- United States

- /

- Biotech

- /

- NasdaqGM:SMMT

Summit Therapeutics (SMMT): Rethinking Valuation After Weak Earnings and Notable Insider Buying

Reviewed by Simply Wall St

Summit Therapeutics (SMMT) has attracted renewed attention after reporting weaker third quarter results, with a wider EBITDA loss and deteriorating EPS. The stock fell another 3% after earnings, reflecting ongoing investor concerns.

See our latest analysis for Summit Therapeutics.

This latest dip follows a challenging few months for Summit Therapeutics, marked by disappointing quarterly results and cautious sentiment around its ambitions in cancer immunotherapy. After a turbulent year, the stock’s recent 1-year total shareholder return of -2.87% shows that momentum has stalled, especially after an extraordinary multi-year run. Investors are watching closely as insider buying offers a hint of longer-term optimism despite current share price pressure and mixed signals on future growth.

If Summit’s ups and downs have you wondering what else is out there, now’s a great moment to broaden your search and discover See the full list for free.

With the stock now trading well below analyst targets after a significant pullback, investors are left debating whether Summit Therapeutics offers undervalued potential or if the market is already factoring in what lies ahead.

Price-to-Book of 69.2x: Is it justified?

Summit Therapeutics trades at a price-to-book ratio of 69.2x, a high level compared to both its direct competitors and the broader sector averages. This high multiple suggests the market is assigning a significant premium to the company’s future prospects, even though current fundamentals are lacking.

The price-to-book ratio measures the market value of a company’s shares relative to its net assets. In biotechnology, this metric can be relevant for early-stage firms investing heavily in research and development, especially when profits are yet to materialize. However, such an elevated value signals that investors are paying a substantial amount above the actual book value, often in anticipation of future breakthroughs or substantial growth.

Compared to the US Biotechs industry average of just 2.7x, Summit’s multiple stands out as much more expensive. Against a peer group at 11x, the gap is even more noticeable, making it difficult to explain based on fundamentals alone.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 69.2x (OVERVALUED)

However, continued lack of revenue and persistent negative earnings could quickly outweigh optimism, especially if upcoming trials or developments fall short of expectations.

Find out about the key risks to this Summit Therapeutics narrative.

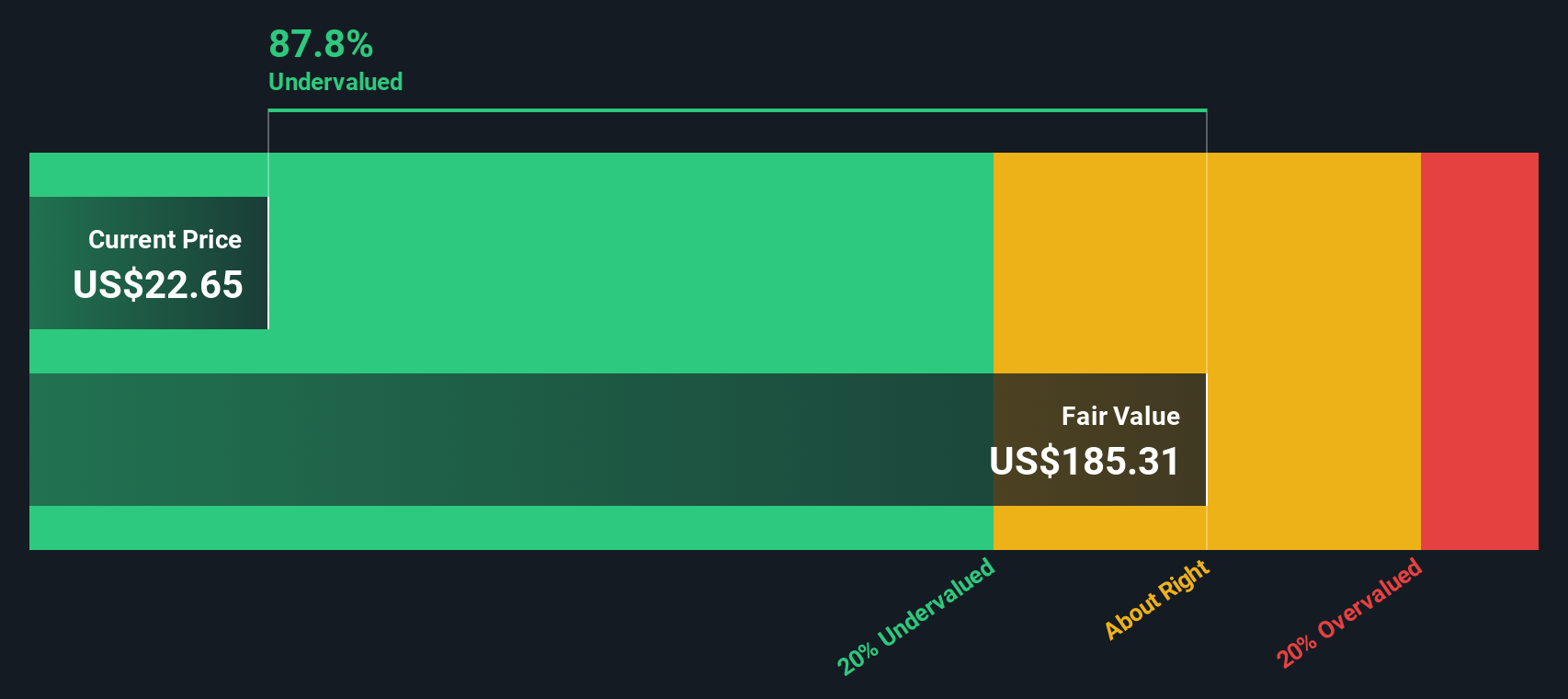

Another View: Discounted Cash Flow Says Undervalued

Switching gears, our DCF model tells a very different story. It values Summit Therapeutics at $157.61 per share, while the market price recently hovered near $17.26. This suggests the stock could be deeply undervalued and challenges the high price-to-book warning from earlier.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Summit Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Summit Therapeutics Narrative

If you see things differently or want your own angle, it's easy to dive deeper into the numbers and shape your own view in just a few minutes. Do it your way

A great starting point for your Summit Therapeutics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t stop at just one opportunity. Smart investors always stay ahead by tracking fresh trends and hidden winners before others catch on.

- Spot unique growth stories early by reviewing these 3566 penny stocks with strong financials to get ahead of the market with companies showing surprising financial resilience.

- Capitalize on the rise of artificial intelligence by scanning these 25 AI penny stocks that could transform tomorrow’s industries, starting now.

- Seek out untapped bargains by exploring these 928 undervalued stocks based on cash flows to uncover stocks trading below their true value before the crowd rushes in.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SMMT

Summit Therapeutics

A biopharmaceutical company, focuses on discovery, development, and commercialization of patient, physician, caregiver, and societal friendly medicinal therapies.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026