just the beginning, or has the market already factored in all the upside?

Most Popular Narrative: 56% Undervalued

According to the most widely followed narrative, Syndax’s fair value estimate is $38.85, which is significantly higher than its last close of $17.09. The current market price trails the narrative’s target, highlighting a major gap between price and projected growth.

Expanding drug adoption, earlier-line usage, and new regulatory approvals are set to drive broader market access and boost long-term revenue growth. Strong late-stage pipeline, fixed costs, and leading positions in precision oncology create operating leverage and sustained momentum for multi-year profitability.

What’s fueling this bold valuation? The narrative banks on explosive revenue growth, ambitious profit margin gains, and a future profit multiple that rivals the hottest biotech stories. Want to see the numbers and forecasts that set this price? Dive deeper to decode the full financial playbook behind the headline figure.

Result: Fair Value of $38.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent risks remain, such as potential regulatory hurdles or setbacks with Revuforj's safety profile, which could quickly shift investor sentiment.

Find out about the key risks to this Syndax Pharmaceuticals narrative.

Another View: A Multiples-Based Reality Check

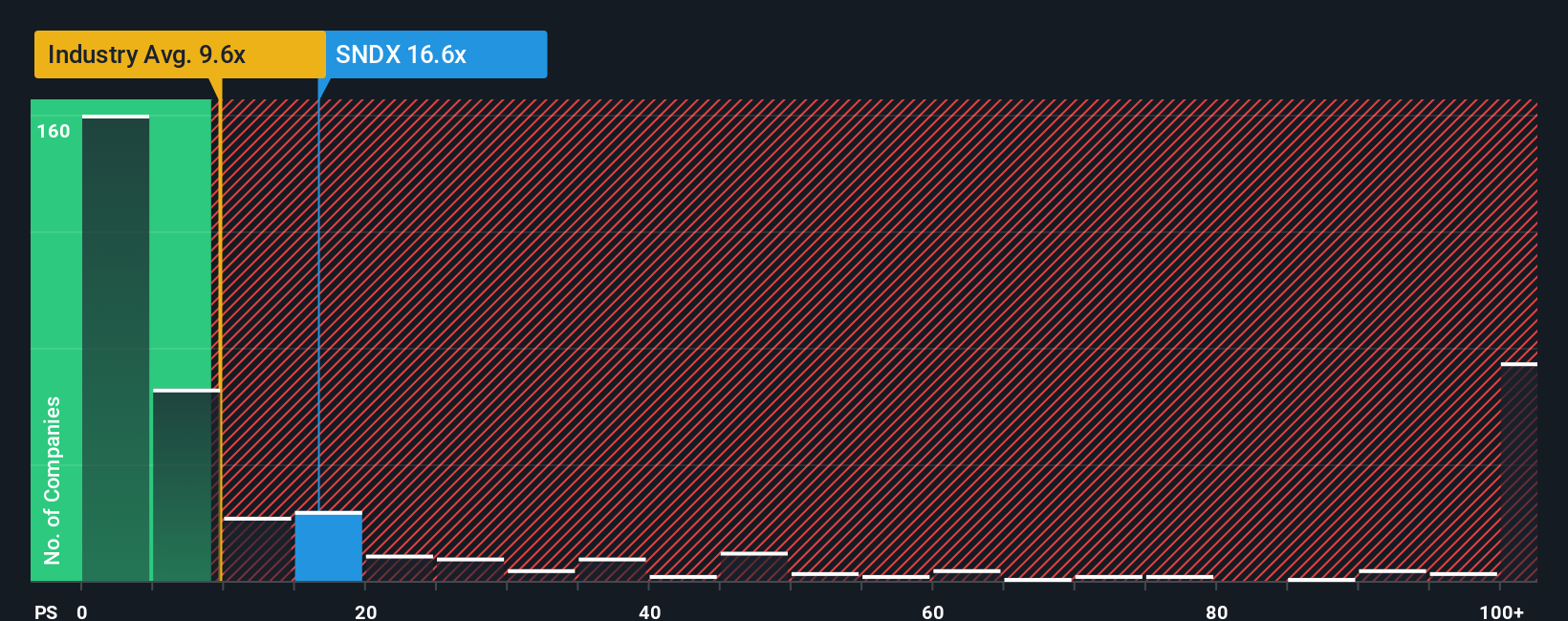

While future earnings projections paint an optimistic picture, a look at Syndax’s price-to-sales ratio suggests a far steeper valuation. At 13.3 times sales, its ratio is higher than both the US Biotechs industry average of 11.9x and peers at 3.3x, and it rises above the fair ratio of just 0.8x. This sizable gap could signal significant valuation risk for investors if expectations are not met. So which outlook will ultimately shape Syndax’s direction?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Syndax Pharmaceuticals Narrative

If you want your own take or prefer to dig into the numbers yourself, you can easily build a personalized story in just minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Syndax Pharmaceuticals.

Looking for More Investment Ideas?

Your next winning investment might be just a click away, so don’t settle for the obvious when smarter opportunities are waiting. Make sure you’re ahead of the crowd.

- Supercharge your returns by scanning for hidden value with these 905 undervalued stocks based on cash flows, which highlights strong fundamentals and untapped potential.

- Catch the next disruptive breakthrough by focusing on innovation leaders using these 27 AI penny stocks, targeting companies pioneering real-world AI applications.

- Boost your portfolio’s income by targeting reliable payers with these 18 dividend stocks with yields > 3% for consistent market-beating yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNDX

Syndax Pharmaceuticals

A commercial-stage biopharmaceutical company, develops therapies for the treatment of cancer.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026